I have in the recent posts, for those who follow my Twitter, and the last report about Transocean/RIG, documented briefly the insanity of Western energy policy.

Intermittent, unpredictable energy sources like solar and wind cannot be the dominant part of the electricity production energy mix. If you want on top of that electrify everything, you make extra unreliable key infrastructures, like transportation and supply chain. Including stuff like food, heating, etc...

Despite that, EU countries are very likely to keep doing what has failed. I have made a list of which industries to avoid or look for in that context. Being already a shareholder of Gazprom, I am not looking to add more out-of-EU energy producers.

I might also cover soon a copper miner, but still sitting on the fence over which to pick.

In the context of unsatisfied energy demand, I would be interested in utility companies able to respond to such demand and benefit from higher electricity prices. And I must be precise, utilities able to provide on-demand power. Not just when the weather allows.

However, EU-based utilities are to be avoided, because they are likely to take political and non-economical decisions. Like shutting down carbon-neutral nuclear power plants... Besides, a lot of low-carbon EU-based utilities are beyond expensive (you will see an example of that below).

For the same reason, I am from now on staying away from the Western oil majors, and have sold all my Exxon shares after the company is considering canceling major gas projects for the sake of getting "greener".

Regarding utilities, only what I will call "fuel-independent utilities" make sense when the input fuel costs are dramatically unstable. This means nuclear (uranium fuel is just 1% of the operating costs) and hydropower (the fuel is free and falls from the sky in the wet season).

So what does it leave us? Well, in the field of energy policy, it seems that of all places, Russia is an island of sanity. 30 years after the end of the cold war, it is still hard to imagine Russia being the pragmatic and market-driven country in Europe. But it apparently is...

Russia also happens to be home to the second-largest hydropower producer in the world. I am speaking of RusHydro (ticker HYDR.ME). Now the exact virtues of RusHydro are to be reserved for my subscribers.

But if you like the idea and performed your own research after I gave you the idea, please don't hesitate to tell me what you found, so we can discuss our respective viewpoints.

Banking on political dogma

A brutal power crunch

The most industrialized countries on Earth, starting from Germany and China, are currently experiencing a power crush. This is happening for multiple reasons:

Part of it is Covid pent-up demand, boosting consumption.

Part is weather conditions (no wind in summer in Northern Europe, warm summer in Russia, cold previous winter), depleting gas inventory.

Part is technical: Capex budgets have been too low for too long, and supply is structurally below demand.

Part is political:

closing gas field in the Netherlands.

focus on wind and solar, and increasingly hydrogen.

closing nuclear power plants.

not ordering enough gas soon enough.

refusing to sign long-term contracts with Gazprom.

And part is geopolitical:

China refusing to buy coal for its former top supplier, Australia.

Delaying Nord Stream 2 approval.

Some of these factors are going to fade away. Energy prices are likely to force entire industries to go idle, like fertilizer factories. It might even trigger a recession, reducing the demand and balancing the market.

The geopolitical factors are going to be more sticky but go on the back burners. It is already happening, with China grudgingly buying "stranded Australian coal". And Putin ordering Gazprom to start sending more gas to Europe.

But some problems are going to be more persistent. Low capex during 6-7 years guarantees a low level of fossil fuel production for the next 5 years. Even longer if all the energy majors are busy canceling already explored projects, like Shell and Exxon are doing.

These oil & gas deposits will be exploited, make no mistake. National companies like Petrobras, or Russian and Chinese companies will develop the abandoned energy deposits in Mozambique and elsewhere.

But the cancellation and transfer of these projects to new developers will delay everything by several years. What should have been producing by 2024-25 will be at best finished in 2028-29.

So who benefits?

In that context, fossil fuel-producing countries will want to export as much as they can, as long as high prices and high demand persist. After all, peak oil demand will happen one day. Better cash in as much as possible until then.

This means that countries like Russia will try as much as they can to divert their fossil fuel production toward exports. And so they will have to cover domestic needs with something else.

One part of it will be nuclear, a field in which Russia is a world leader, including Rosatoms' mobile floating nuclear stations. This might be bullish in the long run for uranium, but I suspect it will take a while to impact nuclear fuel consumption.

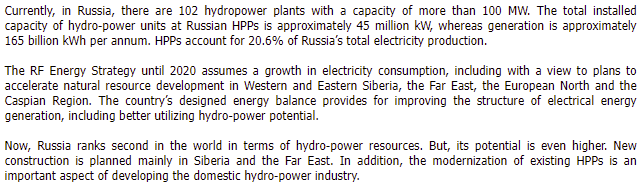

Currently, the ONLY other way to produce reliable power besides fossil fuel (to be exported) and nuclear, is hydropower. Russia has A LOT of potential in that domain. Part of this potential is obviously already exploited. As I mentioned, RusHydro is the second-largest hydropower producer in the world after all.

It is common in Western media to describe Russia as a vile rogue state, completely uninterested in its international image. But I do not think this is entirely true, instead, I expect Russia will try to reduce its carbon footprint as a sign of goodwill.

And for that reason, I imagine it will try very hard to increase its hydropower potential.

A region with an unmatched potential

Looking at the current size of RusHydro, it would be easy to assume the company has already built most of the hydropower potential. With all the low-hanging fruits picked, this would leave little left for future growth.

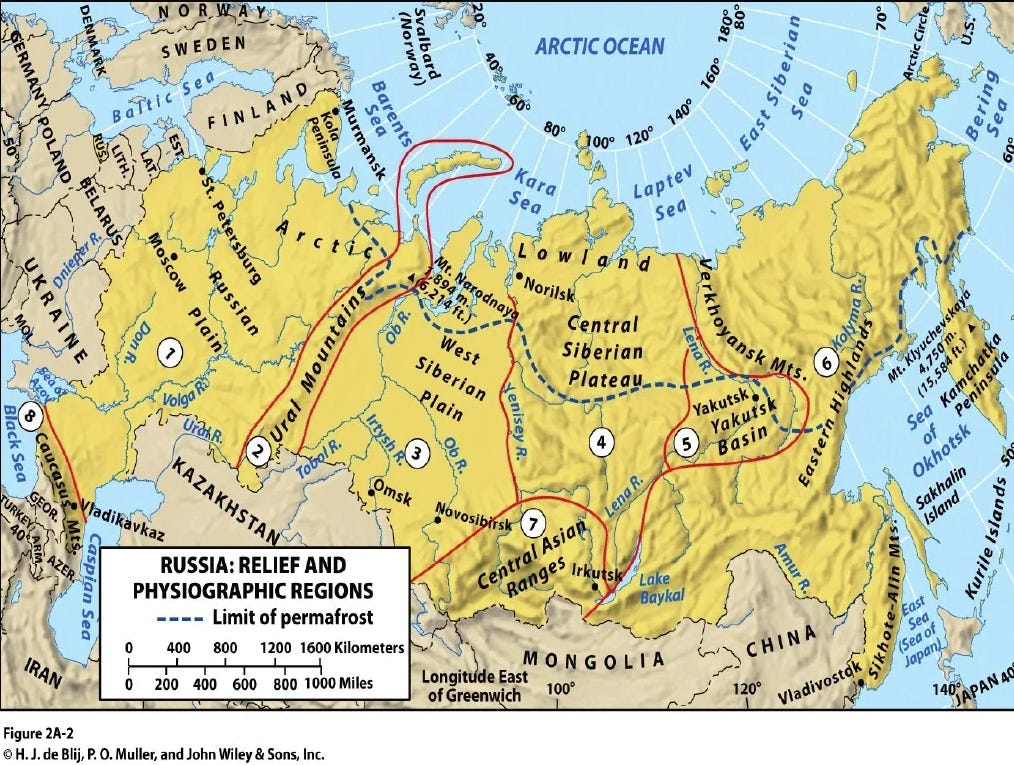

This is forgetting that Russia is the largest country on Earth by surface, with plenty of water running through it. In addition, for hydropower, you need altitude.

Luckily, Russia has plenty of that. The Ural mountains are cutting the country in 2, a little like the Rocky Mountain cross the whole of North America. But you also have the Caucasus to the South, the large and complex Siberian plateaus, and even the Altai mountains, or the edge of what becomes more South the Hymalian mountains.

It is also crisscrossed by multiple rivers all over the country. Very few of these rivers are navigable and they aree oriented North-South. It used to be a hindrance to the development of the Russian Far East. But it is a virtue when it comes to hydropower. And the landlocked nature of Siberia is less of an issue with modern railroad and air transport.

This includes rivers feeding gigantic lakes like the Baikal, the deepest and oldest lake in the world, representing 22% of the WORLD total fresh water and a surface similar to Belgium's.

Even at first glance, you can see how much potential the country has for hydropower generation. The Western relief is perfectly able to provide for the densely populated and industrial West part of Russia.

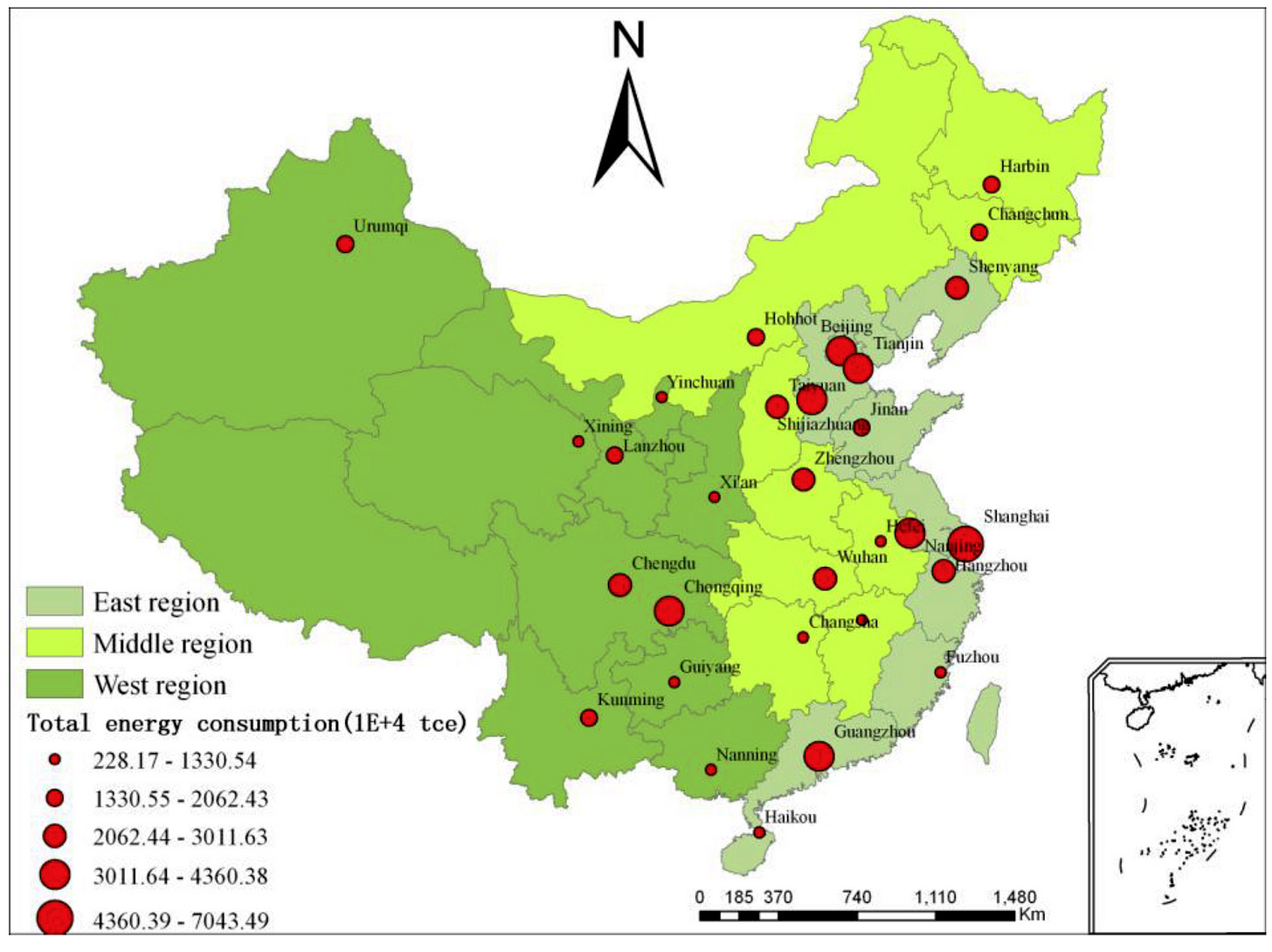

And the lower Siberian plateau is bordering the industrial North and North-East province of China. This includes the northern grid incorporating the large cities of Beijing, Tianjin, and Baoding.

Don't worry, I will not turn this report into a geography class. Even if we will come back later to it to discuss the Kamchatka, Russia's Easternmost region.

But I needed to do this detour to show that far from the isolated, God-forsaken place reputation it earned with Stalin's gulags, Siberia is the next Wild East.

The area will develop very quickly and many "analysts" will never have seen it coming.

The region is not a friendly place to live climate-wise (but not horrible either, think similar to Sweden or Finland, two friendly and perfectly livable places, my neighbors actually).

Forget the climate, what matters is that it is close enough to the Chinese consumers and industries to be able to supply plenty of energy to the hungry dragon.

An energy that is now openly courted by Beijing, and cannot YET be properly sent to China due to infrastructure shortage. RusHydro, operating part of the Siberian electric grid, will probably contribute quickly to solving the problem.

I am utterly convinced that this will change. Russia has already built the massive gas pipeline Power of Siberia I, and is building the Power of Siberia II, to bring a lot more gas to China. And cheaper than LNG will ever be.

Putin will be happy to oblige and provide also electricity to China if requested so.

Still skeptical this might be Putin's plan for Russia's energy? Well then why not simply look at what narratives the Russian themselves are pushing in their own media?

Or the communication from RusHydro itself:

The same Russia that is heavily pushing for hydropower to be part of the internationally recognized green energies at the Cop26 meeting.

Today's RusHydro

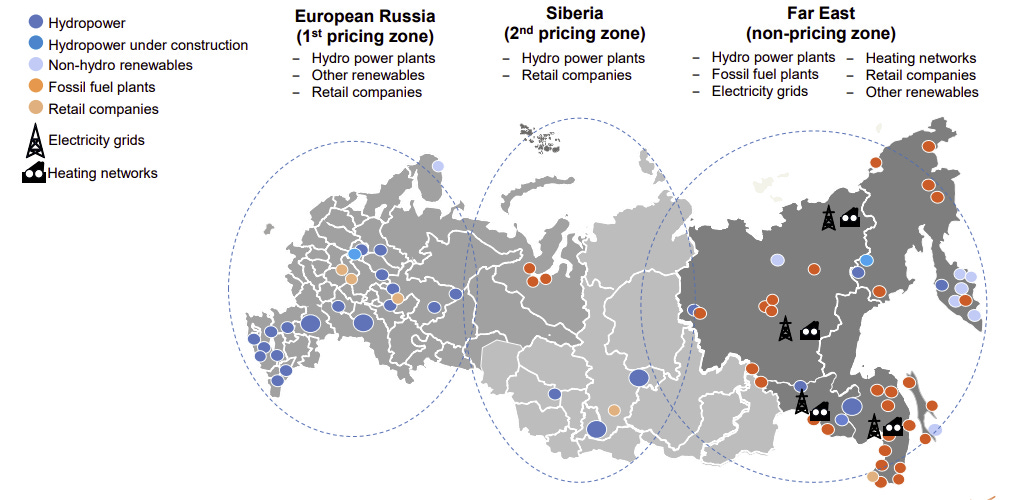

RusHydro is the result of the fusion into one national giant of most of the country's hydropower production. Currently, most of the company's infrastructure is a heritage from the Soviet era.

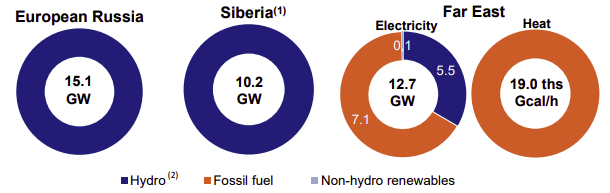

Contrary to what its name implies, the company is also operating quite a few thermal (coal, gas, and oil) power plants.

Roughly, the bulk of the hydropower in the West, in the industrial heartland, often along the large river Volga. Notably the largest hydroelectric plant in Europe:

The thermal plants are in Siberia. The company also operate a few solar field and wind farm, and geothermal plants in the extreme East, but this is drop in the ocean compared to its overall production.

Solid but boring activity

One great quality of a company like RusHydro is that it is really hard for management to screw up. Maintain decently the powerplant, send power to the grid, collect the money, give some back to shareholders. Not much can go wrong.

Or in the famous words from Warren Buffett regarding that idea

“They say in the stock market, ‘Buy into a business that’s doing so well an idiot could run it, because sooner or later, one will,'”

So RusHydro is little bit boring. No self-driving cars, no brand new smartphone design, no incredible new technology. The last thing I would want the company doing is to "diversify" into new ventures it is ill-equipped to handle. Or as Peter Lynch used to call it, Diworsification.

Russian electricity demand is expected to grow by 2%, and with fossil fuel getting more expensive and more exportable, I expect domestic hydropower demand to grow quicker, probably at 3-4%. This will free more hydrocarbon for export, so I expect RusHydro to be under pressure to produce as much power as possible.

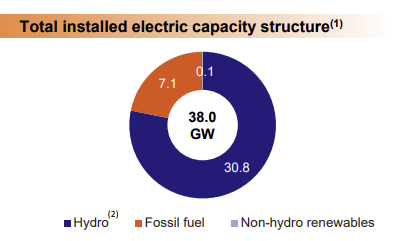

The company is producing 38GW of power, mostly from hydropower. Only another 10GW of hydropower is generated by other sources/companies in the whole of Russia.

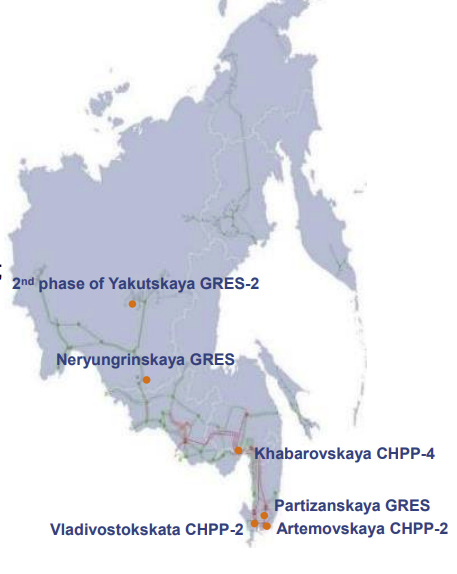

The company is doing focused on things like modernizing the Eastern thermal power plants:

Modernization of 1140 MW worth of generation, mostly switching coal to natural gas

Building additional 870MW production capacity.

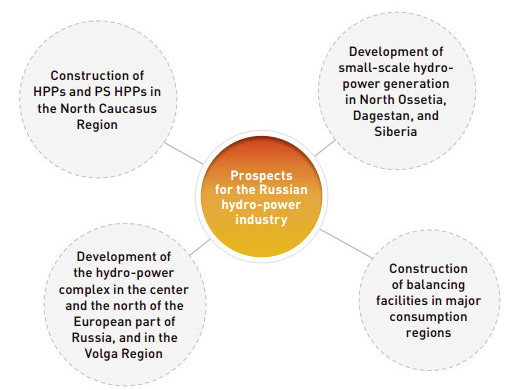

And developing "Small Hydro", up to 350 MW worth of it by 2035, and adding 508 MW "normal" hydro capacity in 2020:

Overall, the long term production should reach 40.7 GW, and this was before reliable energy supply fell in such short supply in neighboring countries in the last few months.

The company's current plan is likely to keep growing production a little, but not by a lot. It will get even higher in the low-carbon proportion of its business, from the current 81% to 86%. If hydrocarbon stays expensive for long enough, I expect them to speed up this transition.

This in itself should help the company to qualify for green-minded and ESG-oriented investors. I do not myself think much of such strategy, but having the company able to profit for this flow of investment in not a bad thing.

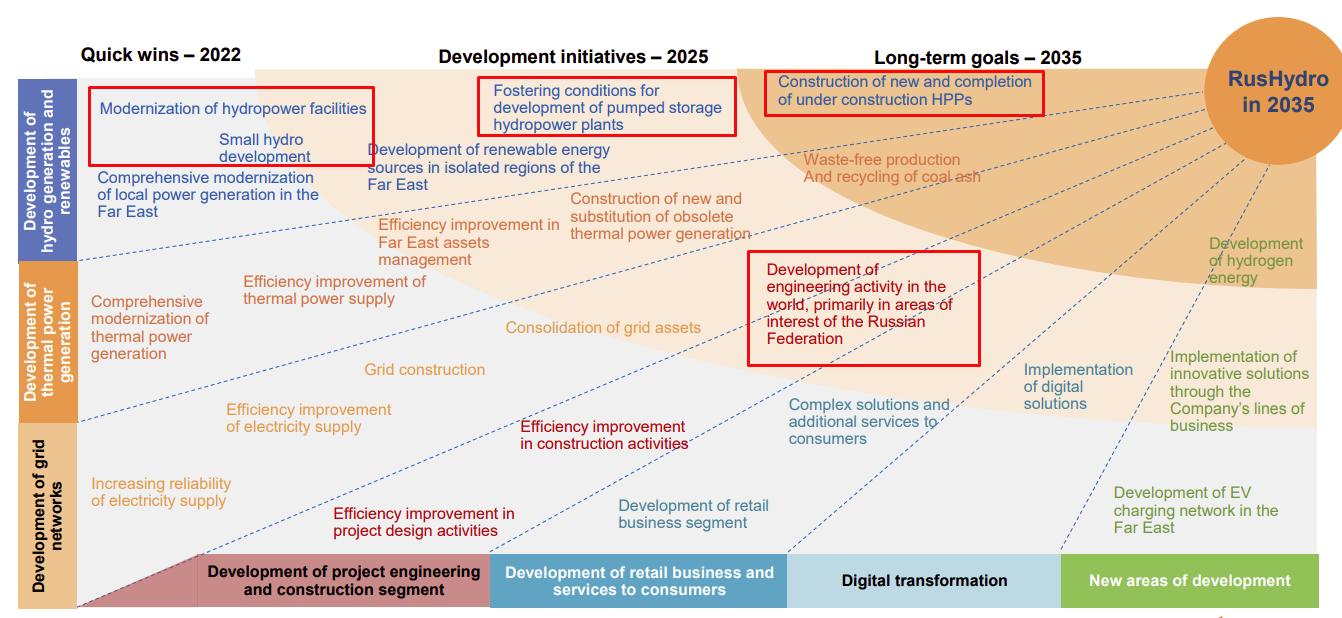

The company provides us with a very extensive overview of the initiative it will take until 2035. I think the key parts are the following, also highlighted red below:

Modernization of existing facilities, boosting production and improving margins.

small hydro allowing to get extra storage capacity and production in remote areas.

new large hydro.

building new dams OUT of Russia, using the government influence to win contracts.

I already mentioned the upgrade, small hydro, and large hydro. I am more intrigued by the "out of Russia" projects. But beyond this slide, management is very quiet about it. So for now I will not even take it into account. But ultimately, the increasing clout of Russia in Central Asia, the Middle-East and Africa might bear fruit for RusHydro for free.

There is also for the post 2025 period "new areas of development like EV charging network or hydrogen energy. I will go back to that later.

The Russian undervaluation in full swing...

The company has generated 382RUB of revenue, and 46B RUB profit (4.6B EUR revenue and 560M EUR profit).

It is currently valued at 360B RUB, or roughly one-year sales, and P/E at 8.9. The stock has frankly gone nowhere for a few years, so this is one for the most patient investors, happy to collect decently high dividends with a cheap and high quality asset. The stock might or might not appreciate, but dividend yield is the only safe bet.

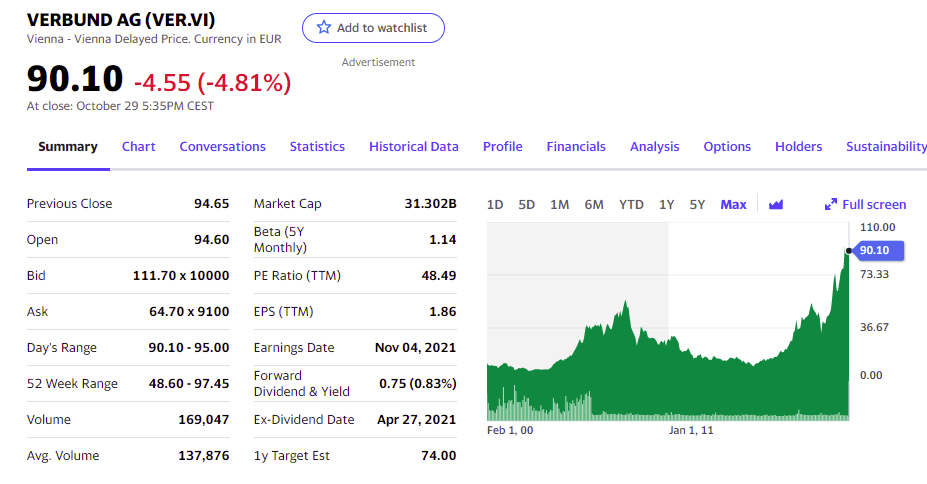

There is definitely a negative effect of location on Russian equity, but this seems a little extreme to me. For comparison, look at the valuation of Verbung AG, the largest Austrian hydropower provider. A P/E of 48 in a business is unlikely to ever grow significantly. This kind of Price to Earning ratios are rarely warranted, but they are never worth it for a utility company.

Really, who is paying that much for so little earning? I guess some Austrian pensions fund or other dumb money looking for something "green".

Sure the stock did great recently, riding the green mania, but the underlying business is still the same boring, stable hydro producer. It will likely never bring much more than 1% yield from its profit distribution. And the price is so high in the stratosphere that risks seems enormous to me.

Both companies are state-owned. Both are mainly hydropower.

The only difference between RusHydro and Verbund is that RusHydro is still viewed as evil "Russian" instead of good "Green".

RusHydro Verbund Production capacity 38 GW 8.2 GW Market cap 4.4B EUR 31.3B EUR P/E 8.9 48.4

Rushydro has x4.6 more power generation capacity, but trade at 1/7 of the Austrian price. Or said differently, each GW power capacity from Verbund is now priced at 3.8B EUR.

If RusHydro was valued the way Austrian Berbund is, it would be worth 145B EUR.

Even with a strong 5-fold divider to take into account that RusHydro is ... well ... Russian, so umpopular, this would still put the valuation at 40-50B EUR, or 10x time the current valuation.

Of course, this is an oversimplification, but this is useful to realize how undervalued RusHydro is compared to its peers.

Either all the other green utility stocks in the world are ridiculously overvalued. Or RusHydro is posed for solid gains.

I expect it is both at the same time.

Undervaluation...despite great financials

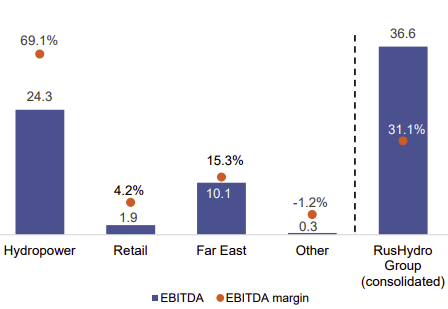

Of course, a non-growth company, even green, usually trades at relatively low multiples. But how many low-growth companies can claim 31% EBITDA margin? The EBITDA is expect to grow by x1.5 by 2026 and x2 by 2035, thanks to improve operation and new facilities.

Not so bad growth in a super stable and safe business line

Another factor is the changing role of hydropower in the Russian power generation system. Hydro is able to produce on-demand, store it for weeks or months at time. So itcan be a price taker, supplying the grid at the most advantageous moment and prices.

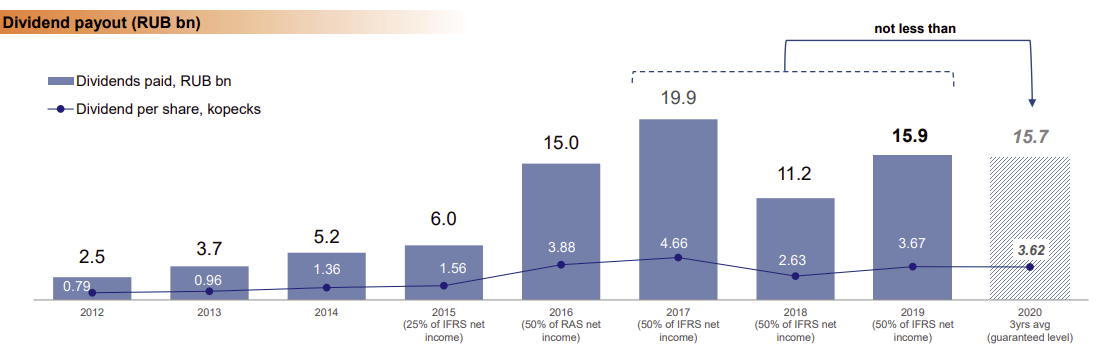

The financial performance already shows in growing dividends. This dividends are guaranteed to be 50% of net profit, but also no less than the last 3-years average. Dividends are also expected to grow in line with the forceasted extra EBITDA.

Beyond the general doom and gloom about Russia, could the balance sheet quality justify the low price? I don't think so.

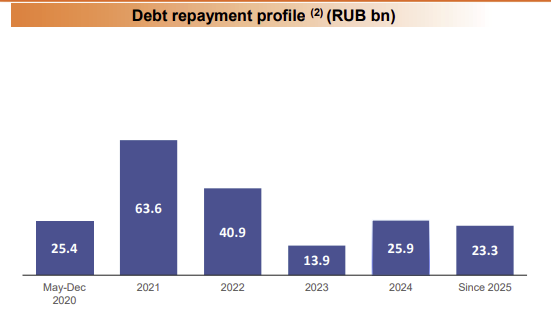

Total debt is just 224B RUB, entirely RUB denominated (so no currency risk).

86% of the debt is at a fixed rate. With extremely long-lasting assets and pricing power during inflation, this debt actually make RusHydro a great inflation hedge.

Remember, dams last easily more than a century. So all the construction costs are in the past, zero fuel costs ever and revenues are in the future. If electricity prices go up, revenues, profit, and assets' value will go up too, but not the debt burden.

The maturity of the debt is reasonably spread out, even if I would like to see the company locking in more 5-10 years long debt instead of relatively short term one.

Ownership and role of the Russian state

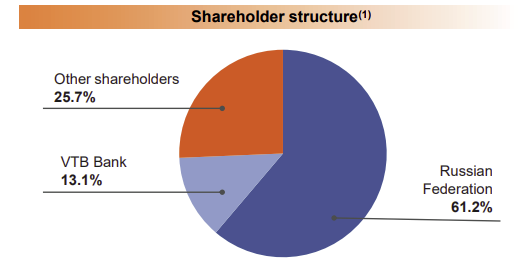

The company is firmly controlled by the Russian state, through direct ownership and through the State-controlled VTB Bank. No surprise here, but this also makes RusHydro a company that will get favored treatment in Russia.

It is also worth noticing that regarding access to capital, RusHydro can count on more than just its own cashflow. The company has a long history of collaboration with the large and politically connected Gazprom bank.

Interestingly, RusHydro used the help of Gazprom bank to very recently emit yuan-denominated debt, confirming the growing tie with China. Supplying energy to China is likely to become a growing theme, and a growth factor not yet acknowledged publicly in the company forecast.

The innovations

EV and transportation

If RusHydro was "just" a cheap and hyper-stable electricity producer, it would already make it a decent purchase.

Long-term returns are likely to be in the range of its long-term ROIC, so 10-11%. Not incredible, but considering the intrinsic margin of safety of the business model, assets, and undervaluation, still decent.

On top of that comes the small but non-negligible chance of repricing at higher multiples, with the world desperate for more green investment targets.

Still, there is another part of the RusHydro's story that should be mentioned. It is the growing demand for electricity to provide energy for processes beyond the usual grid-connected demand.

Part of it is the elephant in the room, with EV and electric transportation in general. I do believe that in the long run, EVs will slowly take over fossil fuel vehicles. It will take a lot longer than Tesla fanboys claims, but it will happen.

RusHydro has established a partnership with Sollers Group, the leading Russian automotive group, to launch an EV car-sharing program. These are small and prudent steps toward the electrification of transportation.

I am glad to see the company dipping its toes into electrification, but also not going all in at once. I expect such a pilot project will slowly grow organically into larger and more numerous ones.

Additional partnerships with other Russian leading firms, like Yandex (The Russian Google AND Russian Uber all at once), are not be ruled out either.

Hydrogen exports

The other new technology worth exploring for RusHydro is hydrogen generation and export. As an experienced utility company, RusHydro has the right profile to handle massive energy consumption and production and export of a highly dangerous and explosive gas.

I personally think that the global push for hydrogen technology is misguided. Basic elemental physics constraints are on the way to making hydrogen an efficient energy storage method.

Ever.

There is simply no theoretical workaround thermodynamic.

But as we saw with renewable green energy, reality and science are unlikely to stop policymakers to aim for "ambitious hydrogen targets" anyway. Accordingly, Russia is ready to oblige and provide hydrogen to whoever asks for it.

Building upon Russia’s hydrogen roadmap, the working group expects that hydrogen-producing facilities using CCS could be commissioned for as early as 2023. Green hydrogen could also be in the works, as the group intends to run trials on hydrogen production from water and other renewables.

This publication goes into more detail about the Russian hydrogen roadmap. Notably:

increase of hydrogen production based on natural gas, including using renewable and nuclear power;

development of Russian low-carbon technologies to produce hydrogen by methane pyrolysis, electrolysis and other means, including by a way of foreign technologies localization;

To this comes an additional bilateral cooperation agreement with Japan and Germany.

A key idea behind the hydrogen move is to use the current network of pipelines to export it. If or when natural gas falls out of favor, Russia aims to still be a large energy exporter, re-using its long-lasting pipeline network to export hydrogen.

Thanks to its massive landmass and water resources, you can be sure that if any of these plans come to fruition, a large part of the energy needed to produce this hydrogen will come from hydropower.

As I said, I am not entirely sure hydrogen makes much sense as energy storage. But even if it is only the aeronautic and shipping industry that turns fully to hydrogen, leaving EVs handle car/bus/truck transportation, it will provide plenty of new opportunities for RusHydro to become a large energy exporter.

It would put the company into the category of energy export giants like Gazprom or Russneft. Even better if other industries turn to hydrogen, like for example carbon-free, hydrogen-powered steel making.

The burning opportunity in the East

The only acceptable low carbon option

But wait there's more!

So far, you should gather from that report that RusHydro is an undervalued, highly profitable, and solid company. And that some growth opportunities exist and are completely dismissed by markets.

As I said, I am not entirely convinced that hydrogen is going to be as large a market as people want it to be. And EV fleet and charging stations might be highly competitive, low margin market not worth the investment.

So does it mean that RusHydro is most likely to stay a stable and boring utility company forever?

I do not think so.

Because one other form of energy is being currently neglected by markets and government alike, but probably not for long.

Even the more climate change skeptical people much acknowledge that concerns about climate change are not going away any time soon. This means there will be a constant demand for more green energy for decades to come.

So far this has resulted in a massive buildup in solar and win power. But slowly, one winter at the edge of blackout at a time, the world will realize they need low-carbon and RELIABLE energy.

It might mean a turn to nuclear power, and I expect that to be the case in countries like Russia and China.

But in Europe and USA or even Japan?

Not a chance. Politicians and the public alike are too spooked by the evils of nuclear power to change their minds any time soon.

This leaves only one alternative, which is geothermal energy.

Geothermal uses underground heat to produce electricity. It has so far been limited to very specific hot spots, very geologically active, like Iceland. This is the equivalent of putting wind farms only where the wind blows the strongest. And it already works.

I expect geothermal energy to become an even larger theme beyond the usual hot spots. In any case, it does not matter for Russia.

The Russian secret energy weapon

Russia has its own personal Iceland-like, the Kamchatka peninsula, on the Pacific coast, North of Japan. It is spotted with multiple volcanoes, 160 in total, of which 29 are active. Basically, the whole peninsula is a giant chain of volcano, continuing into the sea with the Kurill islands.

As you can guess, this means the underground of the region is remarkably hot. I really struggled to find a good map of Russian geothermal potential, but finally found it in this publication.

The geothermal energy production in Kamtchaka has a long history since 1967, and is now well understood. RusHydro is operating profitably at a modest 74MW capacity in 3 power plants at the moment.

This is a staggering low production, considering the region potential was judged at no less than 3900 MW. This is 10% of RusHydro's current production that is currently unused and left in the burning hot ground.

A long-lasting problem with Kamtchaka geothermal potential, like Iceland's, was the relative isolation of the region. Local demand is very low due to the absence of large cities or industries.

But this was before the dramatic economic development of Asia. Kamchatka is actually not that isolated. It is just 2000 km from the north tip of Japan main island and 3000km from Seoul. Not much farther in all northern China, with Beijing at 3500 km.

Very energy-intensive industries have now been concentrated in industrial regions, like mainland China. Things like steel and aluminum foundries for example.

I am convinced that the Kamchatka peninsula is going to be the next industrial center of the region.

We do not need to speculate about how it would work, we just need to look at the example of Iceland. The tiny 300,000 people country is the 11th largest aluminum producer in the world. The reason is simply geothermal power. Operating an aluminum smelter is 1/3 cheaper than elsewhere, thanks to the abundant and cheap energy in the ground.

Now, imagine you are the CEO of an industrial company, looking to launch a line of carbon-free, hydrogen-powered steel. Would you start it in China, and expose yourself to a potential energy supply issues forcing you to stop operations. And have to import hydrogen from Australia or other faraway sources?

Or should you operate from Kamtchka, with nearby clients in Japan and Korea. And with energy for both hydrogen production and to operate the smelters produced locally, while also being the greenest possible, AND perfectly reliable?

This is an angle of the energy discussion that has been entirely missed so far. But with greater concerns about CO2 and the realization of solar and wind limitations, geothermal is guaranteed to make a comeback.

The Russian experience with geothermal, drilling and power generation will come handy to turn RusHydro into a premium supplier of green power to energy-hungry industries.

The mineral resources

By pumping in and out water from the volcanic underground, geothermal power plants also process a lot of minerals on the way. So on top of energy, geothermal production is likely to also produce a lot of rare minerals, first of them lithium.

I am not expecting RusHydro to suddenly turn into a major lithium producer. Simply, with the expected growing use of geothermal energy in Kamtchka, what was so far unwanted byproducts will be an extra income source produced for free. And it will help develop a local industrial ecosystem.

Does it all click together?

Lithium battery manufacturing is an energy-hungry process, so is lithium extraction. I think that the energy-rich and lithium-rich underground of the Kamchatka peninsula is the perfect situation for a few local Gigafactory battery plants.

With additional local production of cheap and green steel and aluminum, this would make the region the perfect green mobility hub, integrated in one spot:

Starting from lithium extraction & abundant green and reliable energy production

lithium and minerals

heat

electricity

hydrogen

Cheaper metals smelting thanks to low energy costs

Steel

Aluminum

Magnesium

Cheaper battery manufacturing, short and integrated supply chain

Proximity to Japan, Korea and Chinese industrial companies.

Bringing together lithium and battery making, metal smelting, and abundant energy to run EV factories

It is all pure speculation at the moment.

Still, in my opinion, not a coincidence that it would fit perfectly into the Russian government goal of making the Russian Far-east a "21 century Silicon Valley".

Conclusion

With RusHydro, you get a cheap and solid utility company with expected 7-11% returns.

+ possible large change in multiples valuation, to catch up with similar companies in other countries

+ free multiple options on the economic development of the Russian Far-East, the Kamtchka resources, and the Hydrogen economy.

Not bad, for a company with low debt and a hyper-safe business model.

This is not the next Amazon. Not the next Tesla. But it should in my opinion steadily compound your money at 10-15% yearly with a very level of safety.

With a lot of possibilities to get even better returns beyond that if any of the following happen:

Repricing of RusHydro as "green", ignoring the Russian part

Massive demand for more power in neighboring countries

Development of the hydrogen economy in Europe OR Asia

Development of the Kamtchaka into an industrial hub