When I was a student we had a (lame) joke you had 3 things to do in your life.

Sleep / Social life / Work-Study / Pick 2 only.

You could have a blast and study but be exhausted.

Study and be healthy but miss on parties and making friends.

On sleep and party, but fail your exams.

Energy policy is seemingly offering a similar choice. You can have clean, cheap, or reliable, but not all 3 at once.

If you want cheap and reliable, it will not be clean. For that, you have gas and coal, and oil. It work, but not so great for global warming and such.

Clean and cheap will not be reliable. You might produce a lot of renewable energy by just plugging a lot of solar panels and windmills into the grid. And if the wind stops blowing for too long, well too bad. This is what is happening in the UK right now. You cannot close thermal power plants, ignore nuclear, and just hope the wind will blow consistently in the North Sea. At least you can hope, but you cannot do that and avoid blackouts.

If you want clean and reliable, it will not be cheap. As I mentioned before, 100% renewable energy grid costs are NOT at the production level, but at the storage. Maybe as far as 80% of the real green transition cost will be in extra grid infrastructures and storage.

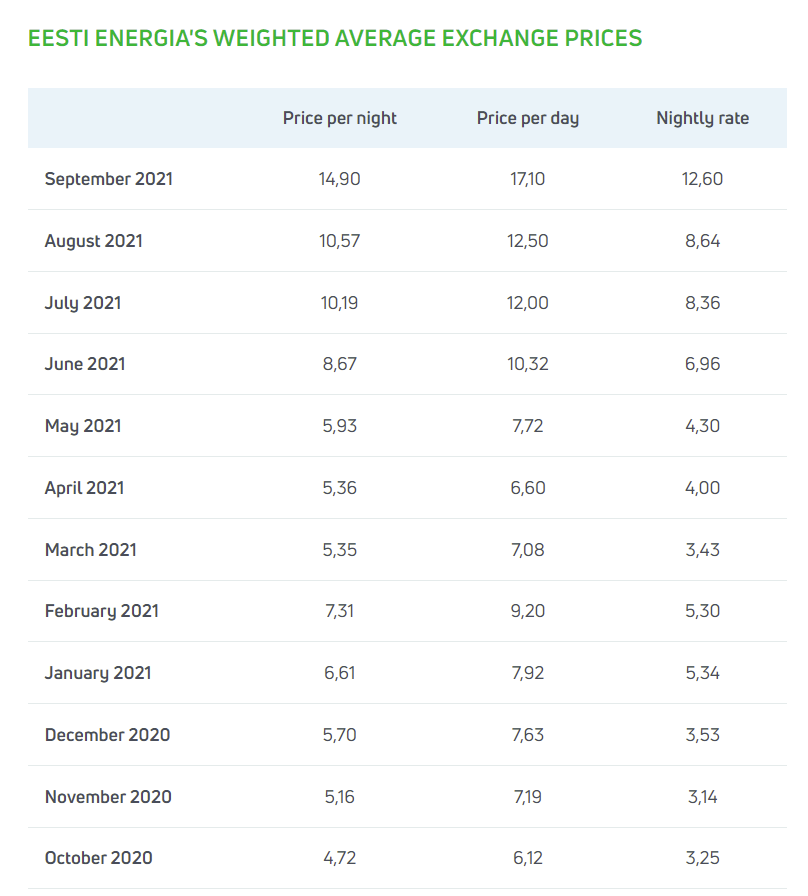

Our policymakers in Europe failed to understand that, and now we have exploding prices AND unreliable energy. To give a real-life perspective on it, where I live in Estonia, electric prices have more than tripled. For a country with 7-8 months of cold/winter, this is gonna hurt consumers badly. The same is true to some extent for all of Northern Europe.

So it is clean, but not cheap and not reliable. Great job...

So what is the path forward? For now, we seem to have the official reaction that the only problem is not enough renewable. And to stop coal or nuclear SOONER.

Yeah, really...

CNNHanna Ziady and James Frater, CNN Business

No one seems to mind the contraction between the headlines below, trying actively to cripple production while we are also running out of the very same fuel:

So now what?

The unwillingness to address energy reality let us see quite clearly the near future for the 2020s. While EU (and American?) politicians will complain about the shortage of gas deliveries, they are going to simultaneously tell us we should not need any gas anyway. The solution is to double down on what failed: more "cheap" and clean and unreliable production.

Only the last part will not be said out loud.

Because you see, making the clean energy production reliable is simply not possible by just adding more production capacity. You need to spend A LOT on storage, either batteries, hydrogen, or other methods. But if you do that, it means clean is not going to be cheap.

Back to clean and reliable but not cheap.

Pick only 2.

Except this is simply not politically acceptable. The cornerstone of politics about the green transition is that decreasing the price of solar and wind makes it a no-brainer against the dirty evil fossil fuels. So we could be green AND keep energy prices low. If factoring in the price of storage, we can't. But no one is going to acknowledge it.

If you need to explain to voters that their electric bill will permanently double or triple to store weeks' worth of energy, that's a tough sale. The kind that doesn't get you re-elected. So our enlightened leaders will simply decided to ... ignore the problem I guess.

There is no talk about increasing spending for supermassive energy storage. Only of boosting green production. And reducing our dependence on the Russians.

The very sad thing in all of this is that they ARE alternatives that is low carbon.

We could have more nuclear power plants. The reactor types like SMR (small modular reactors) or thorium reactors. Things that could and should have been developed 30 years ago. Or at the very least, maintain all the existing nuclear plants UNTIL the renewables are mature enough to take over (looking at you Germany).

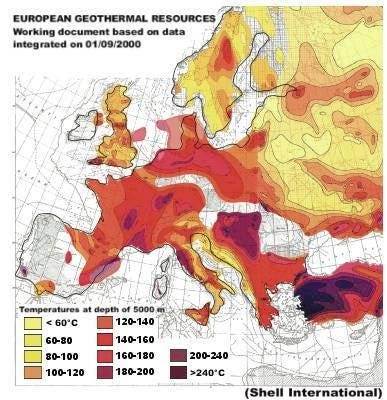

Or we could spend a lot of capital on geothermal energy. With the Alps and other active regions in the middle of Europe, this could be a great option for green non-nuclear baseload energy production. It would require a lot of initial capital, but also have payback during the next CENTURIES. Similar to hydropower dams, still the best source of renewable energy as it can store energy for weeks or months later. I mean really, almost each major European countries have in their border or nearby a hot spot they could exploit:

At the very least, if we are to have expensive spending on green energy, we could do it with super durable facilities and stable production. But it is unlikely to happen any time soon.

Investing takeaway

I would like to say that policy errors will be corrected quickly after one bad winter, but let's be honest here. Brussels is not exactly known for its quick procedures or decision making and flexible governance.

With the EU seemingly determined to ignore scientific facts for its energy policy, we can expect the following for the region:

permanently higher energy prices.

less reliable energy supply.

more likely black swans each winterlike large blackouts.

This first gives us a list of companies to NOT invest in the EU. Either because their energy bills will make them uncompetitive or because their investment strategy will be ideologically driven instead of financially driven:

Energy-intensive companies.

steel, aluminum, and metallurgy in general.

fertilizer producer of nitrate and ammonium.

automotive and heavy industry.

miners.

Energy producers with headquarter in the EU.

Electric companies (many will be tied by fixed-price contracts or pressured by politicians to keep prices lower than costs)

Farming and food producers

Highly leverage businesses with performance tied to EU general GDP.

Large retail and supermarket stores.

Logistics.

However, I am not a big fan of short selling and any speculation downward. This requires having the timing perfectly right, and the way is likely going to be bumpy. Been there, done that, learn it is not for me...

So what should we invest IN in those conditions? We can assume the energy shortage will continue, and so will the push for more renewable productions, hence:

Non-European fossil fuel suppliers to Europe.

Gazprom (even if some of the upside is already priced in now) and other russian energy stocks.

US shale oil.

LNG tankers.

Energy-intensive industries out of Europe.

same list as above, metals, fertilizers, heavy industry, etc... now with less competition.

European hydropower utilities, as they are both "green" and free from fuel costs

Copper mines (for the extra electric grid and electric motors).

Silver mines (for the solar panels).

Solar panel and windmill installers and operators.

Maybe solar and wind equipment producers, but need to find the right one.

There is also a case that can be made for other investments, like uranium, which seems REALLY popular in some part of Financial Twitter and the value investors community. But I am a little bit skeptical of really ideological politicians suddenly turning friendly to nuclear. One protest by Greenpeace or Greta later and it will be gone.

They might choose blackouts or risk yellow vest protesters with pitchforks before admitting they were wrong.

As a result, I think my next report will be covering some hydropower, just not fully sure which yet.

Meanwhile, stay tuned and stay warm.