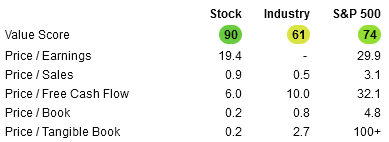

Ticker Transocean Ltd Ticker RIG Market cap $2.5B Website www.deepwater.com Dividend yield N/A

Who could have seen it coming?

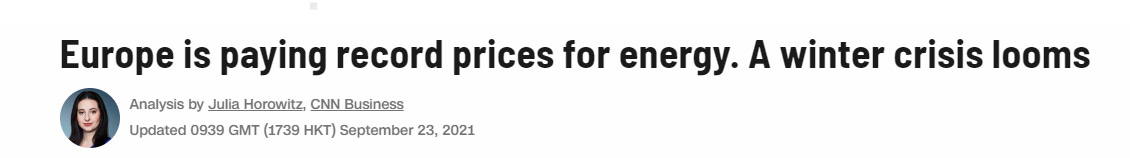

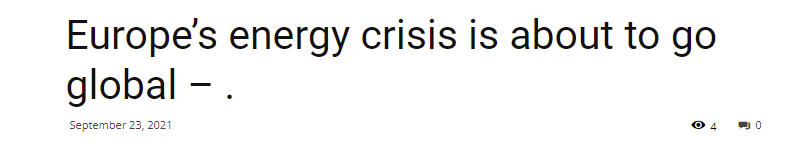

In investing, timing can be a funny thing. I remember distinctively how 1 year 1/2 ago, any talk about investing in the energy sector was at the very best getting you funny looks and indulging smiles. When I was beating the drum of the looming power production problem in Europe from unreliable renewables, and that gas was still the dominant player for electricity generation, it sure was the case.

But when I added that to invest according to this idea, one should look at Gazprom (GAZ.DE), it was much much worse. Some frowned at such an absurd idea to get your money at the mercy of Putin's corruption. Others looked suspiciously at such shameful support to the rogue state of Russia. Climate change discussions would often ensue. And some also pointed out the obvious problem of getting exposed to the ruble, naturally doomed to constant devaluation toward oblivion.

Of course, that was before European electricity price skyrocketed over shortage of natural gas, which could lead to multiple shortages of a lot of other things people generally like to have, light, warm, food, factories runnings... Something that apparently no one could have predicted and is probably going to be Russia's fault anyway...

I am aware that this will sadly mean a lot of real hardships for a lot of people, and especially the poorest and the most vulnerable. This is actually pretty tragic considering that it could have been avoided with better policies and planning. But I am still struggling to not gloat a little when looking at the Gazprom chart, from its 3.3 EUR at the end of 2020 to its current 8.06. (and no I did not catch the bottom due to overthinking it and waiting too long to press the trigger, but I am still up 40% for the year on this position, which is good enough).

I am planning to stay positioned on the energy sector for a few more years until this commodity cycle runs its course. Mostly through exposition to Exxon and Gazprom (see disclaimer above).

What's next?

But this got me thinking, are there still corners of the energy industry that are YET to experience a Gazprom type of repricing. When I started to look into the sector 2-3 years ago, I looked at producers, but also at service providers. The problem with the 2 leaders, Haliburton and Schlumberger, was an oversized exposition to shale oil and the US market, which was dramatically unprofitable and still is barely now at reflated oil price.

Another option was drillers. You see, oil companies like Exxon or Shell generally do not perform the task of drilling the oil wells themselves. Their specialty is finding and operating the oil wells, and then producing the oil or gas. When they are looking for new deposits or launching the exploitation of new resources, they rely on highly specialized contractors to operate the drilling rigs (also called drillships).

Why would Big Oil not operate directly this crucial part of the operation? Partly because it offers them a lot of flexibility. They might need to drill only some years on a specific region, and would have very complex and expensive machinery idle in quiet periods. An independent contractor can instead contract the machine to some other oil operators in the area.

A more cynical reason is that with energy experiencing a typical commodity boom'n'bust cycle every decade or so, when Big Oil cut capex, they can let the drillers suffer from temporarily useless drilling rigs, instead of losing money themselves.

And boy, this was true these last years more than ever.

"Four of the seven largest offshore drillers - Diamond Offshore Drilling Inc, Noble Corp, Seadrill Ltd and Valaris Plc - have sought protection from creditors or begun debt restructuring talks that could lead to bankruptcy.

Two others are reaching out to their creditors. Pacific Drilling last month said it may need to modify terms of its debt, and was seeking alternative funding in the event creditors would not accept new terms. Shelf Drilling, the ninth-largest by revenue, is seeking talks with creditors over loan covenants that take effect next year, executives said"

Offshore Engineer MagazineLiz Hampton, Nerijus Adomaitis

This went way beyond a simple downturn cycle this time. It took the shape of something like an apocalypse for oil drillers. The number of rigs at worked not since this low in 3-4 decades, with a collapse in activity unprecedented in speed and magnitude.

"This month (June 2020), the number of floating rigs at work is expected to hit the lowest level since 1986 as oil companies cancel or defer contracts, said industry executives and analysts."

This blog is called "Cyclical Value Investing" for a reason. I am constantly looking for rock-bottom sub-sector that is at the low point of a cycle, where even quality companies are priced for a cent on the dollar. You can imagine that I kept a strong interest in offshore drillers since last year.

However, there was other obvious and immediate opportunity in European gas, with the completion of Nord Stream 2 and a looming energy crisis, now upon us. With limited time on my hands and most capital already tied up, I lost sight of offshore drillers for a while.

Besides, while I love to invest in a sector in crisis, I do prefer to do so after the first and second wave of bankruptcy hit. This tells us without a doubt which company was actually strong enough to weather the storm. This is also the perfect acid test to judge management quality.

Picking a target

The truth of the energy sector is that the green transition will take a while. In the meanwhile, the industry massively underspend in new development, resulting in very few new discoveries and even less new development being launched. The current energy shortage in Europe is likely just a preview of a recurring problem we will have throughout the 2020s.

This means that once acknowledged by the industry, markets, and even politicians (this one will take a bit longer), we are going to see a lot of efforts to increase production. This will benefit 2 types of energy companies:

Producers with large reserves and the possibility to grow production, like Gazprom or Aramco.

Drillers who will be able to increase their service prices when everybody will want their equipment at once.

You see, oil drilling ships are very specialized pieces of machinery. It takes years to build one from scratch. And the shipyard able to do it are rare and few, and generally have not far much better than the driller the last 10 years. So no matter what, there will not be a sudden increase in drilling capacity, as shipyards will not be able to deliver much more rigs for the best of a decade.

On top of that, a lot of existing rigs have been stored away, a process that often results in substantial damages over time, sometimes to the point of making the repairs not worth it. Quite a few have also been simply destroyed for scrap metal value, as bankrupt companies could not afford the storage costs. It can cost up to 70,000$/DAY to store and keep safe an oil rig, these are not simple or cheap machineries to operate and maintain.

Overall, I would prefer a pure-play if possible, as offshore rigs are a lot more rare and inflexible in supply than other equipment like pipes, pumps, and drilling tips. So a company offering offshore + other services like Halliburton is not likely to benefit as much from an uptick in drilling activity, compare to a pure offshore player.

The ideal driller

So what would be the perfect profile for a driller to invest in my opinion?

The first thing to consider is that it has been increasingly difficult to find new major oil deposits. Part of it is that less money has been spent on exploration. But it is also that simply all the easy to find and exploit deposits have been found already. New resources will not be obtained with a few excavators in Texas or Saudi Arabia. Almost all of the giant oil fields have been found since the 1960s and 1970s. New resources will only be in the Poles or under tremendous depths in the ocean. So I need a driller with the technical know-how and the equipment to do it.

With the slaughter of the last years, it is easy to pick the "best" driller. Just not having recently filed for bankruptcy is an endorsement of quality management and proper balance sheet management. It would be ideal if it managed to stay cash flow positive during the period, but I was not sure if that even existed.

The last element would be anything giving this company in particular an edge. Anything that could give it some form of a moat against the competition, especially

economy of scale (in the top 5 of the industry)

unique technologies

unique assets

low costs

a large backlog of signed contracts or pre-agreed projects

Not much of a choice after all

In 2018-2019, I had a few targets on my list that was fitting the bill. One was standing above a little the other, but not really enough to make a choice. At the time, my intent was to wait for the oil price to hit a bottom, wait to see if that was truly the low point, and buy a few of them at once, instead of trying to pick a winner.

And then Covid came...

Following a really bad decade for oil prices came an unprecedented collapse in demand, leading to NEGATIVE oil prices in spring. For most of the already beaten and bruised drillers, this was the last straw that broke the camel's back.

This left really only one survivor standing on my list. With fossil fuels being again something people realize we need to have for society running smoothly, I think it is time to look more in-depth at the last man standing, Transocean (ticker: RIG).

The survivor

A hyper-cyclical industry

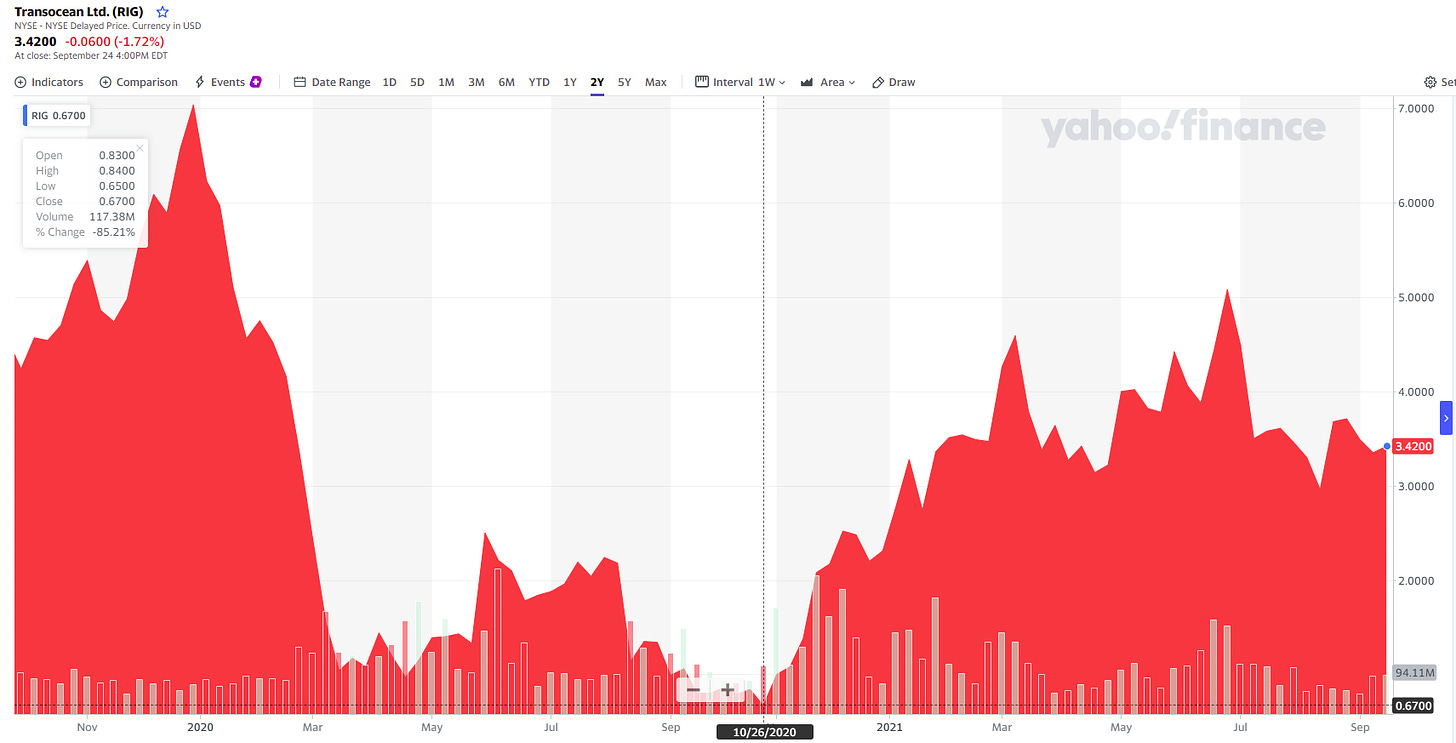

During early 2020, it was not really clear if ANY offshore driller was going to survive. Would the spring crash have triggered a real recession, the weakened companies would all have failed to survived with rig utilization price below cost for years to come. Even with completely unprecedented stimulus, all of Transocean/RIG competitors that where not parts of a larger service company or partially nationalized entered bankruptcy.

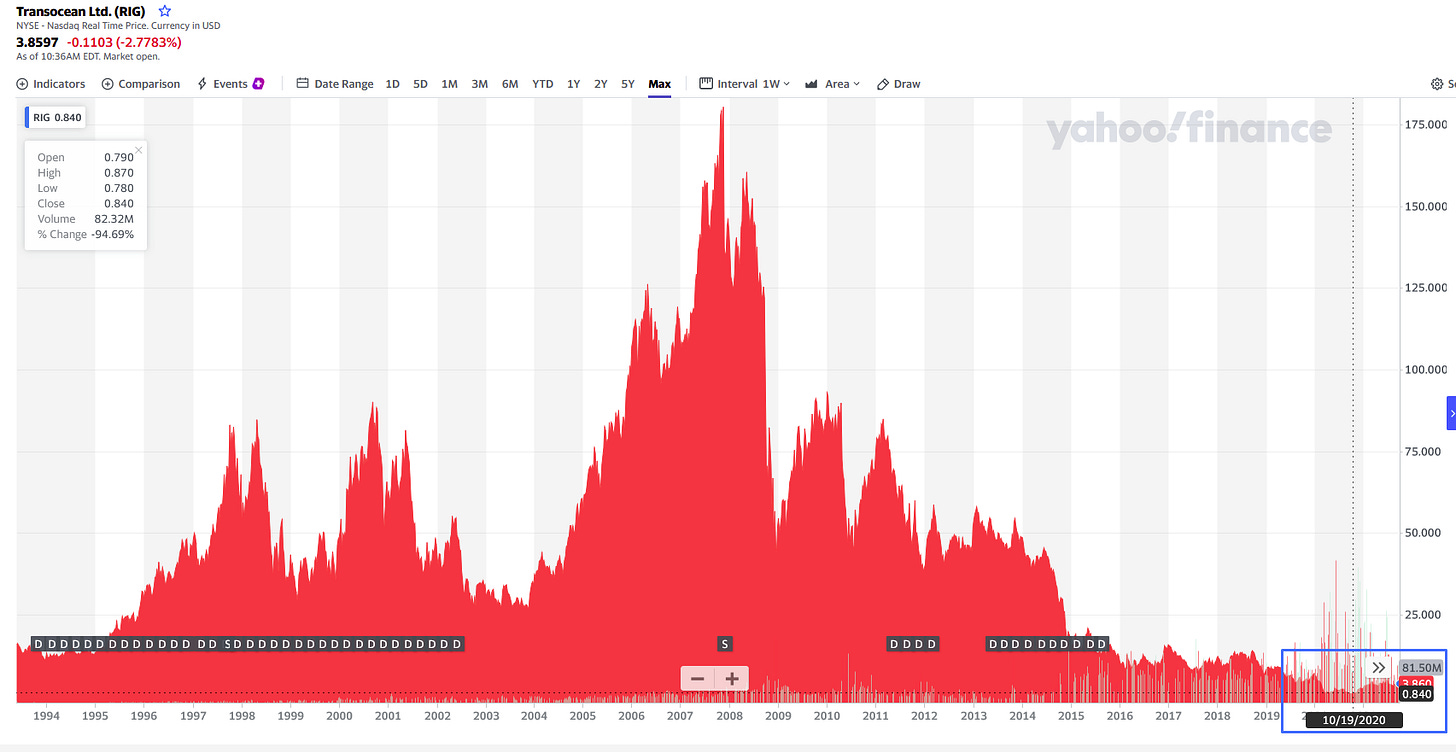

So even retrospectively, I am not sorry to not have taken a chance during 2020, despite the rally from the bottom at 0.67 USD/share to the recent highest in June 2021, at 5.08 USD/share.

I simply don't have the nerves for speculating on a rebound without the fundamentals showing at least an improvement (or COVID getting kept in check with vaccination campaigns).

Is it too late to buy RIG? Did I just miss the boat? It could seem so looking at the graph above. But let's take a little bit more perspective, shall we? How do the 20+ years performance look like? The last 12 months rally I just showed you are barely a blimp compares to the historical data.

I remember very well the period when Transocean stock hit its all-time high, in 2007. It is actually around that period that I started to learn about markets and economics, while doing a Biochemistry Ph.D. (Yes, I had rather an eclectic career path).

At the time, there was an endless stream of forecasts predicting an economic collapse and imminent doom from peak oil, as it was getting harder and harder to replace reserves. Forecasts for $200, $300/barrels where not especially outrageous back then. Anyone even giving a 1% chance for negative oil prices in 2020 would have been considered an idiot or a lunatic.

Of course, it is usually when everyone agrees on the forever rosy future of an industry that we have reached the top of a cycle. When everybody's in, the only way is down. We saw it during the dot-com bubble, we saw it in 2007. And I suspect we are seeing it again today for the broader market, even if calling the top of this market has proven an endless frustration for a generation of value investors.

From here, Rig's almost x10 since last November does not seem so impressive, does it? Truly, I suspect there is some soul somewhere that have bought last November and is on the way to make a 100- or even 200 bagger with RIG. Being naturally more risk-averse, I could be perfectly satisfied with only a 1/10 of such performance in the next few years by buying in now.

A strategic shift

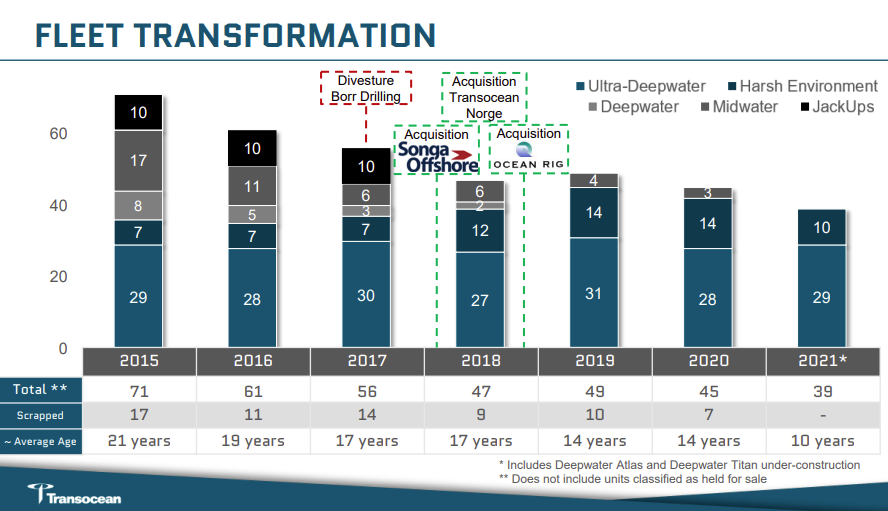

As I mentioned before, most of the easy-to-find and exploit oil & gas deposits have already been found. The one that have not yet been discovered are located in difficult-to-reach environments. Either very harsh weather conditions, especially the Arctic, or very deep under the sea. While its competitors were focused on operating legacy equipment for shallow waters, Transocean has progressively divested its drilling rigs for shallow and mid-depth water from 2016.

In parallel, it did a series of acquisition of small-size companies in order to accumulate more modern deepwater and ultra-deepwater rigs, becoming the unavoidable service provider in that niche. The rest of the drilling rigs are "harsh environment" which actually means very sturdy builds, able to withstand storms and harsh weather in the cold waters of the Nordic and Arctic regions.

During the same time, the average age of the company's rigs went from 21 years old to just 10 years (a rig lasts 30 to a maximum of 40 years before having to be repaired or scrapped). Not only did it focused on the deepwater segment, but it also got rid of all older platforms that were not anymore up to modern standards and were costly to maintain and operate.

Now the transformation from the old, unfocused Transocean is complete, and the company will only operate modern, state-of-the art deep and ultra-deepwater rigs. It is notably illustrated by the change of their main web address, from the old www.transocean.com even a year ago to the new www.deepwater.com instead. This new strategy should have a dramatic impact on margins for 2 reasons:

Deepwater projects are more complex and technical and are generally associated with larger deposits, giving the client more incentive to pay well for a job perfectly done. No oil company executive wants to ever go through what BP's management experienced with the Deepwater Horizon oil spill in the Mexico Gulf in 2010.

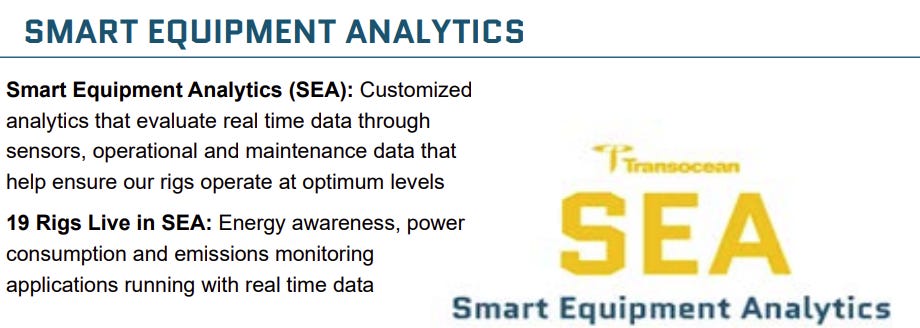

Newer rigs include a lot of automation and electronics that did not even exist 10 years ago, allowing for less personal and lower operation costs. The same feature also increases safety and reduces downtime, ensuring better respect of project deadlines, which in turn helps convince clients of accepting higher rates.

I am not entirely sure that the acquisitions in 2018-2019 were perfectly timed, as I imagine that ever greater bargains could have been made in 2020. But I hardly can blame the company's management for not have forecasted Covid and its effects on the energy sector.

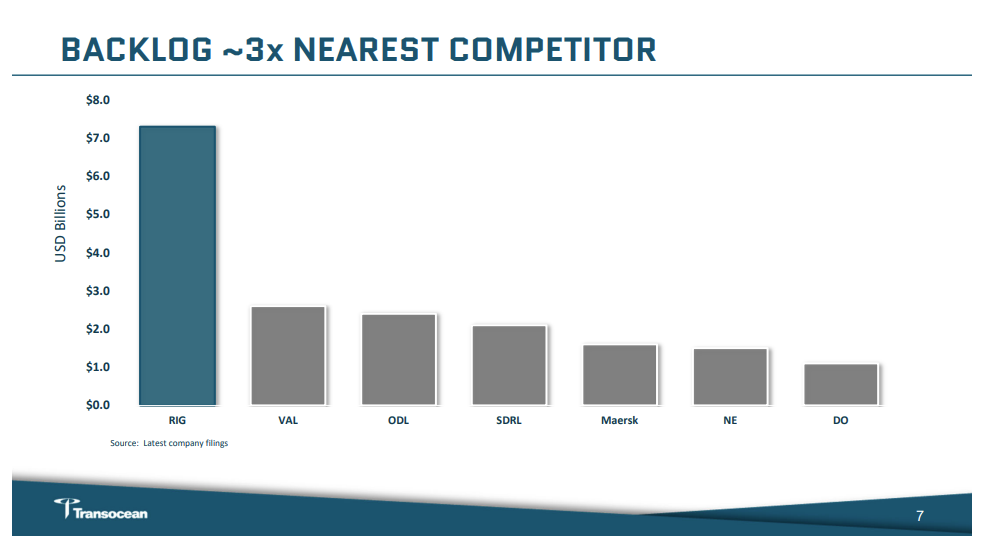

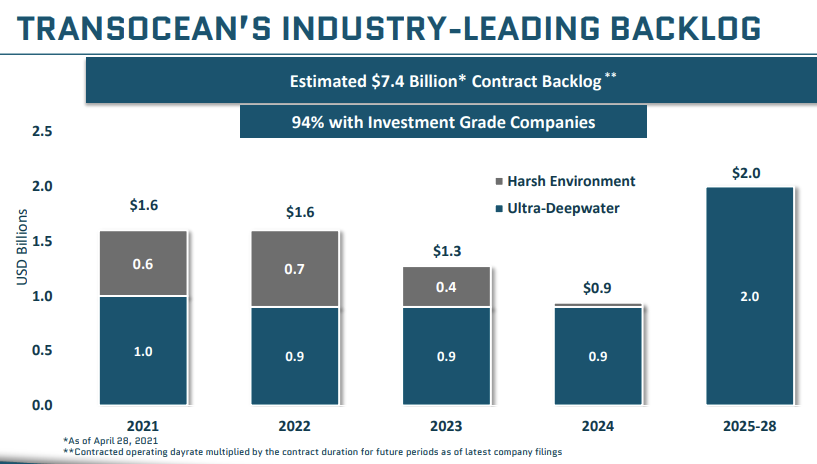

In any case, one positive aspect of the acquisition of Songa Offshore, Norge, and Ocean Rig was the acquisition of their backlog catalog. Combine with the historically impressive backlog of Transocean, this give the company 3x more secured contracts for the near future than its next best competitor, Valaris. Transocean alone has locked-in more work for its rigs than the next 5 leaders of the sector. This speaks highly of its reputation in the field. If you have a lot of choices, you likely prefer to contract a Transocean drillship.

The tide is finally turning

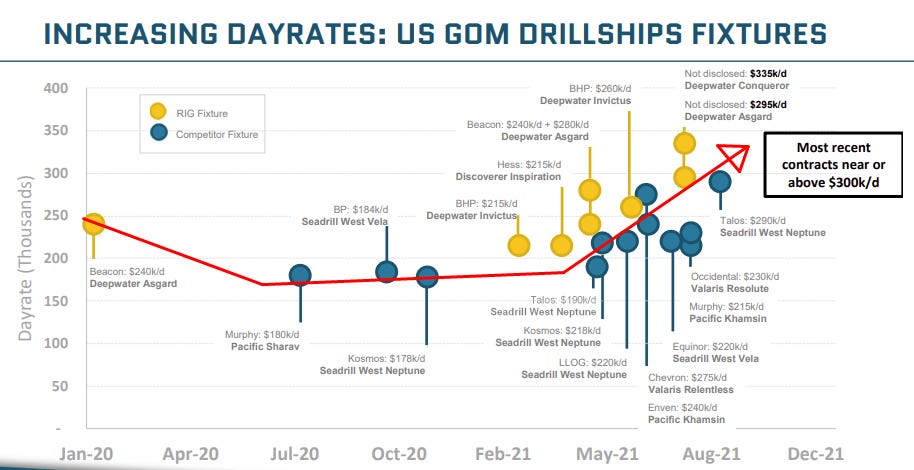

The key metric of the drilling industry is dayrates. This is essentially the price oil companies pay drillers to rent the drilling rigs, on a daily basis. Unsurprisingly, when all the producers cut on capex, dayrates crashed below operating costs. Drillers had to either accept below costs projects, with dayrates around $150,000/day, or idle drillships, which itself cost $70-80,000/day.

The oldest or least in demand drillships were put in "dry storage, an expensive procedure that allows the parking costs to drop to $15-20,000/day, but also mean another expensive restarting procedure will be needed for the ship to be productive ever again. Quite a few of the older drillships have also been simply destroyed to cut costs to the bone, which was still not enough to save most of the industry from bankruptcy, except for Transocean.

After the rare and too cheap contracts in 2020, drill dayrates have finally started to rebound, with contracts in early 2021 finally bouncing above the $200,000/day, and a strong upward trajectory appearing in the last few months.

It should be remembered that 2019-early 2020 were very far from normal prices already. In 2012, dayrates of $500,000 to $600,000 were considered "good" (and that is not even adjusted for 10 years of inflation). After the carnage of the last 10 years, a return to this level would be a dream come true for the drilling industry.

It is also interesting to notice that Transocean/RIG drillships (in yellow) are hired at an higher average rate than almost all the competition. This confirms the competitive advantage of Transocean in having become the deepwater leader.

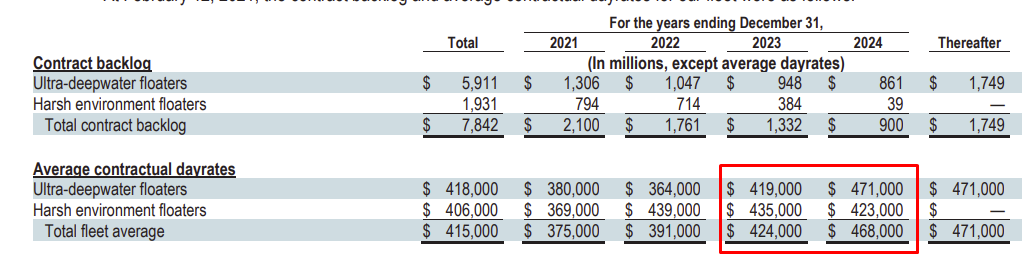

Already, the signed contracts are showing the expected rise in dayrate, with the contracts in 2023 and 2024 at a minimum of $420,000/day.

The number of rigs with a job have also risen drastically, showing the return of some capex spending in the industry. Of the 10 harsh-environment rigs, 8 are currently working (mostly in the North Sea and north of the region), with contracts running for the next 1-2 years.

Of the 27 ultra-deepwater drillships, 17 are working, with the rest stacked away. This is far from ideal but also indicates the capacity of Transocean to quickly mobilize an extra 40% capacity when the demand picks up.

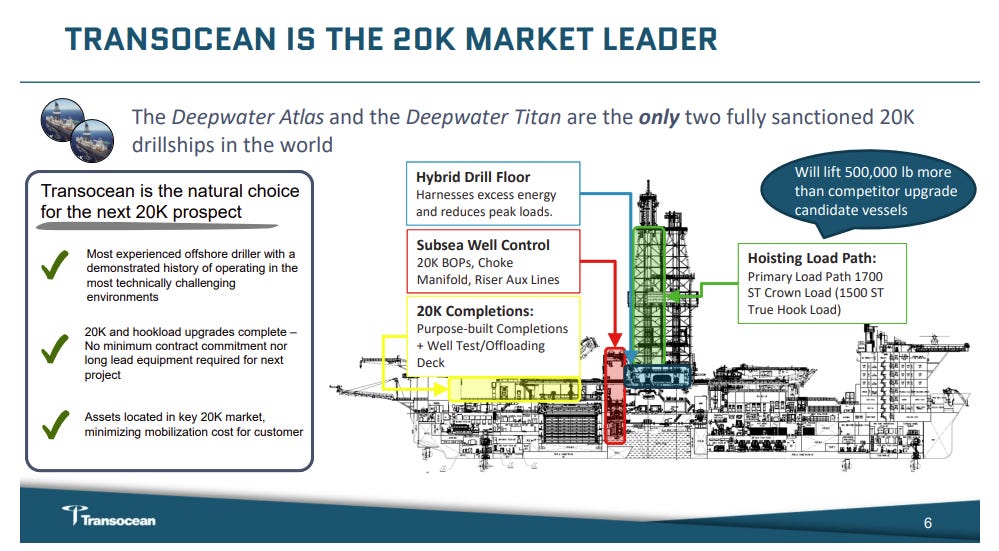

One last good news regarding fleet status is the still-in-construction Deepwater Titan ship, a 20,000 psi able drillship (a very high capacity, more on that later). The Titan is already contracted by Chevron for the period 2023-2028 at a $455,000 dayrate. Titan should be delivered by the shipyard in May 2022, just in time to be carried on site and works its 5-years contract with Chevron.

The other ship in construction, the Atlas, has just landed a $252M contract in the Mexico Gulf with Beacon Offshore Energy. For perspective, the shipbuilding did cost Transocean $422M. Of course not all the contract is pure profit, but I estimate 1/5 to 1/4 of the building costs to have already been paid back with just that contract. Not bad for an asset that will last decades more after this contract end.

Good enough financials

Revenues and earnings

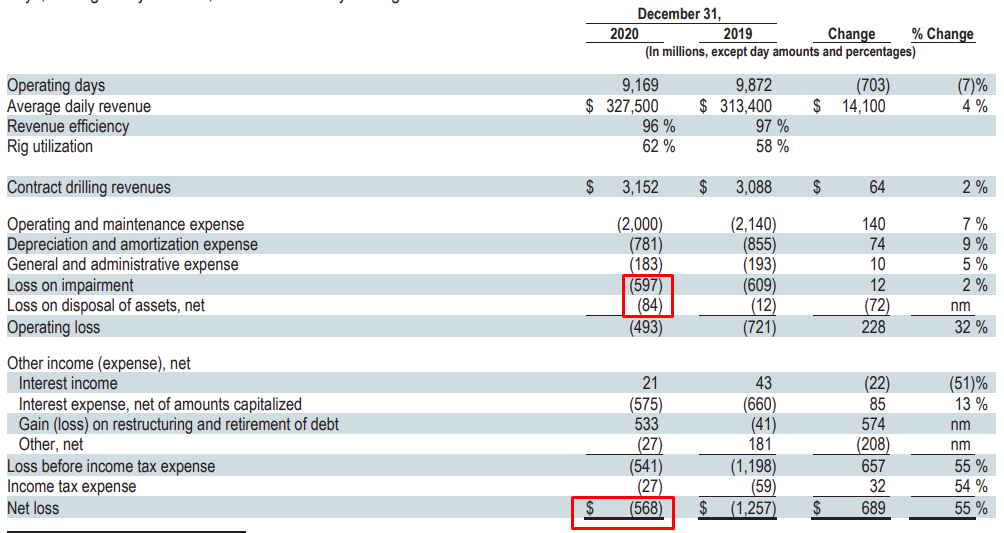

With all the talks about most of the industry going bankrupt, it make sense to be more than a little worried about Transocean financials. The company reported massive losses in 2020, which could at first glance put into question the survival of the company. When looking into the income statement, it however appears that revenues was standing at $3.1B for total expenses around 2.9B.

So why did the company failed to report a positive earning of $200Ms? This is entirely due to a gigantic $681M loss on impairment. The impairment were a mix of old ships being scrapped and sold, and operating ships marked down in value to reflect the current dayrates. If dayrates were to keep rising, I expect a corresponding rise in their value. The impairment is alone responsible for the 2020 net loss.

Again, not great but to be expected after the carnage of 2020. If anything, this shows a rather conservative accounting procedure. What really matters is that even during that period, the company was having a positive income except for impairments.

Debt and cash flow

The company is far from debt-free, but even in 2020 has been working on solving the problem. $930M of cash flows went into debt reduction last year. In parallel, debt exchanges have pushed half of the debt repayment schedule to 2027.

Total debt is standing at $7.8B, an amount that will need to be managed and reduced over time. The company has no less than $2.3B in cash available, so some of that is likely to be used to reduce the overall debt.

However, at the moment, the operating cashflow is essentially covering the debt interest and not much else. So debt reduction should be expected to really happen only in 2023 and later, when dayrates have recovered firmly above the $400,000 mark.

The return to activity of the now idle 2 harsh environment and 10 ultra-deepwater would obviously help speed up the process. But ultimately, just a return to dayrates in line with the historical norm should be enough for the company to reimburse its debt by the end of the 2020s.

The next big thing in oil drilling

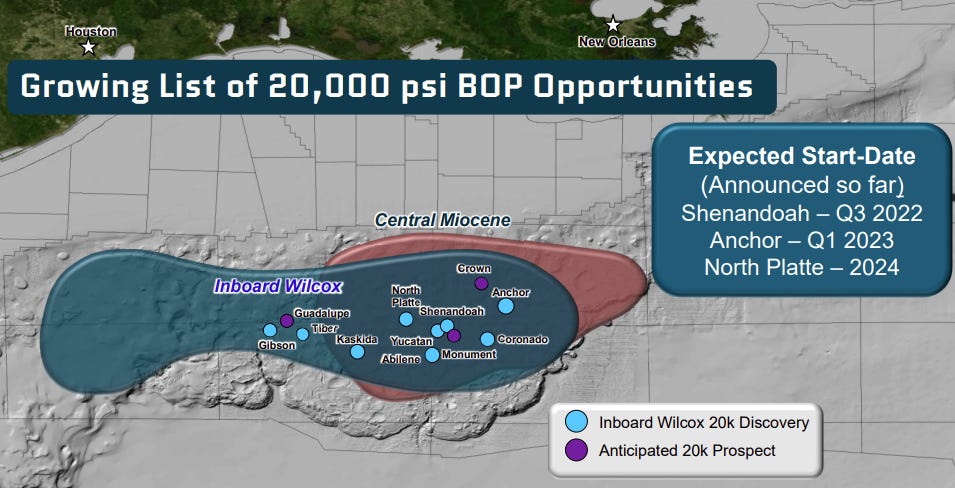

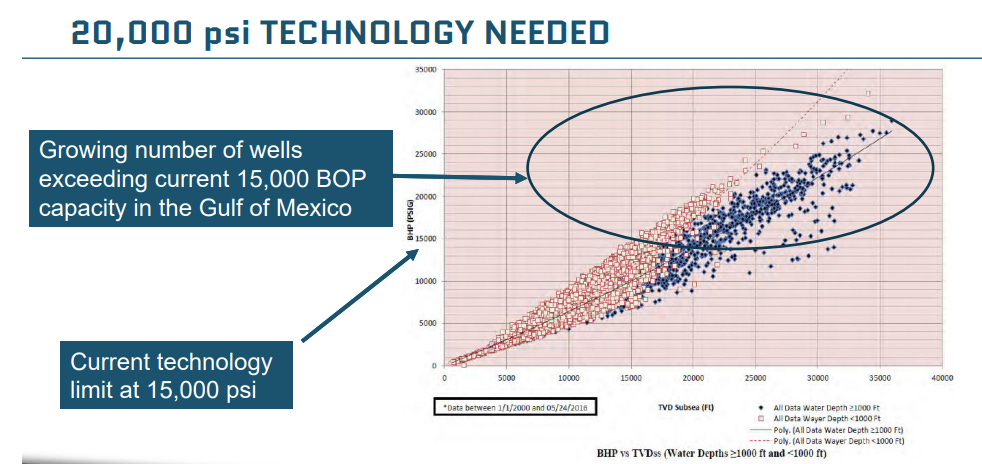

With drilling being done ever deeper, oil wells pressure is getting increasingly high as well. This is especially true for regions exploited for a long time and somewhat depleted, like the Gulf of Mexico

Without going into too technical details, you just need to understand that drillships need to apply tremendous counter-pressure to keep the oil in the well while drilling. This is the same pressure that later needs to be regulated to ensure a safe and stable oil production. High pressure was also what made BP's Deepwater Horizon incident so difficult to solve.

The current technology on 99% of drillships is limited to up to 15,000 psi. Only higher capacity up to 20,000psi, something the patented technology of Transocean is able to do, will be able to maintain production in the Mexico Gulf and other similar regions.

This innovation and investment into the future is already paying off. Both of the 20,000 psi able ships currently in construction, the Atlas and the Titan have landed contracts even before being built.

Both the Atlas and Titan at work by 2022 and 2023 will solidify Transocean reputation as the leader of offshore drilling. Especially when the projects are difficult and require the best technology available on the market. Competition is lagging and is yet to even order similar ships from shipyards, even less get delivery of them anytime soon.

This should leave a blue ocean for the Atlas once its contract is finished, and very limited to non-existent competition for both ships on the 2027 mark. With the expected increased demand for 20,000 psi ships, I would not be surprised to see all-time high dayrates for the 2 drillships, as oil companies will need to outbid each other to get their hand on this unique capacity.

Passed 2024-2025, Transocean will be the only company with experience building and operating 20,000 psi ships. I am not sure how much modifying part of the existing fleet to the 20,000 psi specification is doable, but if it is, this would be a great way to repurpose some of the company's idle ships for this new lucrative market.

Altogether, the Atlas and Titan and potential future similar ships (newly built or old ones repurposed) will be the main driver of increased incomes and margins for Transocean.

Conclusion

Transocean is a company with $22B in assets for $9B in liabilities, or $11B in net assets. The debt load seems now manageable and market perspectives are improving. So I do not think the market cap as low as $2.5B is justified.

Plainly speaking, markets are valuing the company assets barely above scrap metal value. At the lowest point of valuation last year, they probably valuing the assets below scrap value.

In fact, such valuation is not justified even if the 12 idle drillships (out of a 37 fleet) never come back to work, and dayrates never go back to the 2012 level.

With Europe entering a potential energy crisis this winter and with gas & oil prices hitting levels not seen in many years, it is not a stretch of the imagination to expect at least ONE of the following to happen in the next months or years:

New drilling projects in the North Sea to improve Europe's energy independence

New deepwater projects putting back to work some of Transocean's 10 ultra-deepwater rigs

Shortage of drilling rig in specific locations, leading to higher dayrates

Increasing demand for modern 20,000 psi able ships, giving an edge and improved dayrates to the Atlas and Titan rigs in their next contracts.

New 20,000 psi ships, repurposed or custom-built, to take advantage of the growing demand.

Each of these could lead to significantly higher earnings for Transocean and allows it to quickly extinguish its debt. With some of the debt bearing 8%-11.5% interest, this would significantly free additional cashflow. In parallel with debt reduction, I expect the improving fortune of Transocean to allow it to secure a lower cost of capital.

The scrapping of older rigs and dry storage of ships that might never get back on the market is a recipe for an industry-wide shortage in drilling capacity for the next 4-7 years. With the dawning realization that the energy transition is going to take longer than hoped, the entire oil & gas sector is more than ready for a repricing. This has already begun for the oil majors, but the offshore sector is yet to truly catch up.

I fully expect Transocean /RIG to be the next winner of this energy sector repricing, once the market realize the inelasticity of offshore drilling pricing in the next 12-18 months. In addition to the whole sector repricing, as the market leader and sole owner of the unique 20,000 psi capacity, Transocean should significantly outperform its peers.

Alternatively, if somehow Transocean's stock price would fail to reflect the return to profitability, its management will have the option of repurchasing shares at the current depressed level and create tremendous value for its shareholders.

To me, the only negative scenario would be a systemic shock similar to the 2008 crisis or even larger, which would depress the world economies and oil demand. While not impossible at the currently elevated market valuations, the already depressed valuation of the offshore sector might provide some shelter compare to the much more stretched valuation of other sectors. And with growing geopolitical tensions, a little too much oil or gas, instead of too little, might become a new priority for a lot of countries anyway.