How To Deal With The Mother Of All Bubbles

How I Learned To Stop Worrying And Love The Bubble

I recently saw passing this chart, illustrating how US equities are SOOOO far out there compared to the rest of the world that it is not even funny anymore.

We are talking 4-5 standard deviations above the “normal” level that had only been breached in the last 2 major bubbles in the last SIXTY YEARS.

The Financial Times itself commented and called it the mother of all bubbles, written by Ruchir Sharma, a chair of Rockefeller International:

“US stocks are "over-owned, overvalued and overhyped to a degree never seen before"

The US accounts for nearly 70% of the leading global stock index, up from 30% in the 1980s.

So of course, the answer would be to avoid US equities.

But this is not so simple, even if I am somewhat of an advocate of this idea.

For example:

Russian and Central Asian equities are off-limits for 99% of Western investors.

The Middle East is on fire and it will likely get a lot worse.

European and Japanese industries are suffering greatly from terrible energy policies and lagging in innovation compared to China, the EU even more than Japan.

Both have also terrible demographics and social issues, the EU even more so if you don’t count the recently arrived and economically net negative non-European population.

China is grossly undervalued (see that topic on next article), but is also likely to stay so with Trump tariffs and the risk of WW3.

Africa is a perpetual mess, and only specific opportunities like SBSW I covered in the last report are good enough to make sense.

India’s IT service economy is likely to be hammered by the arrival of AI, and so are the low-value industries where automation and robotics are replacing cheap manual labor.

So this leaves only a limited geography, which I have been covering relatively extensively: South America & neutral-enough SE-Asia countries like Indonesia.

But maybe this is not the answer at all.

After all, look at this curve. This time it IS truly different. So what is going on?

Financialization

The obvious trend is the terminal financialization of the economy.

This graph with equities and financial assets going parabolic is the other side of the coin of why the USA can no longer make icebreakers, frigates, electric transformers, drones, batteries, shells, etc.

If your business is mostly to get everything done somewhere else and give pieces of paper in exchange, you can as a collective become very, very profitable.

Libertarians will tell you that there will be hell to pay for this imbalance.

They are likely right, but they are also expecting it to happen any time, you’ll see, very soon, for … a few decades now?

The right thesis wrong on timing is the same as being wrong in investing.

Nowhere To Go

Another factor at play here is that international capital has very little place to go.

I have discussed the geography issue but there is an even bigger factor at play here: the bloodbath in bonds.

I mean … look at the hundreds of billions in unrealized losses:

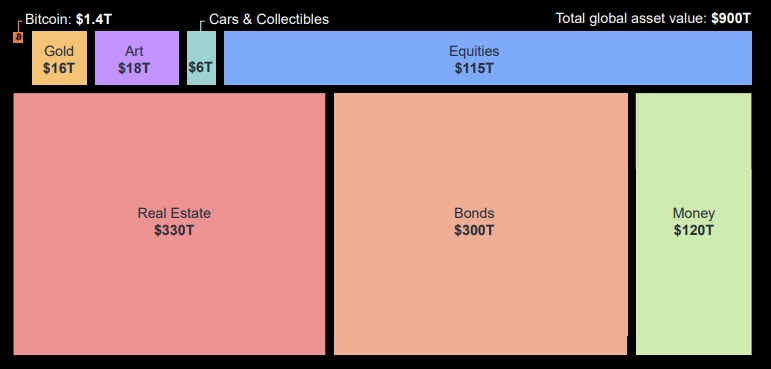

Talking about investing and stock, we often forget that the bulk of the world money is actually NOT in equities.

It is in bonds, real state and cash.

Now, with inflation and rising rate hammering cash holds and bonds, this is a stockpile of 420T that might be considering flowing into equities.

However, this is very, very, dumb and easily scared money. This the liquid assets of pension funds, insurance companies, utilities companies, retired baby boomers, etc.

So they will flow were the consensus is.

And after a decade of easy money, the consensus is S&P 500, and especially tech stocks of the Magnificient 7.

How To Play It (Safe)?

Frankly, I am still mostly looking for myself at South American oil stock, Indonesia coal mines, defense companies, and such.

This is because I have a high volatility tolerance, I invest without having to justify it to anyone, like returns above 15% and above would not do well with my nerves if my money was on the Mag7 stocks.

At the same time, other people will have other constraints:

Investment funds with geographical or market cap size mandate.

Family office with very conservative clients.

etc.

In these cases, I think it might make sense to bet on the recent winners, at least for now, and here’s why:

The USD Dies Last

There is a definitively non-zero chance that we are entering the end game of currency devaluation.

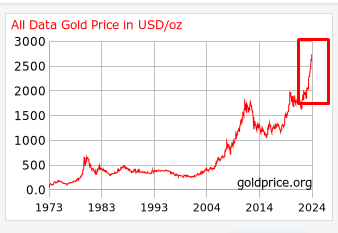

For sure, gold seems to be trying to tell us just that the last few months:

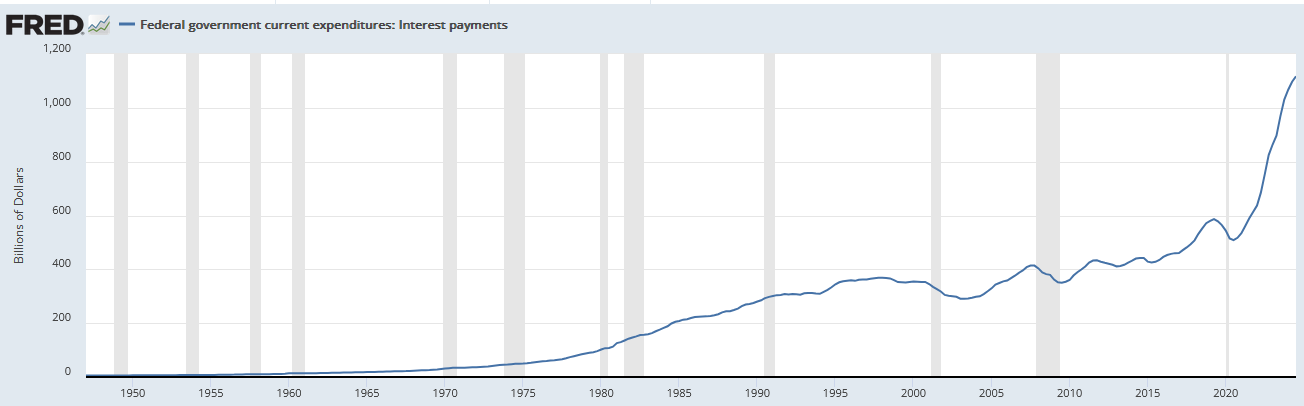

So are the US interest payments, having jumped above a trillion and larger than the already massive and wasteful defense spendings:

And can you notice how ineffective the Fed cutting interest rates has been:

The problem with the “imminent demise of the dollar” is that by all metrics, at least 2 other major currencies are in way worse shape: the Euro and the Yen.

As long as these die QUICKER than the USD, this is the capital of economies as large as the US flowing into the dollar and out of these currencies. This will be reflected in US equity pricing positively.

So yeah, the USD might die soon-ish.

But as long as the Euro and Yen die quicker, it will actually stay afloat.

It doesn’t matter if you run quicker than the bear.

You just need to run quicker than the other guy.

Yen

Our squirrel-level collective attention span has already forgotten, distracted by the US election and the Ukraine war, but it was in August THIS YEAR that the yen carry trade almost crashed the global market.

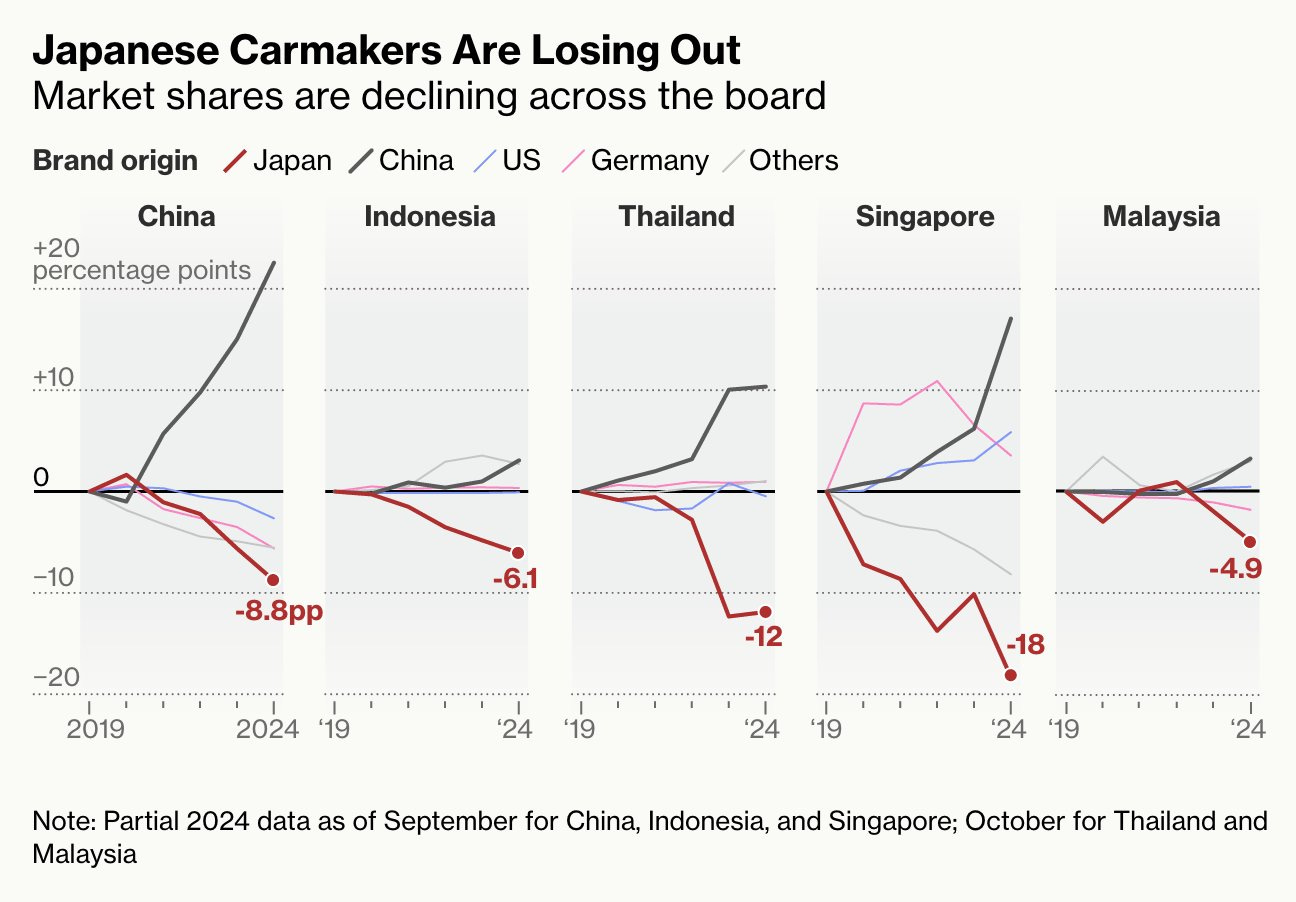

Since then, Japan has not been doing better. At all. Just look at Japanese car exports in Asia:

How will that do for the yen do you think?

Euro

Meanwhile, the main economy in the Eurozone, Germany, is having every major industrial company in the country cutting jobs by the tens of thousands: Bosch, Volkswagen, BASF, Deutsche Bahn, Ford, etc.

This is a mix of manufacturing dying from too high energy prices and a general malaise in the continent that just keeps getting worse.

The perspective of a hot war with Russia, unspeakable openly, is nevertheless slowly making its way into the collective subconscious as well.

The Eurozone is HUGE. This is a lot of capital looking for refuge in Nvidia and Meta. Of for that matter, in Exxon and Chevron for the bad climate unbelievers heretics that still live in the EU.

The Trump Effect

Talking with people with large businesses, and seeing sales in e-commerce personally, I can say that the whole world was holding its breath before the US election of this year.

Now that there seems to be a Trump presidency with no assassination, massive voter frauds, riots, or even a hint of civil war, the USA looks a lot more appealing.

Meanwhile, even if it turns out to be just a show without proper actions, Musk’s DOGE initiative will give the hope of reforming the US bureaucracy.

This too will alleviate the fear of an imminent currency crisis.

Expect the EU to be in parallel busy shooting itself in both feet for good contrast.

How To Trade The Mother Of All Bubbles

On one hand, we reasonably know that one day the music will stop for a bubble fed by the breaking down of the American Hegemony.

On the other hand, the looting of its European and Japanese satellites, as well as money flowing out of bonds and cash will keep propping up equities for the foreseeable future.

So what I see emerging is a strategy where you want exposure to not only US risk assets, but the most OUTRAGEOUS ones.

Here a short list of such uber-speculative assets that might added to a portfolio:

Bitcoin and other cryptos.

Microstrategy, which is basically a Ponzi inside a Ponzi at this point, a sort of ultra-leverage call on Bitcoin.

Nvidia, as the AI spending might just keep going in the mania.

Tesla, as the Musk-Effect will now be in overdrive after his victory alongside Trump. Expect Tesla and SpaceX to become the reshoring/remanufacturing savior of America, as Musk will likely not be below a little bit of self-serving push for his own company when he heads DOGE.

All the uranium and SMR companies in the nuclear space. Something will need to power as these Tesla factories and AI datacenters and it will not be solar panels.

Anything quantum computing related. Quantum is easy to hype and utterly esoteric, perfect for mindless speculation.

Space-related companies, like Rocket Labs will work as a proxy for SpaceX, despite much worse economics. The stock price is likely to not care and go to the Moon much before NASA figures how to do it again.

Intel, which I explained previously.

Palantir, as it is as much Peter Thiel as Trump & Musk who won the elections, with Vance deeply tied to Thiel.

Defense industries, especially General Dynamics, are less likely to be Musk’s target compared to white elephants like Lockheed’s F-35 already bashed by the DOGEmaster.

How to do it: here the step-by-step approach:

Put a double-digit percentage of the portfolio in these ideas. Exact level should be how you can sleep at night doing it as a max threshold and how much your clients need to see to be reassured as a minimum threshold.

The more speculative, the higher the P/E, the better. Enjoy the 50-100% returns on this ultra-volatile part of the portfolio before the music stops. These will either go up or down, but never stay put.

Monitor CLOSELY the emergence of a real crash. Anything that might indicate that something in the US financial system is breaking or that the mania is losing steam.

Ignore completely any crash originating from the EU or Japan, these will only create volatility, but ultimately accelerate the flow of capital toward US equities.

US bond-related crashes are a little more tricky, but you can assume a repeat of the Silicon Valley Bank salvage. Nothing too bad will happen here, not with the Fed printing at will when needed. The USD will die before its bond market unrealized losses are acknowledged.

Inflation going fully out of control should be a warning sign. I am not talking of 8-10%. More like 20%+ and accelerating. This is when to start taking your chips off the casino table.

On the other hand, a major NATO/US military disaster, like a crushing defeat in Europe or the upcoming removal of Israel from the map, both likely possibilities at this point, should be the warning signs of the Wall Street rats getting ready to leave the ship. Follow them and try to outrun them.

An Upside Down World

The funny thing is that I personally would consider putting money in the Magnificient 7 a very risky and speculative move, considering their valuation.

And Colombian oil stocks for example a flight to safety.

But for most money managers, their clients will have nothing to say seeing at least part of the portfolio in Mag7.

The positive thing is also that by waiting for a more visible crisis, it will be easier to sell at the right time, instead of suffering years of “underperformance to the benchmark” that can be a career killer.

Besides that, I not just hope, but I actually mean, that your conversion of beliefs (and you arebby far not alone recently) means that we are very, very close to the top!

gold prices could raising also due to fear of war...