Investing in the Caucasus: Georgia Capital

A specialized fund, in the only country in the Caucasus I am willing to look at as an investor.

If there is one Eurasian region that has a dubious reputation for investors, beyond the Balkans, it is the Caucasus. The home of not-so-lovely places like Chechnya, Dagestan, and most recently a brutal war between Armenia and Azerbaijan that might still turn into outright genocide.

So this might not be the first place that comes to mind when looking for investment abroad. But there is one country in the region that have greater potential and seems to now turn away from the petty ambitions and historical grudges so characteristic of the region.

I am talking of Georgia (the country, not the US State).

A Quick Primer on Georgia (and the Caucasus Region)

A region of conflict and division

I will not turn this into a geography lesson, but a bit of context will be useful. As when I covered Steppe Cement in Kazakhstan, there will be plenty of hard-to-spell and harder to pronounce correctly locality names in this report.

The country forms a bridge between the Black Sea and Azerbaijan.

In the map below you can see in green the Nagorno-Karabakh region, which is the current area of Armenia that Azerbaijan recently conquered. Ultimately, Azeri goals are to conquer enough of Armenia to at least have a land bridge with Turkey.

While important for the region, this conflict does not really involve Georgia. So I will not cover it further in this stock report.

Other conflicts that very much involved Georgia were with Russia over Abkhazia and South Ossetia. You can follow the previous links for a Wikipedia overview of these 2 regions.

Abkhazia has been in and out of Georgian control over time, with the region's great powers (Greeks, Byzantine, Ottomans, Russia) interfering sometimes in favor of the locals against Georgia, other times siding with Georgia. The same can be said of South Ossetia.

Both regions fought against Georgia in wars of independence from 1991-1992. Currently, both territories are under protection/occupation (depending of opinion) by Russia.

They are both likely to be digested into the Russian North Caucasus region, which protects/occupies other similar mini regions like Dagestan, Chechnya, and North Ossetia, … So while officially part of the Georgian map, those regions are pretty much lost in practice.

I honestly will take here my usual stance when it comes to ethnic and territorial conflicts in areas like the Caucasus and the Balkans:

Both sides have some legit claims, and both have practiced colonization, forced deportation, and ethnic cleansing over the last centuries. Layers of religious persecution add to the nastiness of these conflicts.

Stupid nationalism and inability to let go of past grievances hinder a peaceful resolution, like for example a Swiss-style confederation or EU-style free trade union.

I will not pick a side, and as an investor, only care if the next 1-2 decades will be peaceful or if the conflicts are boiling to the surface again.

The capacity and interests of the meddling great power matter more than local politics. This is a place of the world where might makes right.

The Georgia-Russia conflict has for all practical purposes been settled for now. Georgia suffered a humiliating defeat, discovering the friendship and support of the West did not really extend to any militarily useful help.

For this exact reason, I expect Georgia to focus on economic development for the foreseeable future, with a reasonable Russia-friendly policy, but with good relations with the West as well.

With Russia very busy in Ukraine, I do not see them looking for another conflict in Georgia for the foreseeable future, even in the case of an eventual victory. The costs of the war and of rebuilding and integrating Ukrainian regions would be too high. In case of a defeat, this risk would be even lower.

So despite the mainstream perception lumping Georgia in the “Russian targets” list, I think this risk is very low since the conquest of the 2 separatist regions.

Georgia

The country is mountainous in both its North and South borders and sparsely populated there. The capital Tbilisi essentially controls any possible East-West trade from Azerbaidjan through the central Valley crossing the country.

Most of the population is located in the Eastern and Western plains.

The country is experiencing explosive economic growth:

3.2% in 2019.

10.6% in 2021.

10.2% in the first 9 months of 2022.

Inflation was high in 2021 (9.6%), but is coming down as the central bank raised rates to 11%. An inflation target of 3% seems somewhat realistic. In any case, there is no sign of any imminent distress in the economy, something rather remarkable for an emerging economy not based on commodities.

The country has a low tax rate, and a business-friendly environment and has actively courted foreigners looking for a residency for a digital nomad lifestyle to move their activities to Georgia.

If you work more than 183 days, you will automatically become a tax resident – the income tax is at a moderate 20%. However, Georgia offers an Individual Entrepreneur scheme, where your business turnover up to GEL 500,000 (around €155,000) is only taxed at 1%. With this scheme, you are also able to extend your one-year Digital Nomad Visa to a permanent residency.

(source Relocate.world)

It is ranking globally 1st in the Open Budget Index, 7th on ease of doing business, above the Czech republic on the Corruption Index, and above Japan or Portugal in the Economic Freedom Index.

Simply put, Georgia is a “normal” country when it comes to business, not the corrupt or backward place people easily imagine.

It is also a growing tourist destination, benefitting from beautiful landscapes, historical monuments, cheap prices, and its millennia-old wine industry (it might even be where wine was invented in the first place).

You can read more about Georgia's economy in the Georgia Capital presentation.

Russians Immigrating to Georgia

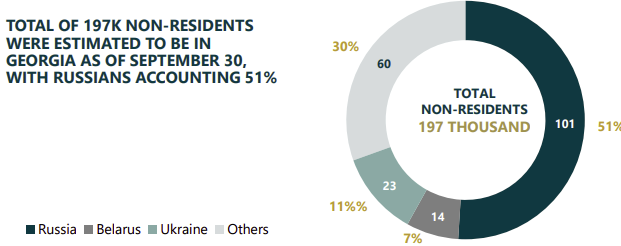

The country has seen a large influx of Russians fleeing the risk of mobilization. For the 3.7 million people country, the arrival of 112,000 Russians was a large population increase. Half are IT specialists able to work remotely. And ultimately likely to keep their jobs, as Russia can ill afford to lose most of its IT specialists.

This has created predictable tensions in the local real estate market (rents have risen by 80% almost overnight). And a boom in the local economy.

"These are high-end people, rich people ... coming to Georgia with some business ideas and increasing consumption drastically. We expected the war to have a lot of negative impacts. But it turned out quite different. It turned out to be positive."

Overall, a similar situation to Kazakhstan, with a profile of the Russian emigrant even more tilted toward high-skill, high-pay specialists.

New bank accounts opened by immigrants in 2022 were worth $500M. Significant in the $18B economy (almost 3% of GDP).

So the arguments made for a boom in consumer spending, construction, and investments made in the Steppe Cement report are valid here as well.

Where Kazakhstan was a forced choice for Siberian residents, Georgia is a preferred option for Russians with money, which they likely know well from previous tourist trips.

A Growing Regional Hub

Georgia is already an important transit hub for energy, with the South Caucasus Pipeline. The regional energy transit corridor accounts for 1.6% of the world’s oil and gas transit volumes.

There is also the Trans-Caspian Gas Pipeline under discussion, meant to carry gas from Kazakhstan and Turkmenistan to Europe.

The country also signed free trade agreements with the EU, China, and Turkey, making it a key point of a Silk Road 2.0 bypassing Russia toward Europe.

The Trans-Caspian Transport Corridor that will boost Kazakh cement needs should also boost the Georgian economy.

A key part will be the construction of Georgia's first deep-water harbor, the Anaklia Deep Seaport. It could provide a key entry and exit point for trade for up to 146 million people living in the region, many of them landlocked (Armenia, Azerbaijan, and Central Asian countries).

It will also be an alternative road for Chinese trade with Europe and the Middle East, not dependent on Russia or ocean access. The total capacity should be 100 million tons (Mt).

The Company: Georgia Capital