US Cannabis is an investment topic I have been considering for a while, but I felt there was no rush nor enough negativity about it considering we are reaching low enough prices.

Honestly, it is also something that I am not personally supporting to see becoming mainstream. While I support legalization for the effect of starving cartels and drug dealers from income, I doubt popularizing a drug and making you LESS energetic is something we need.

Still, as investors our personal opinion is irrelevant, markets decide if we make money or not.

It is also an incredibly difficult market, for a multitude of reasons:

Quickly changing market structure.

Unstable regulation, with a LOT of false starts and a state-by-state haphazard deployment of legalization, while still a full ban at the federal level.

This also means no interstate trade of cannabis, even between 2 states with full legalization sharing a common land border.

California’s legal cannabis could as well be on the Moon than next door when it comes to Nevada or Oregon.

Lots of inefficiencies due to federal status, from no access to banking, the impossibility to list in main stock exchanges to custody issues for the shares.

Virtually no access to banking

cash only transaction = extra costs and security risk

no insurance

poor access to healthcare plans for employees, pensions, etc…

No access to credit, leading to bonds often asking for 10%-20% interest rates.

No tax rebate for a lot of business expenses, leading to a real corporate tax rate at 60%+

Leading to an outright impossibility to own any cannabis stock for most financial institutions.

Leading to loan terms with interest of at least 10%, often 15%-20%.And that was BEFORE the Fed started to raise rates.

Terrible company profiles:

rarely any profit and often awful unit economics.

growth for the sake of growth, burning through investors’ capital for overpriced acquisitions.

So why on Earth would I (or any of my readers) want to get involved with a space that has collected a reputation on its “quality” only equaled by junior miners and crypto?

Because the sector has amazing potential, despite a poor start.

(On a side note, I THINK that one of the stocks I discuss in this report could be bought even by “normal” financial institutions, bypassing the custodial issues. I would of course recommend any institutional investor reading this to double-check it with his legal support team).

The Cannabis Investment Case

Sin Stocks Are Golden

Sin stocks are famously outperforming other categories. Tobacco, alcohol, gambling, guns, and weapons, all of these are money-makers for an obvious reason, they all deal with addiction.

Once again, objectively dirty businesses from a moral standpoint.

But markets have no morals. And my ownership or lack of ownership of Philip Morris stock will not change how many cigarettes they sell, does it?

Another reason is that a lot of investors and institutions are unwilling to invest in sin stocks, for branding/moral/virtue signaling reasons.

So they tend to be both undervalued and cash-flowing. A perfect recipe for an endless stream of stock buybacks and generous dividends.

The last extra bonus is that these activities are highly regulated/repressed by the law. Short of a total ban, this acts as a barrier to entry and a perfect investing moat.

How could you launch a new cigarette brand if advertising is outright forbidden? Some countries even impose “neutral” cigarette packs, so packaging won’t matter either.

New Sins?

This is a hell of a rare time when a NEW sin sector becomes investable.

Think buying on the cheap Jack Daniels at the end of the prohibition (was Uncle Jack listed back then before improving my student parties? … Anyway…).

And for sure cannabis is HIGHLY popular. Despite being illegal and carrying real legal risks, this is a $85 billion market, of which only $18B is legalized so far. Compare that to the $223B market for alcohol.

Among the younger generation, cannabis is viewed as equally, if not less problematic than alcohol. I am 35 and most of my generation knows a user who would swear by it. This only got more true for younger GenZ.

I highly recommend you consult this infographic from Visual Capitalist for the full set of data and statistics. You can also consult this sector overview by IIPR.

The unavoidable legalization

Legalization is widely supported across the US, with a lot of states already allowing full adult use. And a lot more medical use, which tends to be liberally granted by doctors anyway, you just need to say you feel depressed, have insomnia or migraines, etc...

A large majority of people support legalization and even more de-criminalization.

Legalization has been used as a bargaining chip in political struggles between Democrats and Republicans. But in the long run, passing a law that brings a LOT of tax revenues from the formerly black market, AND pleases the voters will pass. Whether it takes 1 or 5 years is somewhat irrelevant for the long-term case.

Complete Bloodbath

But even if cannabis is widely consumed, issues with profitability and delayed legalization have hammered the valuations in the sector.

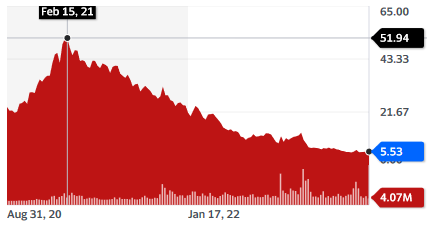

It suffered a full 90% loss since the peak of the latest cannabis bubble in 2021, as shown by the MSOS ETF.

Whenever I hear about a 90% collapse of share prices in one sector, my antennas for deep value get buzzing.

I can tell from cannabis newsletters and investors’ comments in the space that the mood went as such:

Summer of 2021: “King of the world! To the MOON!, Green leaves are the new bitcoin!”

Winter of 2021-2022: “Just a temporary setback”

Up to summer of 2022: “OMG this is bad, but we are reaching a point of low valuation at least.”

November of 2022: “This is horrible, it cannot get worse”

End of 2022: “OMG! We lost another 50% from the November low. The SAFE legislation is postponed ad Infinium. The bulk price of cannabis is SO below production costs. The sector is so screwed, how are cannabis companies going to pay back their debt?!”

Spring of 2022: “Bulk/wholesale prices are recovering, but does it matter? Valuations are still terrible, still no legalization in sight. It will never end…”

This capitulation point by previously hardcore cheerleaders for cannabis is where I wanted to see the sector. There is no rush in going in for purchasing tomorrow, but we might be reaching a bottom of sorts (I will discuss the trading aspect further later in this report).

A Confused Market

As an entirely new industry, cannabis has been through a lot of growing pains.

Part of the issues was related to the sluggish pace of legalization, and a general political dysfunction in the US on the topic.

Others were related to the sheer novelty. No one knew what product would be popular in a legal market. What would not be popular. How to market a brand for what was yesterday an illegal drug. How to get licensed. How to navigate multiple state regulations.

For that matter, no one knew how to grow it at scale in a competitive market.

The illegal cannabis drug market was far busier with smuggling, avoiding police and turf wars.

The legal market has to focus on ROIC, unit economics, contamination in large greenhouses, fundraising, capex, debt repayment schedule, etc…

So a lot of business models and growth strategies got it really wrong.

What Failed

Premium versus cheap bulk

One thing the initial proponents of the cannabis brand failed to understand is that it is more akin to the beer market than the cigarette one.

Because cannabis addiction is likely weaker than with cigarettes, consumers are rather volatile in their preferences. Also, the desired effect is getting high, not a specific taste.

This means that spending money on “premium quality” and branding is not that efficient.

Of course, there is a subsegment of the consumers that will be looking for higher quality and pay for it. Still, cannabis is overall like the non-wine alcohol market.

The bulk of the money is in producing cheap and “bad” beer like Bud or Heineken, or bulk cheap whisky like Jack Daniels.

The craft beer market exists and some consumers will want to pay $200 for a bottle of fine wine or whiskey. But if you want to capture the market at large, cheap and efficient at delivering the drug effect (alcohol or getting high) is what you need to do.

High-profit niche markets

Some states went with a strategy of legalizing, but allowing just a few licenses for producing and selling.

This led to a situation where legal cannabis was 3-10x more expensive than in more liberal markets like California.

On paper, this gave legal producers very high margins and a barrier against the entry of competitors.

In practice, it also made these markets very small, as the illegal producer could retain 70-95% of the market.

In addition, as soon as more licenses get granted, prices crash, and high costs producers’ stock get obliterated or the companies even go bankrupt.

Once again, large-scale production at low cost is better than niche craft production.

Hypergrowth

The common perception among cannabis entrepreneurs was that they needed to move fast and “establish leading brands” before someone else does.

So the playbook was to raise as much money as possible, and open as many greenhouses and dispensaries as possible, as fast as possible. And then try to figure out how to cut costs and turn a profit …maybe … at some point in the future.

A favored method was the expensive acquisition of other smaller state-licensed operators, to be allowed to operate in new markets and turn into one of the fabled “Large MSOs” (Multi States Operators).

Then, legal market prices per gram of cannabis crashed, making most MSOs burn through cash at an accelerating rate. And discover that branding did not matter much, and most consumers would flock to the cheapest price per milligram of THC/BCD.

Cannabis Market Conclusion

So cannabis is a great market if you can survive it.

It is also a market where first movers all pursued a high-quality, high-margin strategy. When consumers wanted cheap and potent drugs. A costly mismatch…

This mismatch caused a lot of value destruction and contributed to abysmal performance as much as the bubble popping or delay in legalization and banking regulations.

It is also barely investable if you are not a retail investor, and even then you might struggle to find a broker that accepts to buy the stocks for you.

After a 90% crash, this is also a sector where even rabid enthusiasts are giving up.

So a perfect setup for having a recovery, AND waiting out for legalization to let institutional money flow into the sector.

This is why I decided to cover 2 different stocks here, with the first being a form of REIT. So technically, it is not a cannabis business, it just rents facilities TO cannabis businesses.

I am not sure if this is enough to solve all custody issues, but this should help at least some of my readers, as their broker might be less picky or even not realize that specific REIT is cannabis related.

For people able to overcome fund mandates and custody issues, I will also cover a stock that has a potential of turning into the Budweiser of cannabis, as the sector finally takes more of an industrial/commodity structure and a less artisanal/craft structure.

Keep reading with a 7-day free trial

Subscribe to The Eurasian Century to keep reading this post and get 7 days of free access to the full post archives.