Investors today cannot afford to not have an opinion about certain topics. For example, will WW3 erupt soon, something I have discussed, including the milestones and warning signs to watch out for in this previous article:

Another topic that can hardly be ignored for virtually any portfolio is the persistent fear of a Chinese economic collapse.

Would it happen, it would annihilate the economies of commodity-centered economies like Canada, Australia, and most of South America. It would also likely send the rest of the world in a Depression with a capital “D”.

Would it NOT happen, Chinese stocks as a whole might be an opportunity not seen since at least the bottom after the dot.com bubble popped.

Getting The Right Metrics

The very first thing needed is to understand where the collapse fears come from.

Essentially there are a few elements that are concerning, especially with the historical example of Japan. In order:

The Chinese economy was overly reliant on real estate and to some extent speculation.

It made up 25% of the Chinese GDP.

That bubble has popped for good. It even has its own “2020-present” Wikipedia article.

Chinese demography is said to be “collapsing”.

An isolated China will not manage to keep its exports up and face problems from “overcapacity”.

The first 2 are highly reminiscent of the Japanese bubble popping at the end of the 1980s, leading to 3 decades of stagnation.

Real Estate

What is interesting regarding the real estate bubble “popping” is that contrary to the US’s 2008, it is intentional.

For years, the CPC and Xi in particular had a message for the Chinese banks, speculators, regional authorities, and investors:

Real estate is for LIVING, not speculating!

This message mostly fell on deaf hears, leading to the need to forcefully deflate the bubble in 2020 through the 3 red lines:

Liabilities should not exceed 70 percent of assets (excluding advance proceeds from projects sold on contract)

Net debt should not be greater than 100 percent equity.

Money reserves must be at least 100 percent of short-term debt.

This instantly forced the largest real estate companies in the country to pull the brake, and for the weakest of them to fill for bankruptcy.

International bondholders were the first to bite the dust, and the focus has been on delivering the already paid-in-advance flats, leaving the investors and speculators to take the loss instead of the population.

If real estate in China had kept rising or even not been deflated, starting families would have been impossible for young people.

A topic that brings us to demography.

Demography

While I explained in detail the argument in this article, I consider that China's shrinking population is mostly a good thing.

The short version:

A declining population makes automation a positive trend, instead of a destabilizing force.

With most of its population in the wetter & lower eastern region, China is overpopulated, putting terrible stress on its land, water, and air resources.

A lower population means less dependency on imports of food & energy to avoid famine.

But to be manageable, the population decline needs to be both going at a slow pace AND stop somewhere, probably around 800 million to 1 billion people.

Both are far from guaranteed. In fact for now we are yet to see a modern country succeeding at fighting demographic decline. And the “solution” of importing masses of foreigners is obviously not a good one.

Here is what China has done so far:

Cheaper real estate, with the construction bubble unlikely to reflate

Financial incentives to build large families (“Three child policy”)

All tutoring companies forcibly turned into non-profit organizations.

Promotion of traditional gender roles and removal of representations on TV of gay people

Will it be enough?

Maybe not, I honestly do not know.

As far as I can tell, only ONE type of sub-group in modern society reproduces above the replacement rate of 2.1 children/women, and this pattern holds true in societies as different as the USA, France, Finland, Russia, Israel, and Turkey.

Extremely conservative and religious self-isolating subculture.

Amish, Mennonites, Mormons, Latin-mass Catholics, Laestadian, old believers, Haredi, etc. This seems to be the ONLY social “software” where your culture is self-reproducing, without needing import from other populations.

With the CPC firmly in the camp of communism atheism, I am not sure that purely economic measures will be enough.

However, this will be a slooooooow motion thing, far from the “collapse” lies of people like Peter Zeihan.

The working-age population will fall by … 23% by 2050. Or 700 million people working, MORE than twice the current US population.

Hardly an overnight collapse, and is likely to be just one economic factor among many, including automation, energy systems, geopolitics, etc.

China Is Isolated

The argument that “China is isolated” is pure propaganda and is to be dismissed as such.

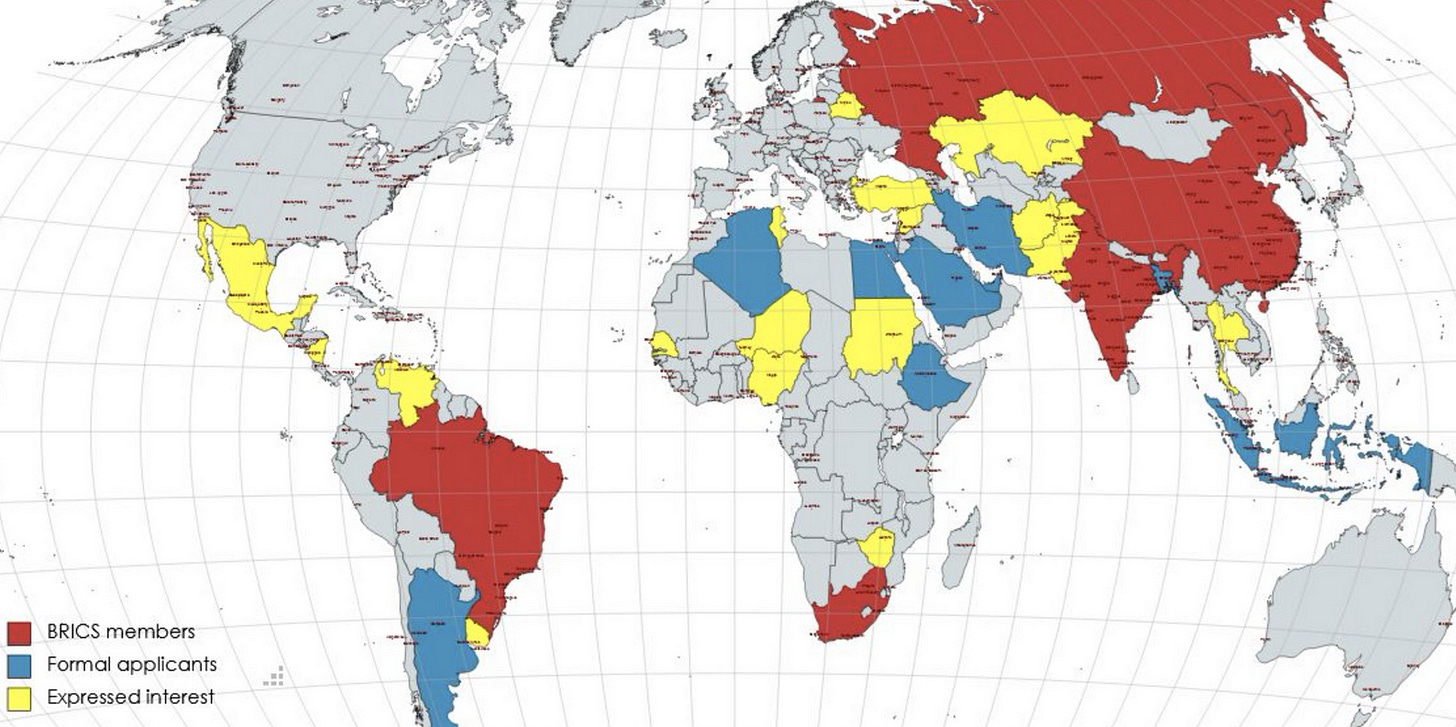

You could just guess that by looking at the 2 main China-led international organizations:

The SCO (Shangai Cooperation Organization)

The BRICS (not up to date map, but you get the point)

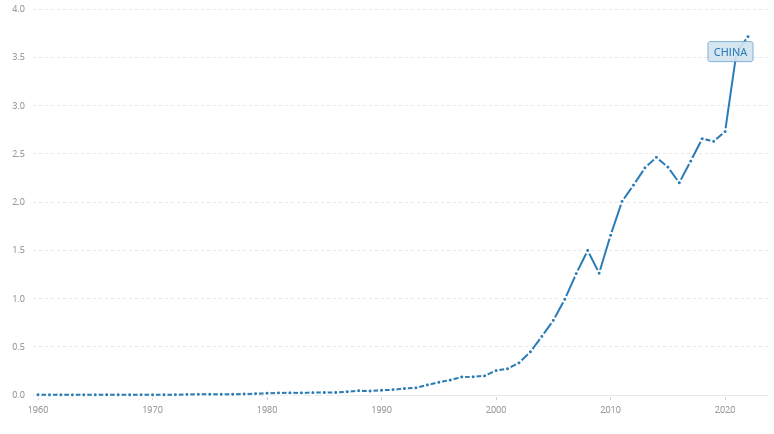

And maybe the turmoil with Russia has forced “deglobalization/reshoring/friend-shoring/de-risking” or God knows what other newspeak invented in think tanks.

It should show on Chinese exports, right?

Right?

But of course, the funniest propaganda failure is something familiar to astute readers, experienced with Schrödinger’s Russia, which is both AT THE SAME TIME:

So weak it can be provoked without risks, and at some point

dismantleddecolonized.So strong that it threatens the whole free world.

Similarly, Schrödinger’s China is:

Already collapsing and will never become a global power like the mighty USA.

An economic juggernaut that needs to be stopped at all costs.

How isolated is a country whose car exports has recently become the largest in the world? And which is literally producing everything for everyone, with 36% of its GDP from industry?

But of course, the simplest demonstration of neither a collapsing economy nor isolation is that Yellen had to visit Xi and start threatening him rather brazenly:

Yellen Threatens Sanctions for China Banks That Aid Russia War

Yellen says global concerns growing over China's excess industrial capacity

U.S. will push China to change policy that threatens American jobs

about

stealingregulating TikToK : “Many U.S. social apps are not allowed to operate in China,” Yellen said. "We would like to find a way forward."

If you need to threaten China to stop producing so much stuff, or at least to be so DAMN EFFICIENT at it, China is not isolated, China is not collapsing, and China is not overproducing.

Overproducing

Why not “overproducing”? Because this word had a definition before Yellen started muddying the water:

According to Oxford Dictionary: produce more of (something) than is wanted or needed

This can happen and manifest in poor sales and growing inventories.

So EVs, solar panels, and chips selling like hotcakes and “threatening American jobs” are not overproduced.

They are just more competitive.

Free market, competitive advantage, R&D advantage, economies of scale, industrial ecosystem, yadiyadiyada.

And it is not dumping either, here is the definition of dumping:

Dumping occurs when a country or company exports a product at a price THAT IS LOWER in the foreign importing market than the price in the exporter's domestic market.

When BYD sells an EV (Dolphin) in China for €24,400 and sells it in Germany for €35,990, it just shows how absurdly UN-competitive the Western industries are if it is a serious threat when foreigners can bump up the price by 50% and still outprice your domestic production.

In Part 2

In the next part, we will discuss how the parallel to 1980s Japan does not hold water and why.

And instead, what is going on and what we should expect from the Chinese economy.