Discussing Portfolio

I have been asked by one of my subscribers to share my personal portfolio. It is something I have been reluctant to do until now, mostly because my way of investing for myself is highly unlikely to fit most people.

I am solely single-minded on focusing on long-term returns, and have discovered over time that volatility does not impact me at all.

My portfolio moving up or down casually by 10% or 20% in a single week is not a rare occurrence. Most fund managers would get fired if they could not justify why it is happening. And most retail investors would panic.

I know a lot of people SAY they are long-term oriented, but in practice they act differently. Case in point, how I often get asked by such “long-term” investors if a move down 30% invalidates my thesis.

By definition, a change in stock price does not change your thesis if you are value and fundamental-focused.

Potentially, the cause of this price change may reflect negative news that changes the investing thesis. But 90% of the time it is just fluctuation in sentiments or the way money flows these weeks from one sector to another.

So while it is in the disclaimer of every investing article, this time it is REALLY not investment advice.

My reports tend to offer ideas and explanations about an industry and a company.

In contrast, this article covers MY portfolio, and will probably not be fit for your own financial position and investing situation.

Analyzing My Portfolio

It is however interesting for me to cover it, and not only because I have been asked to do so.

I can use it to show a bit of my process and illustrate how it can apply to your portfolio as well.

My family’s holdings are split between 2 accounts, and I will not display the nominal value, just the percentage of the portfolio and explain the history behind that investment. For the sake of simplicity, I have merged both account numbers into one.

I will also not do a multiyear retrospective of the portfolio performance. Once again, the short-term (1-3 years) returns are mostly random in a concentrated high-vol portfolio, and paying attention to that metric is a losing method.

I am actively refusing to check performance on a short term basis, as it would force me worry about it.

Even if for the record, I have had 15-20% yearly returns in the last 3 years, when I came back to a more active style of investing, after a few years of focusing on building a homestead, starting businesses, and having a baby.

What is more interesting is looking at each investment, what was properly judged when entering the position, and what mistakes were made. As well as the reaction to them.

It is also a good occasion to revisit some ideas together with my readers.

This is an exercise I might do roughly yearly in the future.

The Portfolio

Composition

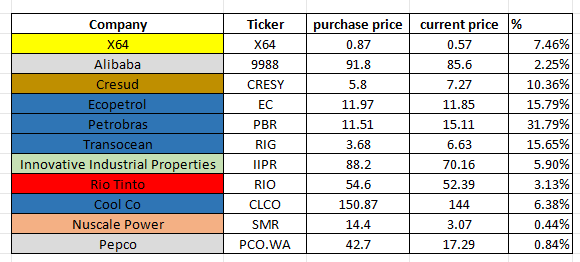

The list goes as such:

X64, a troubled gold miner.

Alibaba (needs no introduction).

Cresud, an Argentinian farming and real estate company.

Ecopetrol, the national oil company of Columbia.

Petrobras, the national oil company of Brazil.

Transocean, the leader in ultradeep and harsh environment offshore oil & gas drilling.

IIPR, a REIT providing greenhouse facilities at scale to cannabis companies.

Rio Tinto, the second world’s largest mining company, with a focus on iron, copper, and aluminum.

Cool Co, an LNG shipping company.

Nuscale, a Small Modular Reactor (SMR) nuclear startup.

Pepco, a Polish discounter of clothes, toys, and household items.

Concentration

The first thing you will notice is that this is a highly concentrated and un-diversified portfolio.

The highest weight for an individual stock is 31.2%.

A nice total of 69% is oil, gas or LNG-related (in blue).

Commodities (farmland/food and mining) make up another 13.5%.

So the first thing I can say proudly is that I am walking the talk when it comes to a bullish position on commodities and energy.

Another thing is that most of my returns come from a few outsized bets. In retrospect, it is clear that I have performed better on ideas I had high conviction about (with one exception, see below) and that half-hearted entry points at single digit percentage of the portfolio mostly brought losses.

Time Frame & Volatility

Another thing not visible on this table is the timeframe. Cresud and X64 are some of my oldest holdings (3+ years), followed by Transocean, Pepco, Petrobras, Rio Tinto, and Nuscale.

IIPR and Ecopetrol are very recent additions, in the last few months.

Post-Mortem One-by-One

Now let's look at each position individually, why I bought them, and what happened since.

X64

That is by far my largest loss, as the below 10% weight is mostly due to declining stock prices. The company is (was?) an interesting gold miner with high-ish dividends (6-7% yield) operating in the Philippines and good production costs (low AISC).

In total, I collected a 12% return from dividends which have been reinvested in other stocks.

Since then, a war between board members erupted, with some fired, who then tried to take over the company in an ongoing litigation. Ownership dispute, frozen assets, a complete mess!

The abysmal governance has sunk the stock price and the company until now. I am mostly stuck with it, and take it as a lesson to avoid small miners, even if they are not junior miners.

In general, commodities, and mining in particular is such a badly managed sector that you might want to stick to the big boys…

Not a total disaster, thanks to dividends reinvested in other positions and the possibility or recuperating losses, but still a major irritant to me.

Alibaba

The plan was to buy a little with cash in the investment account, and progressively grow the position.

With the mood about Chinese equity getting somehow worse in the past 2 years, I never pushed the trigger to add more.

So far.

I intend to put quite a bit of my savings and incoming dividends into the company, in order to implement the barrel idea I presented a few weeks ago (hyperdefensive at one end AND bullish China and growth at the other).

Reducing energy exposure to buy more Chinese equities was also in the plans, but for now, I will wait a few weeks at least to see how the war in Israel unfolds. At worst, I could see a small decline in oil prices, but the upside optionality of oil stock + a war with Iran is much bigger.

Cresud

I really like this Argentinian company for having demonstrated the ability to navigate several hyperinflation episodes and come out of it bigger and richer.

Their business model is to grow stuff (soybean, cattle, etc….), sell it abroad for dollars, and buy back more land and real estate in collapsing pesos.

Just the land value and out-of-Argentina assets cover the company’s market cap, with tons of malls and office real estate in Buenos Aires on top for free.

And I wanted a little exposure to food production and farmland, with Cresud being the only large non overvalued stock I could find.

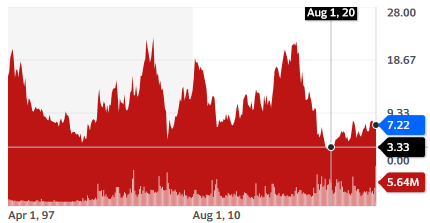

The stock chart is a roller coaster, and while I did not buy it at the lowest of $3.33/share in 2020, the $5.8/share average cost is good enough.

The current share price is close to the lows of 2013, 2008, and 2002, despite the company owning A LOT more assets today.

This is NOT a bet on the upcoming Argentinian election. But on smart operators managing to buy assets on the cheap. A track record of almost 30 years doing so vindicates this view.

The company also gives a nice 6%+ dividend yield, which is fine by me for sitting for years waiting for a rebound of Argentina in general, or a boom in agricultural commodities, probably both happening in tandem...

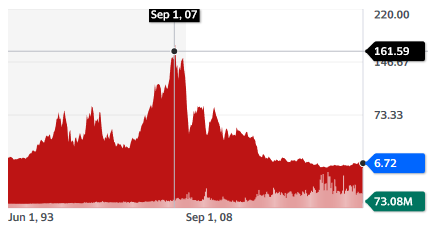

Ecopetrol / Petrobras

I will cover these 2 together because they are so similar.

Both are fine oil & gas companies with depressed share prices, because of socialist presidents in their respective countries.

Both countries are highly dependent on the company’s dividends to keep the national budgets and populist welfare afloat.

Both socialist presidents have proven unable to fully control their parliament and government and seem unable to go full Chavez-style even if they wanted to.

Both are paying lip service to green energy, and in practice are gunning for more oil production.

Both are giving above 20% dividend yields, with petrobras almost at 50% last year.

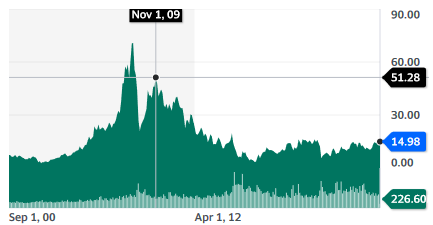

Petrobras in particular is EXTREMELY aggressively drilling for more oil, “cornering the market for offshore drillships”. This allowed it to lock in for the next 3-5 years a lot of drillships at not cheap but still acceptable dayrates. Other oil majors will likely regret not having done so.

The return on Petrobras ($11.51—>$15.11) does not even tell the whole story. Last year's real dividend yield was closer to 50% (it was hard to believe while it was happening), and with this year close to 30%, this has carried the whole portfolio up.

Ecopetrol was the same idea, I bought it on an opportunistic move, with the next 2 dividend payments already announced, EACH at a 10% yield, could be grabbed easily in just 5 months.

In fact, another exceptional dividend might even be happening, which would bring a 25% yield in 5 months!

To finance the Ecopetrol purchase, I sold a Brazilian hydropower equity (Copel) that was up 35%+ AFTER giving a 15% dividend yield.

So this was also a move to have less exposure to a single country, and take profit from an utility stock that I never expected to rise that hard.

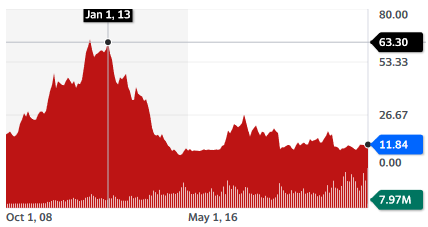

Transocean/RIG

A company I was pushing for when no one believed in oil in general, offshore drilling even less.

My only regret is having almost bought it below $1/share, but not having the cojones to pull the trigger.

The probability of bankruptcy was a little higher back then, but was really priced-in once, twice, and thrice over.

So truly a failure of execution of my part to have an average cost of $3.68, which “only” doubled to current prices. I should also have put a larger part of the portfolio in it.

This is a purely cyclical industry, and so I plan to sell when the dayrates have risen enough and/or the stock hits the $15-18/share levels.

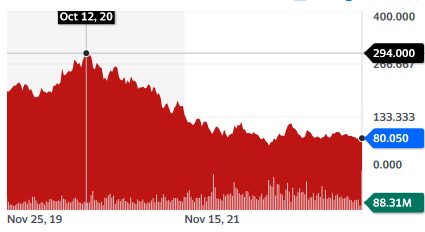

The stock is recently down 20% on the news of dayrate stagnating for a full quarter. Still a very low level of convictions from markets, despite a stellar run since the lowest point of $0.67/share in October 2020.

The lesson I got from RIG was put to good use in Petrobras.

Go big or go home.

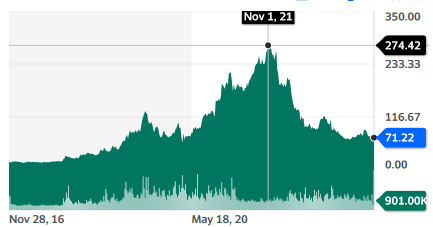

IIPR

A recent move on cannabis through an industrial REIT. The sector has been seesawing up and down chaotically since my cannabis report in June.

While I also like Glass House (see report), I see IIPR as a good spot to get exposure AND dividend yield while waiting for an actual change in cannabis regulations.

The yearly dividend yield of the REIT is 10%+, so I am fine if this all I get from it in the medium term.

Regarding cannabis, I do intend to get more exposure to actual producers with economy of scale like Glass House and maybe Village Farms, but I prefer to collect high dividends from oil and REITs while waiting for the US Senate to get its sh** together … which might be a slow process…