Quick Pepco Update

Growth even better than expected and EU inflation boost the discounter business even if share price is flat

I am currently looking at Pepco again, as the stock is basically back to where I initially bought it, despite that the company has grown a lot since and accelerating its expansion.

This update will build on the previous report, so if you have not read it first, I would recommend it.

This is not something I will not do for every stock I have covered, but only if I think there is a new or continuing buying opportunity.

Like in the case of Pepco, when the share price is mostly unchanged, but the company delivered on its growth targets and then some more.

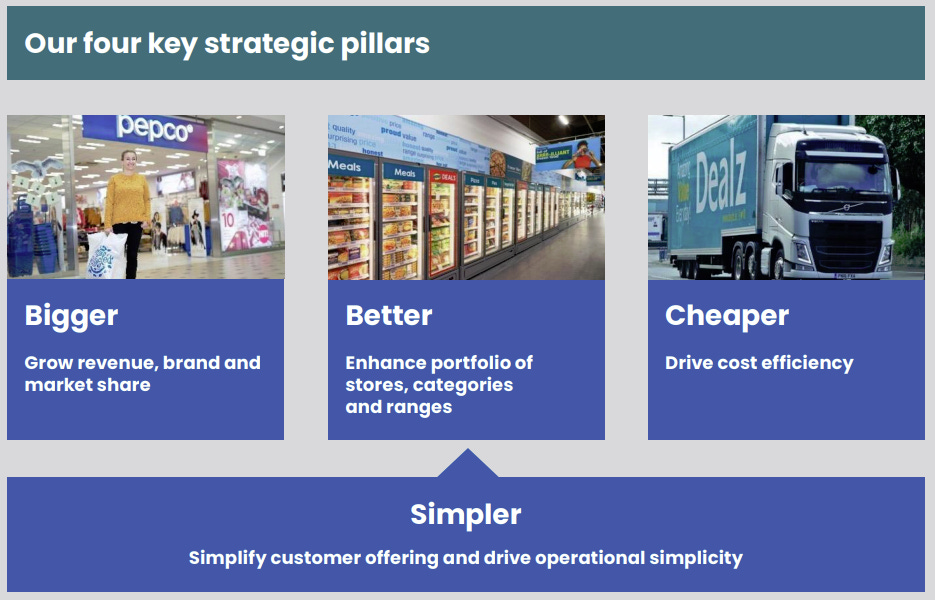

Clear Strategy and Positioning

The company brand, offering and strategy are more clearly stated than before and perfectly in line with the product line and their customers’ expectations.

You can see it in the 2022 Annual Report:

We are a large-scale variety discount retailer operating across Europe

…our core shopper, a “family on a budget”,

…offering apparel for the whole family, household goods and toys at the lowest prices

… fulfill our purpose in offering families on a budget great range, value and convenience

Ongoing Expansion

The Pepco group has successfully opened a lot of new shops and also increased sales per shop in response to the “cost of living crisis”. A.k.a., EU energy crisis and inflation. As EU energy costs are likely to stay dreadful for years, this is a win for the Pepco group.

This is why I liked the stock when I wrote the first report, and it has fully delivered on the promise of benefiting from the ongoing EU crisis. And this is BEFORE we actually see a real wave of bankruptcy in Europe.

Already 448 new stores have been opened, a +18% increase. 2/3 of them were financed from free cash flow, and 1/3 from $200M new debt. With great ROIC, this should not be a problem.

If anything, I would like to see the group secure more cash before interest rates rise too high. The higher the interest rate, the more people will shop in discounters to compensate for exploding mortgage payments (most of the EU has variable rate mortgages), and the more aggressive Pepco expansion should be.

168 of the new shops were in Spain, Austria, Italy, and Germany. Germany's expansion is kind of slow compared to my expectations, with still only 4 shops. This is really where they should focus some effort from now.

Among the most recent market entry was Greece, with successful shops and good reception.

Solid Profitability

Revenues grew 17% year-to-year. Profit before tax grew by 35.1%. Overall not only the sales are increasing, but so are the margins and profitability.

ROIC in 2022 was 25%. The IRR (Internal Rate of Return) of the newly opened Italian shops were standing at 50%.

So the more expensive Western European shops should be as profitable as the Eastern European ones, something that was likely, but still in question when I wrote the last report.

Increasing Efficiency

Labor hours required at the shop level decreased by 8%, thanks to new EPR software and more efficient logistics. the EPR implementation is still ongoing, so it is for now a cost but should contribute to increasing profitability moving forward.

Also contributing to margins is the self-checkout added in Western Europe shops, and it is apparently well received by the consumers.

I was also impressed by the rotation of the inventory. 75% of the products in the shop sell in less than 8 weeks, and I suspect the number is even higher if you exclude the bits of decoration and kitchenware/glassware.

A new shop design tested in Poland resulted in 4%-12% more selling space, with increased customer satisfaction. The concept will be rolled out everywhere in the next 1-2 years.

Regarding supply, a larger rooster of countries is now providing goods to Pepco, and some “near-shoring” as well, which should neutralize any geopolitical risk. This removes a danger for Pepco which was too reliant on China's supply for my taste.

In FY23, PGS is opening a near-shore sourcing operation in Poland to increase our sourcing flexibility out of countries such as Turkey, Poland and Romania; as well as continuing to expand our Far East capabilities in countries such as Cambodia, Vietnam and Indonesia.

Clearly, the country risk is something Pepco management is very wary of as indicated in another quote:

By providing and owning the 3D CAD designs for our products in house, we are able to ensure sourcing agility and flexibility, with the ability to move production to any vendor in any country as well as driving scale leverage.

Lease costs are also going down, utilizing the growing scale of the group to press prices down:

We continued to deliver significant savings on our rental costs, notably in the Poundland business where the volume of lease expiry events and the strength of our negotiating position delivered significant benefits. We renegotiated 82 leases in the year, saving on average 45% versus the prior lease agreement, alongside acquiring new sites at attractive lease terms.

Last but no less critical, the company was ranked “second-best employer in Poland in Forbes Poland's Best Employers 2021 ranking”, an anonymous survey.

I can somewhat confirm this is likely legit, as I personally can see that Pepco employees are generally looking happy and more relaxed than most retail staff in Estonia (retail workers are notoriously “grumpy” and poorly paid or treated here).

Increasing Scale

In general, the increase in shops allows for more cost efficient logistics, as the increased volume can spred fixed costs on more shops and revenues.

Speaking of logistics, new distribution centers are being built.

Notably, one in Romania in 2023 to reduce transport costs for the Southern-East Europe area, is important considering the recent openings in Greece, which would not be properly covered by the Polish warehouses.

20% of goods are also allocated to a shop the same day they arrive at the distribution center, reducing the warehouse requirements.

Future Expansion

The goal of 20,000 stores is still far away, with “only” 4,000 shops now, up by roughly 500+ shops year-to-year.

Pepco will open in Portgual in Spring, and had great success in its opening in Greece in the last months.

Germany remains the sore point, with almost no presence so far, and no explanation for the slow unrolling in the country. Success in Austria is encouraging, but Germany is really the test to see if Pepco can succeed in ultra-competitive markets with plenty of other discounters already.

The success or failure in Germany will also determine the brand's future in the Netherlands, Belgium, Switzerland, and more importantly France. Together, this is a 200 million people market that will make or break the long-term growth story for Pepco.

Therefore to be watched with attention.

Harmonizing Brands

The Dealz brand in Spain is becoming Pepco/Pepco +. Some Irish shops are testing to see the reception for the same brand switch. Pepco clothes are starting to be sold under the Pepco brand in Poundland in the UK.

Over time, the plan is clearly to put everything under the Pepco brand name umbrella. Pepco will be the entry point for most new customers, looking in a local small shop for cheap toys, gifts, or children’s clothes.

So making them look at other larger Pepco for cosmetics, frozen food, pet food, etc… makes sense while the “cheaper, better” trust has been established.

This will take a while but should help build a much stronger and more recognized brand.

Valuation

Valuation with a P/E at 28 is a bit pricey, but the growth justifies it. The only thing that might make me hesitate to add too much yet is the general market shakiness and the despondent mood about Polish stocks.

Big tech firing 5-10% of their employees might indicate a recession or deeper stock crash ahead.

The war in Ukraine getting worse, and in Ukraine's disfavor, will not help lift the mood either.

So the very same looming recession / EU Depression that is boosting Pepco's business might slaughter its stock price regardless of the company's performance.

So I might do a slow accumulation more than a big purchase at once. Decide the best strategy for yourself and your patience + risk tolerance (mine is usually higher than most people's).

Conclusion

That’s pretty much it. Pepco is killing it over European consumers being squeezed. It is expanding aggressively in new countries with good success in almost all of them (except for Germany).

Profitability is great, operations are getting more efficient, and the business is getting less exposed to supplier and geopolitical risk.

It still needs to prove it can expand quickly and profitably in Germany to really justify a growth target as aggressive as 20,000 shops from the current 4,000. Without it, I would see growth stagnate around the 8,000-10,000 shops.

This would still be a +150% growth of the company, but that puts the level where growth slows much closer (4-6 years).

Its 28 P/E ratio is not cheap, but perfectly okay for a business growing 20-30% per year, and with a lot of room to keep growing even without France+Germany. Especially with good macro headwinds.