Regis Resources Report (RRL)

Cheap Aussie gold miner with growth and optionality

My history with Regis

Regis Resources is a company I analyzed for a client in Australia around a year ago, part of a 20+ miners/commodities listed in Australia compilation. I liked the company a lot myself and bought shares of it soon after. I still own them and even added a bit more over the last year.

Ironically, virtually all the other companies I analyzed back then did better than Regi which traded sideway… The same can probably be said about Medusa Mining, the other gold miner with which I started this newsletter. So while this post is not investment advice, you have been warned that this is not a very quickly rising stock for now.

Nevertheless, I still think this is one of the best gold miners available considering how cheap it is, its jurisdiction, and its growth potential. And in a time of monetary turmoil, some exposure to leveraged gold (aka gold miners) feels right in a portfolio. I will keep this report as short as possible, as the company is rather simple to understand.

The company

The mining assets

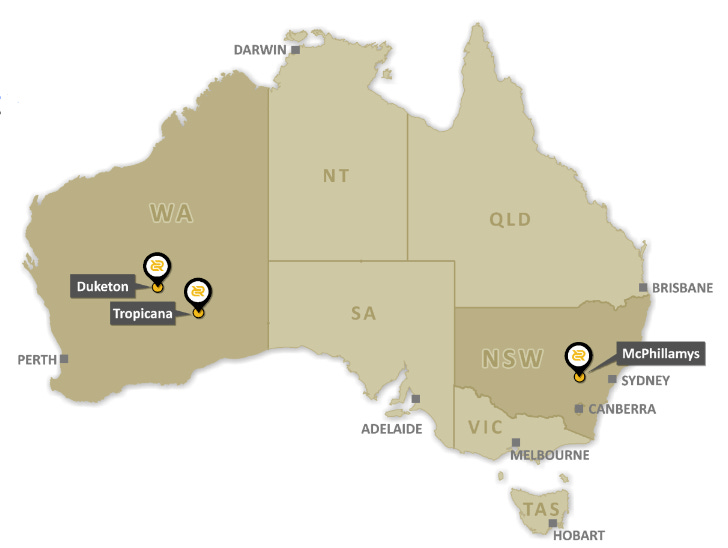

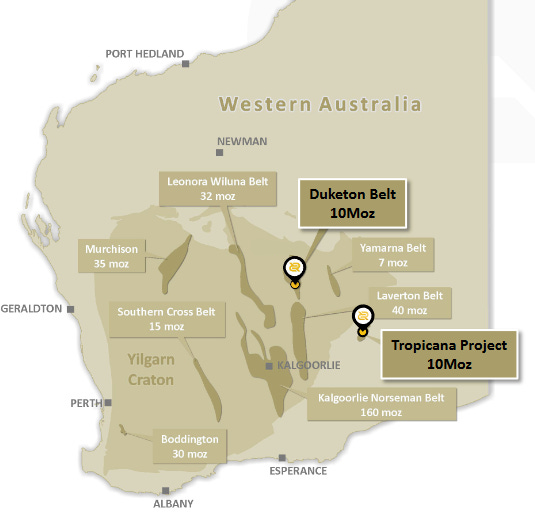

Regis operates exclusively in Australia, probably the safest Tier-1 mining jurisdiction on Earth. In my opinion, better than Canada which seems to progressively lose its mind over environmental rules and political activism. Australia is more self-aware of its dependency on commodities and acts accordingly. Such jurisdiction quality usually come at an expensive premium, but in this case, Regis is still decently priced.

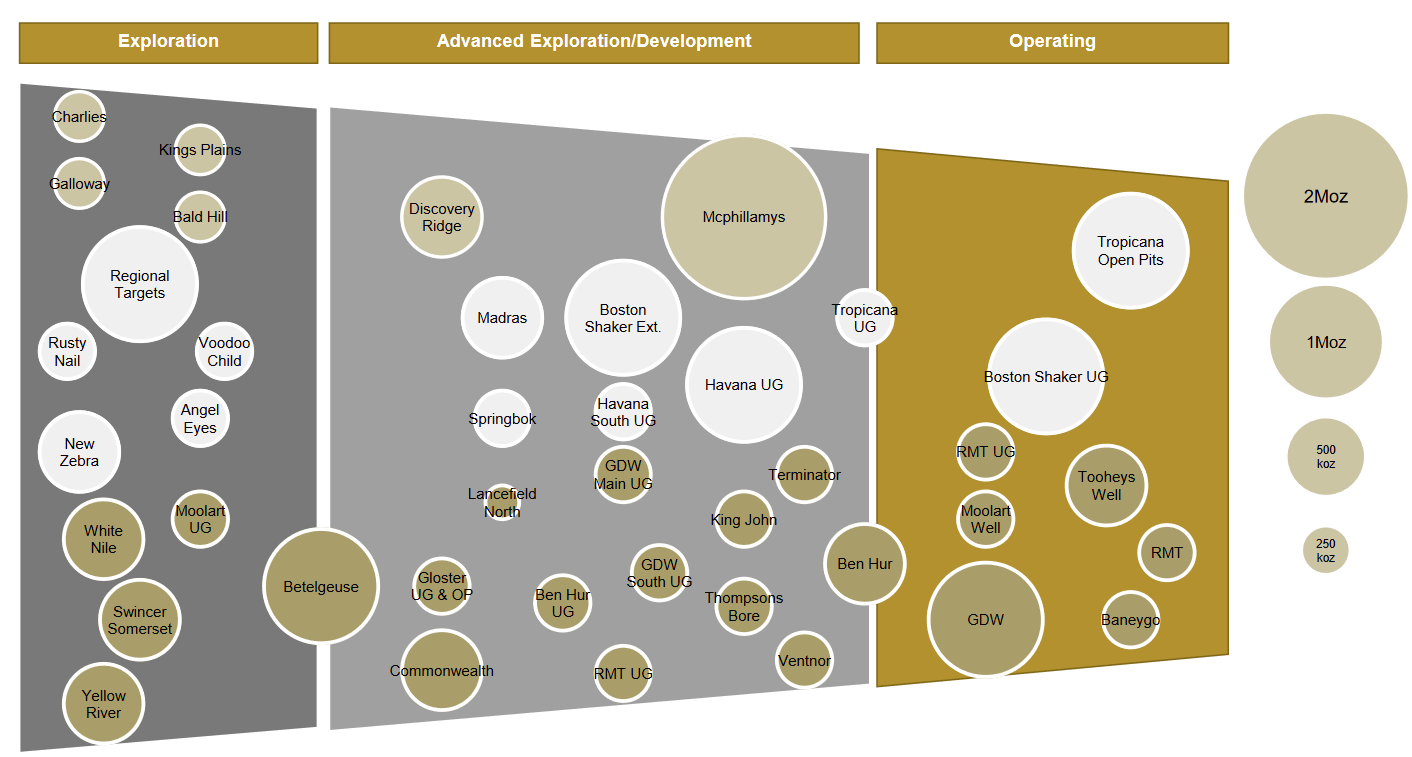

The company is operating 3 major sites:

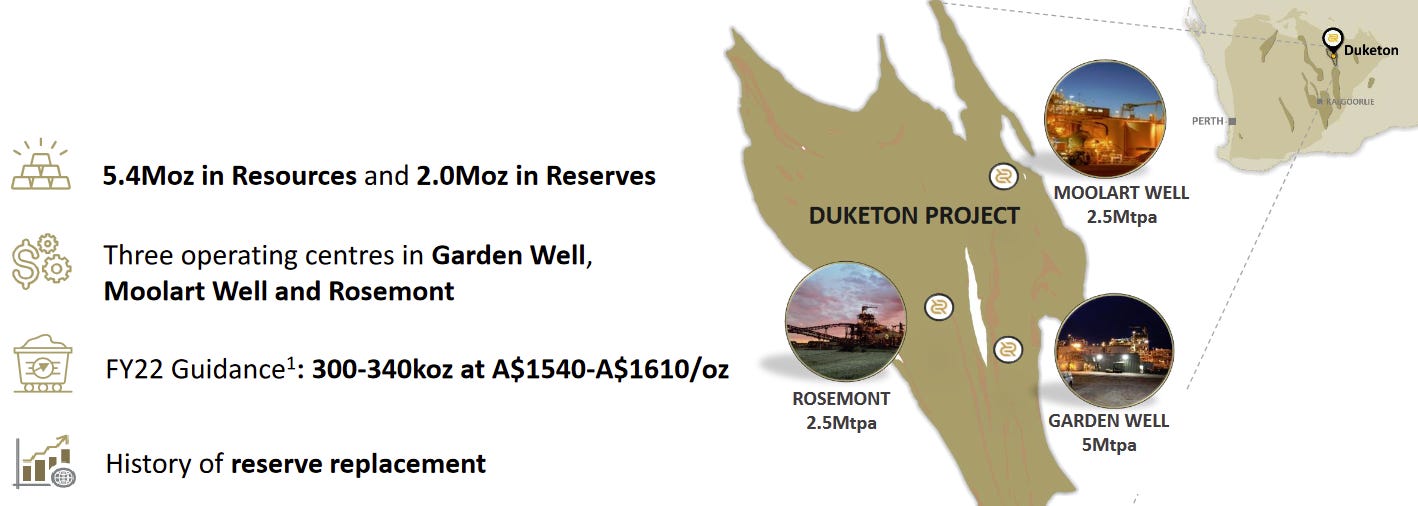

Duketon, with 3 mines close to each other (Moolart, Rosemont & Garden Well)

Tropicana, 30% recently acquired by Regis Resources (more on that later)

McPhillamys, still in development

Reserves and profitability

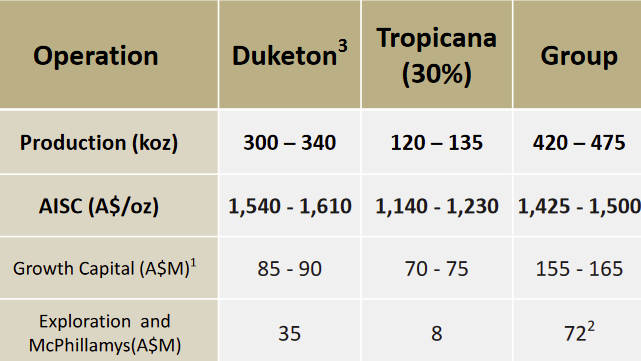

Duketon mines are long-lasting assets with large reserves: 300-350k ounces produced per year, 7.4 million in the ground. So lasting roughly 20 years at least.

Tropicana is 3.1 million ounces in the ground, producing at 500k/year (30% for Regis), so 6-7 years of duration, with maybe more if more reserves are found.

An annoying little quirk of the company is reporting everything in Australian dollars. For AISC (All-In-Sustainable-Costs, roughly, cost of gold production) this can be annoying for people used to following gold price in USD. So let me translate it in USD:

Duketon AISC is around $1140/ounce, and a VERY low $855/ounce for Tropicana. The group AISC is just above $1000/ounce.

This put Regis in the lower tier of production costs worldwide. Gold prices would have to dramatically fall over for Regis Resources to turn unprofitable. Way below the lowest point in the last 10 years.

Financials

Balance sheet

With miner, I am always paranoid about debt. Too high, and we are one short-term downturn from bankruptcy. At the end of 2021, Regis had “only” AUD294M in long-term debt and total liabilities (including lease, provision, etc…) of AUD738M.

With AUD164M of cash and AUD433M of total short-term assets, the company seems well enough capitalized to me. Again, low AISC also acts as a buffer as it gives large margins.

Cash flow

Operating cash flow in 2021 was AUD136M. Free cash flow is slightly negative at -AUD33M, as a lot of money is put into growth capex. By removing the acquisition (Tropicana) and exploration budget, we can find a “real” maintenance capex at AUD60M. So Duketon mines free cash flow is around AUD76M.

Growth & capex

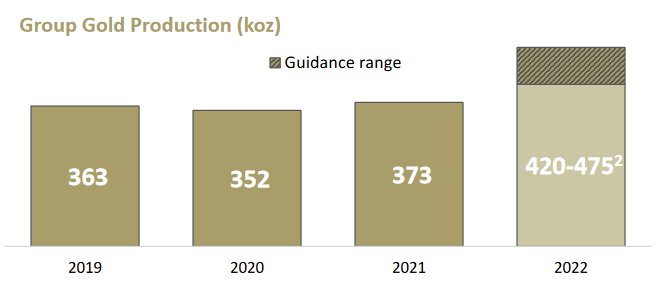

Operating revenues of AUD 136M are slightly below the growth capital needed to get Tropicana running at full speed this year (company total growth capital requirement of AUD 155M). With the extra 100,000 ounces/per year from 2022, it will increase operating revenue to keep covering the current 3% dividends and spending on future growth.

The growth story

As I said, an attractive part of Regis Resources is its growth potential. If you want to bet on gold prices, future production will also be expected to be more valuable. 2022 production will increase and is not yet reflected in current earnings.

Tropicana

Last year, Regis purchased from AngloGold Ashanti 30% Tropicana, the 5th largest gold mine in Australia. It instantly made Regis the 4th largest gold miner in the country. Regis spent $1B (from debt+equity) to acquire its part in Tropicana.

With roughly 1 million ounces of gold acquired in the transaction, this makes a $1000/ounce cost of acquisition. Considering an AISC of $855/ounce and a current price hovering around $1850/ounce, this was quite expensive.

To make an actual profit from the Tropicana acquisition, we will need to see gold prices rising or more reserves found on site. Both are somewhat likely. So I would mostly consider the Tropicana acquisition an option on rising prices. If all prices crash, the Tropicana acquisition will turn out to have cost shareholders.

Regarding finding more reserve, management seems confident about it. The mine life is expected to go beyond 10 years, through multiple underground mines. With the current very low AISC, newly found deeper/lower grade reserves, exploitable at higher costs, would still have decent operating costs. So it is likely that in the long run, Tropicana still turn out an okay acquisition, even if a bit pricey to my taste.

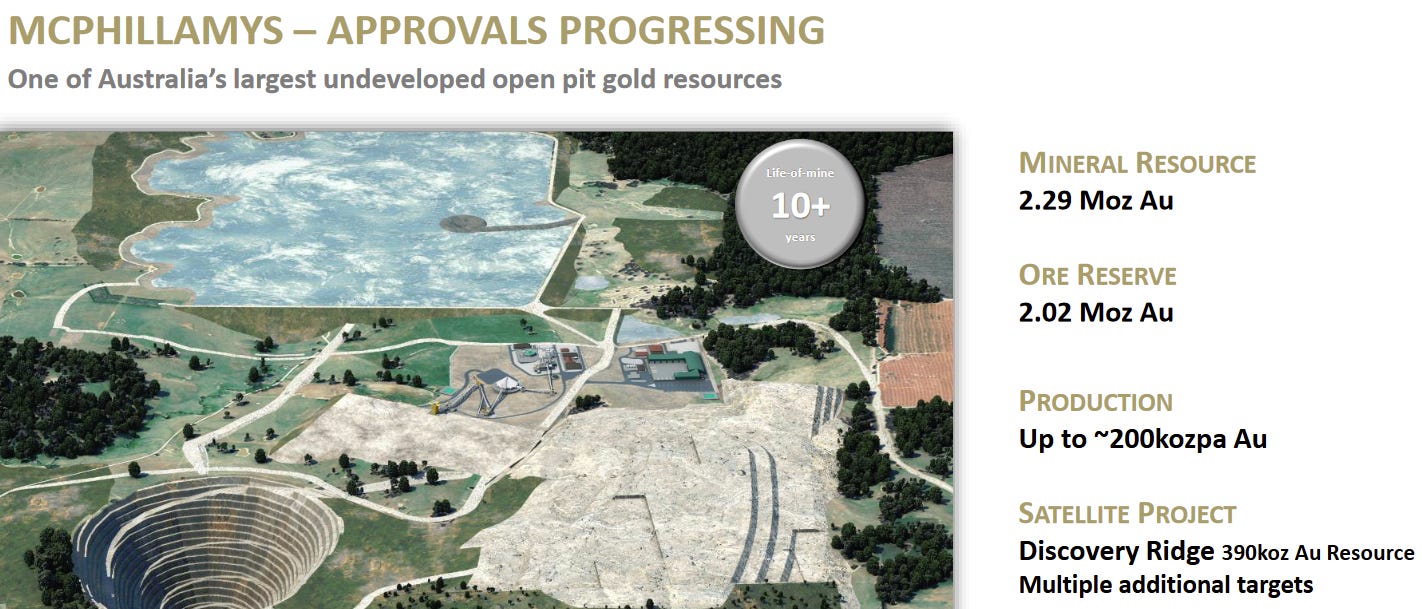

McPhyllamys

This is the next big thing for Regis Resources, a 10+year lifespan open-pit mine in eastern Australia. This is still waiting for approval, so it has a rather large uncertainty left.

McPhyllamys ore grade is at 1.04g/t, slightly lower than Duketon assets (0.27g/t). So I expect a decent AISC, in the $1200/ounce, but not very cheap. This makes this mine quite an option high gold price as well.

Other exploration

The company is conducting a lot of other exploration projects in South-West Australia. This makes sense considering the abundance of 10-160 million ounces projects in the region. It is always hard to put a price tag on such very prospective projects. So I would overall not take them into account, just remember them as a nice-to-have option in case of discoveries + rising gold prices.

The valuation

Why gold miners

When it comes to judging Regis valuation, I would first like to discuss why to buy a gold miner in the first place. Gold in itself is mostly a shiny rock with few real use cases beyond some electronics and jewelry. The real value of gold in a portfolio is two-fold:

diversification, as gold tends to be uncorrelated to other assets.

insurance against inflation, negative rates, and monetary disaster.

I personally prefer to own gold miners instead of gold itself (although I own some gold too). Gold miner stocks tend to have several times higher volatility than the underlying commodity. So instead of having let’s say 20% of a portfolio in gold, you can have 5-10% of a portfolio in miner and get the same level of diversification.

The only “cost” is higher volatility, and I am fine with very high volatility anyway. Someone unwilling to see +/-20% volatility in one month should probably avoid miners altogether.

The other advantage of miners is that they are businesses. By picking low producing costs miners, I am likely to avoid bankruptcy risks (they can slow down operation before that). And if prices are good, I will collect dividends. So instead of immobilizing capital in physical gold, I get income from it. Again at the “cost” of volatility.

Regis’ valuation

I will perform the calculation on the new, post-Tropicana acquisition company. We are talking of an average of 10+ years of reserves, at an average 2021 AISC of $1080/ounce. Considering a reasonable $1800/ounce average, this translates to $720/ounce operating cash flow.

To get free cash flow, I will exclude half of the growth capex, as 2021 are not representative of future development costs. By keeping half, I aim to also factor in some unexpected costs, inflation costs, etc… This removes around $180/ounce from operating cash flow as measured by AISC.

Production will stand at 420,000 ounces/year, so approximately 420,000 ounce * $540 = $226M in free cash flow per year.

Here, the normal next step would be to make a discounted cash flow calculation. Using this calculator, you can come to a company value of $1.24B, to compare to the $1.08B current valuations. So short of a collapse in the gold price, the company is cheap or fairly valued.

Personal expectations

However, I am not entirely sure of the validity of using DCF for measuring Regis valuation. Not only did I consider a residual value of 0 in10 years (unlikely), but this is too dependent on future gold prices.

I personally expect gold to do great over the next decade. When I bought Regis stock a year and a half ago, stagflation was perceived as unlikely. This is slowly becoming a mainstream forecast. Back then, stagflation fears were dismissed because

Inflation was still nowhere to be seen.

Energy was still dirt cheap.

The 70s scenario was “alarmist” and would need a comparable and unlikely rise in oil/gas crisis and high geopolitical tensions.

One brewing European/Asian energy crisis since this winter + the Ukraine invasion, and we are there. Continuous supply chain issues with China’s lockdowns are going to keep more inflationary pressure for the next year as well.

I do not see the Fed or ECB being able to raise rates to the 8-12% inflation rate. When “aggressive”, they talk of rising rate by 0.5% increments … maybe … one day. So this should keep real rates deeply negative. Negative rates are the perfect (and exceedingly rare) environment for gold to outperform almost any other assets.

Overall, mounting stagflation fear should keep gold elevated for the few years to come, even if the situation unexpectedly stabilizes. And if things get worse, gold miners’ inherent leverage on gold prices should be a powerful insurance policy against a stagflationary crash.

In that respect, Tropicana and McPhyllamis mine, both essential options on future gold prices, are the real value of Regis Ressources. The same holds true for all of the exploration portfolio. If gold prices go down, the stock will do poorly. But if they go up, the optionality will multiply the move several folds.

As I mostly buy gold miners to access “leveraged” gold, Regis's high optionality is what I am looking for.

Jurisdiction advantage of Regis

Gold miners will only outperform when gold prices rise. But if that happens, I expect a lot more political interference or even outright nationalization in many places.

I personally will keep 10%-20% of my portfolio in gold miners. While I love deeply undervalued stocks like Medusa in the Phillippines, I also want some safer Tier-1 jurisdictions like Regis.

The more inflation hurt economies, the more gold rise, and the riskier it will be to own assets in less safe jurisdictions. Copper and lithium miners in Peru, Mexico, and Chile are right now re-discovering this risk. I think gold might be next, so diversification and caution are a must in this environment.

Wrapping-up

To conclude, I think Regis has something to offer on this front as well.

The core thesis is as follow

low AISC

high optionality from future production growth and reserves

large exploration portfolio in a gold-rich region

maybe the highest jurisdiction safety in the world

cheap for its jurisdiction

distributing 3% dividends

Disclaimer: This report is to illustrate my investment strategy and portfolio building and DO NOT constitute investment advice. Please do your own diligence and invest accordingly.