EV False Start

Electric Vehicles (EVs) were supposed to progressively take over the automotive industry as soon as us peasants realized a Tesla costing 50k is actually cheap when taking into account lower fuel costs and maintenance.

Together with the inexorable march of technological progress and the pressure of global warming, this made EV domination all but a certainty.

Except it did not happen like that.

Don’t get it wrong, EVs WILL one day dominate the auto industry. This is because from an engineering standpoint, electric motors are superior in many ways (yes really):

Convert almost 90% of its “fuel” into motion, compared to 20% in Internal Combustion Engine (ICE) (the rest is waste heat).

Accelerate better from 0, giving every electric car great acceleration performance, especially where it matters the most.

Can use regenerative braking to collect back energy when using the brake, improving performance in traffic and town driving.

Almost no moving part and almost no maintenance required, while very small and light

ICE engines are instead incredibly complex, having to synchronize what is essentially constant mini-explosions.

Electric motors are ultra-durable, opening the possibility of cars lasting 20-25 years if the rest of the material is of high enough quality.

The problem with EVs is with the power source: the battery.

Lithium-ion batteries have gone a long way but are still found lacking when compared to oil:

Much lower energy density, leading to a lot of extra weight of EVs, reducing performance (fuel efficiency, acceleration, etc. )

Slow to charge, leading to problems for long-distance travel and waiting time at charging stations.

Loss of power in cold temperatures, which can decrease the EV range by 3x in winter.

This is compounded by the absence of ICE “waste heat”, so the battery gets drained to keep the passengers from freezing.

Low lifespan of the battery, with severe capacity loss at 10 years.

High price, often 40-60% of the EV total price.

The combination of higher price (due to batteries) and less practicality (charging time, low range) makes for a poor-selling argument beyond the green activists and tech enthusiasts.

Changing Auto Market

Vindicating this position are a few recent data points:

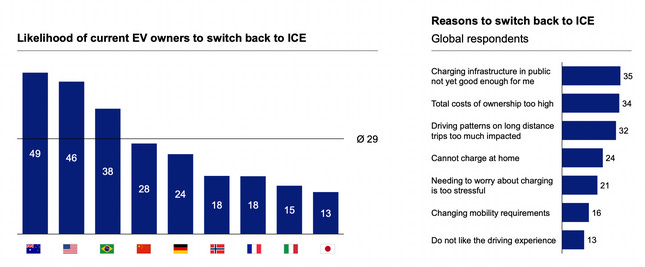

Mobility Consumer Pulse for 2024 conducted by McKinsey & Co., the survey found that 46% of EV owners were likely to switch back to owning a gas-powered vehicle.

In another study, it is “only“ 29% wanting to switch back.

Interestingly, the strongest factors are the ones that are hardest to mitigate are the main reasons why people want their ICE car back:

Most people in cities live in flats and do not have their own chargers. It means the inadequate public charging stations, either too slow, to crowded, or too spare/far are a hassle. This combines well with the “cannot charge at home” and “needing to worry about charging is stressful“.

The charging stations problem makes most urban dwellers (out of suburbs) actually unlikely to buy an EV anytime soon.

For the rural population, other issues block EV adoption: too high prices + driving over long distances is unpractical.

The 16% of “Changing mobility requirements“ is interesting. Maybe getting kids or different jobs now need more reliable batteries for daily commutes?

So overall, EVs will not see mass adoption as long as BOTH battery technology progresses AND charging stations are ubiquitous and as easy to access as fuel stations.

Remember, this is about the people WITH an EV. If they are not convinced anymore, it is unlikely that the mass of ICE users will switch any time soon. And in many countries, improper electricity infrastructure will anyway limit adoption for a long time.

This means that we are likely to see EV mass adoption only in countries that are VERY good at infrastructure. This includes China, likely Japan, and a handful of Northern European countries.

It most likely does not include most of the world, including the South of Europe, the USA, South America, MENA, and South Asia.

Still, battery tech and EV tech progress has made viable an alternative to ICE: hybrid cars.

Why Hybrid Sales Are Exploding

Sales of hybrid vehicles have increased by 44% year-over-year last October in the US. The demand has also risen for vehicles priced between $20,000 and $30,000 in new cars and $15,000 to $20,000 in used cars.

The story is of course the combination of rising interest rates making living more expensive, through growing mortgage payments and more expensive car loans.

And an over-cost of living crisis due to real inflation higher than reported and economic stagnation in the midst of an energy crisis.

This is a segment where EVs are struggling, with only Chinese EVs able to compete, and only with their cheapest model like the Seagull from BYD at $10,000 in China and $20,000 in the EU.

Chinese EVs

Chinese EVs are definitely competitive in some contexts and are going to upend the auto markets in:

Developing countries, where total costs (purchase + maintenance + fuel) is everything and cheap EVs’ technical limitations will be tolerated.

Most have good relations with China and no domestic auto industry, meaning no tariffs.

Among Western militant EV buyers looking to reduce purchase costs, at least in the EU tariffs are low enough to keep Chinese EVs competitive + many will be built locally in Hungary, Serbia, and other friendly EU countries.

As a secondary cheap electric car for small local commute.

Because this is actually a lot of use cases globally, it seems to me rather unwise to bet on any legacy auto manufacturer. Competition from China will be brutal. Add an ever-looming recession risk, and you do NOT want to bet on a cyclical industry like automakers.

Some will make it, like Toyota & Hyundai, both hybrid leaders, and probably Volkswagen, but many will not (Stellantis makes for a sort of a good stock to short) and become absorbed by Chinese companies or go bankrupt.

Best Of Both Worlds

Why are hybrids suddenly popular? Blame EVs!

First, hybrids have acquired the image of a “compromise EV”. It can run partially on electric, cost less to operate, and all the other EVs’ advantages.

But it ALSO has an ICE engine with 600km+ autonomy, can be refueled at any station in 5 minutes, and runs well in winter.

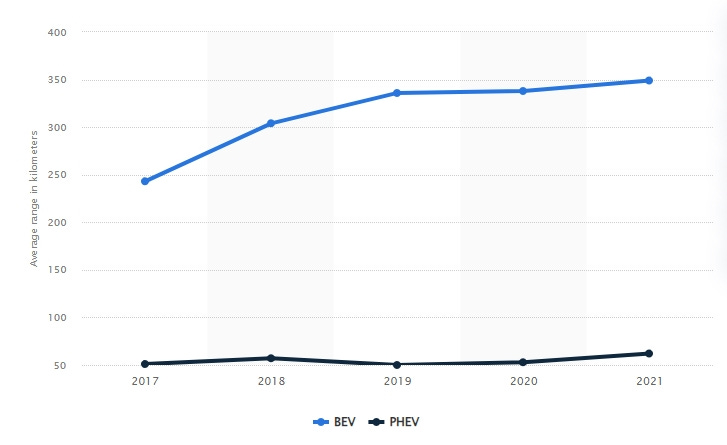

Compare that to the only 350 km average range for EVs.

Meanwhile, the 50-70km hybrid’s electric range is enough for most commute travels, just not the occasional but important for drivers long-distance trips.

Source: Statista

Many drivers have been convinced by EV enthusiasts of the cheap fuel costs of running electricity in traffic jams and short commutes. If they can not sacrifice range or practicality the better.

Another reason is that the tech in EVs also makes hybrid better.

Mass production has created giants like CATL that benefit from massive economies of scale. This provides cheap batteries to EVs, but also hybrids.

In the same way, an elaborate supply chain for lithium, cobalt, nickel, etc at the purity required for EV batteries has been built and itself achieved a massive economy of scale.

Denser batteries in EVs make for denser batteries in hybrids. You need less total battery volume in a hybrid, so you need very few ultra-dense batteries.

Mass production of EVs created a whole ecosystem of suppliers for electric motors perfected for the auto industry.

Software designed to optimize battery usage can be used to optimize how to combine EV & ICE modes.

The tooling and engineering expertise needed for EVs, like designing and integrating battery packs, wiring, manufacturing, testing, etc. have already been bought and hired by all automakers.

So we have a situation where both legacy automakers and drivers have an interest in switching to mass hybrid adoption.

Automakers are to make money on EVs as they do not sell well, and are too expensive.

But the same automakers are desperate to utilize the billions they poured into electric mobility technology.

Drivers want the advantage of EVs for daily commutes (low fuel costs) but none of the downsides (low range, high purchase price, impractical charging, and long travels).

How does this look globally:

In France, hybrid vehicles accounted for 36.7% of registrations in the first two months of 2024.

In Estonia, it was 53% of total sales.

More than half of China's car sales were plug-in hybrids, up 51% year-to-year, so even in the EV center of the world, hybrids are making a killing and will soon replace most ICE cars.

In the US, due to cheap fuel prices, it is a bit lagging behind in giving up pure ICE cars but we are getting there as well.

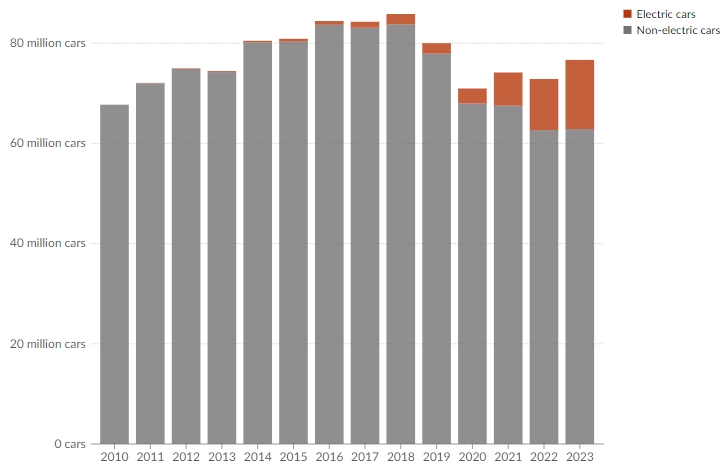

You can notice that where EVs stumble, hybrids keep rising:

Hybrids’ Win Is Platinum’s Salvation

EV rise was to be played with Tesla and BYD when no one believed in them.

A collateral damage to enthusiasm for EVs has been the platinum metal group.

You see, platinum and similar metals of the same chemical family like palladium are mostly used in catalytic converters in ICE cars. The metals have many other applications, but fuel engines and pollution-reducing converters are by far the largest consumers.

Platinum is also very rare, mostly only found in South Africa in concentration commercially viable, even at the current high price. Palladium is a bit more diverse, with important production in Russia.

In both cases, the “imminent EV domination” has depressed these metal prices and even more the price of the associated miners.

Except we know now EV will not dominate the market for at least another decade.

Meanwhile, hybrid ICE engines often start cold and need MORE platinum to stay within the parameters of air pollution.

Every additional million hybrid cars sold creates a demand for roughly 150,000 ounces of PGMs.

And there are plenty of ICE cars waiting to be turned into Hybrids over the upcoming decade of car purchases, with around 60 million sold every year:

Source: Our World In Data

Assuming only half turn to hybrid over the upcoming decade, this will make on average 30 million cars, or 150,000*30=4.5 MILLION ounces extra needed.

Or 140 tons.

For reference, the world’s production in 2022 was 190.

This is a VERY small market, subject to brutal moves due to its concentration and overall small size, as well as the rarity of decent mineral deposits over the world.

Just compare it to other metals:

And in the platinum business, there is really only one name that should excite the value investors.