Oil & Gas Technology

No Production Decline (Yet)

It is no secret that the Russian state relies heavily on O&G revenues to finance its government spending. This is also how it keeps the private economy running, through fuel subsidies (fuel is dirt cheap for Russians) and gas subsidies (keeping warm in the cold Russian winter is cheap too).

In the short term, it seems that Russian production has not suffered from sanctions. This means they can operate relatively efficiently with the equipment they already have.

This ran contrary to an EIA report that expected Russian production is to decline by 3 mmbpd (million barrels per day) (on a side note, the EIA seems to be less and less able to correctly predict anything, after the blunder of expecting a “permanent decline in oil demand” during the pandemic and a lot of green dogma taking over the agency).

The same EIA then predicted a 2 mmbpb decline by the end of 2023.

Still, a LOT of advanced O&G technologies are Western-made. So there is a good case to be made that production will decline soon for this reason alone.

Future Production Losses

A good indication of how Russia needed Western technology to optimally produce more oil was all the partnerships Russian oil companies have signed over the year. It included Exxon in the Arctic, Shell in gas in the Sakhalin, or offshore with BP.

I could not find a reliable assessment of how important such partnerships were to keep the oil flowing (in comparison to launching new projects).

It would strike me as reasonable to assume a 5%-15% decline in production over the next 2 years. Most likely, it will be more pronounced on oil than on gas, considering the gigantic reserves of Gazprom (the largest in the world). Even if some fields suffer, the whole should keep going.

With Russian oil production of around 10 mmbpd, this would remove from the world market an average of 1 mmbpd, maybe 2 at most.

OPEC+ Quotas as an Indicator

Non-coincidentally, the OPEC+ cartel has recently decided to reduce its quotas by 2 mmbpd.

Considering most OPEC members were already producing less than quotas, the total effect should be more moderate, around a 1 mmbpd reduction in production. Such reduction will mostly come from Saudia and Russia.

(you can see this Twitter thread to look at the estimate by experts more reliable than the EIA).

I suspect both were anyway struggling to keep production.

For the Saudis due to undeclared depletion, and for the Russians due to sanctions. (one day I will discuss the real state of Saudi oil reserves, but let’s just say for now they are likely much worse than official claims). It also keeps Russia in friendly terms with the Gulf power, something very useful to keep military supply flowing, in case the alliance with the US cracks even more.

So making it a “voluntary” decision makes it look like a power move instead of an unwanted decline in production. I expect a similar reduction by another 500,000 barrels/day to 1 mmbp in the coming months.

Mobilization Effects

The current mobilization should have limited effect, as it concerns only 300,000 men. But would the conflict escalate even more, this might change. I assume it is likely that mobilization will go above half a million.

There was also the puzzling declaration that the Russian energy industry should be a “perfect provider of fighting-age men”. This makes little sense on surface value to risk skilled workers bringing most of the money needed for the war.

However, would some O&G fields be shut down, this would indeed provide “free” manpower for the army.

Redirecting Energy Flows

Besides production, another question is the logistic of exporting all that oil and gas. I highlighted in my previous report that a key chokepoint for Europe will be LNG ships availability. And this was BEFORE Russia’s need to redirect it production from pipelines toward ships to Asian markets.

The situation is somewhat different for oil and gas.

Redirecting Oil

As a general rule, oil is easier to transport and redirect, as it is a relatively dense liquid. So in theory, any oil tanker could take Russian oil and refined fuels and send it to India/China/Pakistan/Brazil, etc…

In practice, most of the Russian oil used to be sent to the EU markets. This will stop with the EU sanctioning Russian oil in a few months.

Some of that oil was sent by pipeline and will need new ships to reach new buyers. Some was already sent by ship, but there’s a catch.

These existing ships are relatively small tankers, as Russia does not have the kind of deepwater harbors able to take in VLCCs (Very Large Crude Carrier). It was fine when the cargo had to go over small distances to EU harbors. But to reach Asia, VLCCs are needed.

So the only option is to use the regular smaller ships and do a ship-to-ship transfer to VLCCs. This option immobilizes both ships for weeks.

This will take the VLCC supply from tight and expensive to absurdly costly.

This is compounded by Europe already hiring at any cost VLCCs to get fuel from afar, like the Gulf and Brazil, instead of the previous local Russia-EU trade.

They need to both replace Russian oil, but also Russian gas as a lot of facilities and power plants are starting to burn oil instead of gas to keep the lights on.

Ultimately, either shipping costs will be too high or ships will simply not be available. This will force Russia to reduce production, as it cannot physically nor financially ship it to its Asian customers.

This alone, irrespective of production issues, should kill 2-3 mmpbd of Russian supply.

THIS IS EXTREMELY BULLISH FOR NON-WESTERN, NON-RUSSIAN OIL EQUITIES.

I cannot emphasize this point enough. Even with the current release of the US Strategic Petroleum Reserves (SPR - 1 mmbpd) and China in lockdown, the oil supply is tight.

The combination of the steep Russian oil supply decline, the end of SPR release, and China reopening is the most bullish conjunction for oil since the 70s oil shock.

Redirecting Gas - Power of Siberia

When it comes to gas, the existing LNG exports will keep going through the Artic road.

But increasing significantly LNG exports is not an option for Russia. Its existing LNG facilities are simply not to the scale of what was exported to Europe by pipeline.

The ONLY alternative is exporting it by pipeline to China.

The problem is that most gas production comes from the Western Siberia region, which is not really connected by pipelines to the Eastern part of the country.

The most aware of my readers will know about the Power of Siberia I and II. The number I is functional since 2019 and has been ramping up exports since.

Number II will increase total export capacity, allowing all eastern production to be exported, and some of the Western Siberia production as well. But it will not be ready before at least 4-5 years at best.

Power of Siberia I has a capacity of 61 billion m3/year, and Power of Siberia II a 51 billion m3/year.

These pipelines have 3 functions:

Find a market for the East Siberia gas field

Expand the market for the Sakhalin field, before that limited to LNG exports

Ensure a steady, Western-independent income to Russia.

What the Power of Siberia pipelines cannot do is carry to China what used to be sold to Europe. At least not in a significant amount.

The power of Siberia I capacity will be maxed out by local production in Siberia and Sakhalin. And II will also partially be used by local production. So I would give a guesstimate of 20-40 billion m3/year “spare capacity” for Western Siberia-produced gas.

This is to be compared to the 186 billion m3/year previously exported to Europe in 2021.

Redirecting Gas - New Pipeline Network

In all likelihood, Russia's exports westward will not entirely stop. For example, the Balkans, but also Hungary or Slovakia will probably still receive some supply. But this is very small compared to what used to be sent to Germany, Austria, and Italy.

So this makes something in the range of 150 billion m3/year to redirect toward Asia.

Between the Power of Siberia and Eastern network and the Western network, there is a massive connexion gate, which I (artistically I hope) circled in green below.

So here is the list of rather herculean tasks to be done to redirect all the EU gas toward Asia:

Finish Power of Siberia II, as most of it is already planned and agreed upon

Connect it to the Western field so at least all Power of Siberia I & II are running at full capacity all the time.

Add A LOT more connection capacity north of Kazakhstan.

For reference, the Power of Siberia I construction did cost $16B. So I would guess a total cost of around $50B-$80B to account for inflation, rushed construction, and sanctions would make sense. This is totally doable, considering Gazprom's $40B net profit in just H1 2022. But this will nonetheless be quite a massive investment.

Soyuz Vostok

To close this West-East gap, the key will be the Soyuz Vostok gas pipeline. (not to be mistaken for the Vostok oil pipeline in the Arctic, I know, Russian names are confusing and un-imaginative).

It is not an accident that the feasibility study of the project got finished in January 2022, one month before the attack on Ukraine. This is a vital project, rushed now that the viability of exports to the EU is compromised.

Soyuz Vostok is more about increasing Power of Siberia II capacities. But remember, this would make no sense if the East-West connection is not improved, as the existing Power of Siberia II project was not going to receive enough supply from the Western Siberia field already.

So my suspicion is that extra construction is made in Central Siberia for increasing the existing West to East capacity, except this was not announced in Gazprom’s annual reports.

Considering how strategic this move is, and vital to the war effort, there is little surprise the Russian state would not want to discuss it openly.

How advanced that “stealthy” construction of the East-West connection is, is anybody’s guess. I suspect it might still be 2-5 years before full completion. This estimate is because Power of Siberia II is not going to be finished before 2027-2028 at best, so anything before that is not very relevant anyway.

More generally, these China-Mongolia-China discussions can be formalized during the SCO meeting, like it was recently:

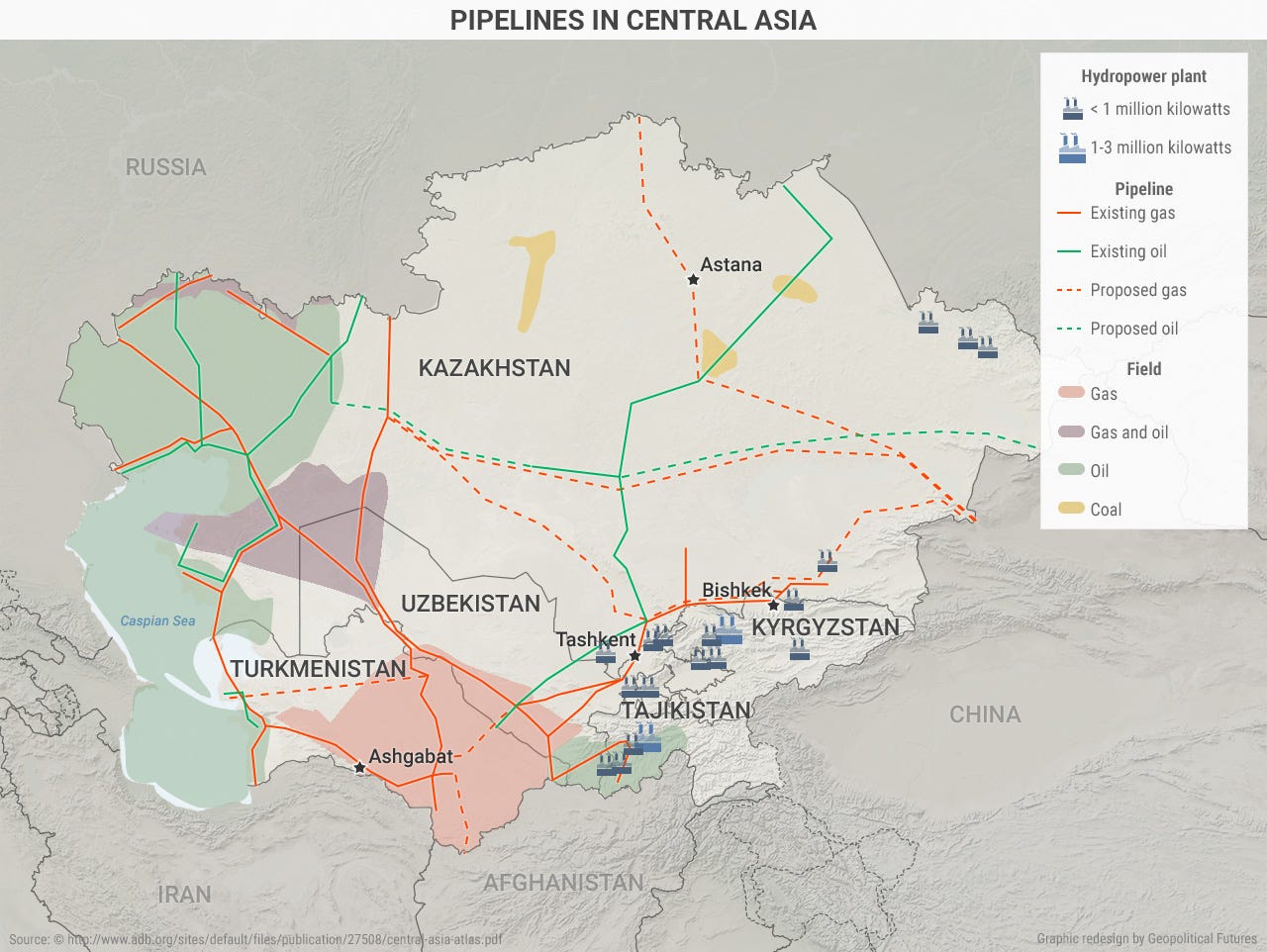

Central Asia

The central Asia region is a gas producer of its own.

Many gas pipelines crossing Kazakhstan toward China have been proposed. Until now, China's reluctance to rely on Xinjiang as a transit area blocked these plans, making Power of Siberia happen instead.

With Xinjiang now much more firmly under control by Beijing and Russia eager for more transit roads, this is likely to change quickly.

For now, Central Asia local network is tied to mostly China-bound exports, or dependent on export through the Russian network, north of the Caspian sea. Russia is also deeply involved in the local infrastructure, including a very recent $4.6B deal with Uzbekistan.

This is likely to change in the next few years as well. Azerbaidjan is already positioning itself to be a key supplier to the EU in replacement of Russia, with its ally Turkey as a key transit country.

This position will be even reinforced when the proposed Trans-Caspain pipeline comes into action.

Increasing the flow of gas from Central Asia to Europe will have multiple effects:

Reducing non-Russian gas supply to China.

Offering much more pricing power and revenues to Central Asian states.

Freeing pipeline space toward China for Russian gas.

If you wondered why the West is passively watching Azerbaidjan attack and conquer Armenia, this is why.

Previously, both Russia and Iran strongly opposed this project. I am uncertain if this will still be true.

The reason was that both saw this as a threat to their control of gas export to Europe. This is even more true today that Russia has an interest in seeing European economies collapse from energy shortages.

At the same time, it would make China VERY dependent on Russian and Iranian gas, as Central Asia is its only alternative reliable supplier.

South Asia

Lastly, India and Pakistan would LOVE to receive cheap Russian gas. Even better if at pipeline prices instead of LNG prices.

The long-stalled TAPI (Turkmenistan–Afghanistan–Pakistan–India) pipeline would solve that. You can imagine it is the Afghanistan part that is tricky. This might explain the recent agreement to sell fuel to the Taliban signed by Moscow a month ago.

This is still a long shot considering Afghanistan's perpetual instability.

An alternative to the TAPI pipeline (more likely in my opinion) would be a swap deal with Iran. Iran builds a new pipeline to Pakistan, extending the connection reaching the Chabahar port, and sending it gas. And Russia sends gas to Iran for its domestic uses.

The longer view

It is likely that Russia’s oil production will decline drastically over the next 3-5 years. This will come as a combination of technical issues (from sanctions) and logistical chokepoints (pipeline and shipping).

Regarding gas, the same can be said, with a 4-7 years timeframe, depending on how quickly new pipelines be built. It will also depend on how much stealth work has already been done on the West-East gas connection.

Both mean a durable and ongoing global supply shock in energy.

2-3 mmbpd of Russian oil going offline will likely send the barrel to $110+ for years.

With Russian gas unable to be redirected to China, this means the battle for LNG supply will intensify even more. The result will be most likely Europe + China + Japan outbidding everyone else for LNG. It will also force them to transfer the costs to their consumers, boosting global inflation.

This will have catastrophic consequences for other poorer countries dependent on LNG to keep the lights on. Pakistan especially comes to mind.

Consequences

Energy

For both gas and oil, the decline in Russian production/sales will be accompanied by a dramatic rise in price.

So it should not hurt much Russian income or war chest.

More likely, it will hurt the Western alliance, China, and the world to a much greater extent.

In a 5-6 years period, we can expect the situation to stabilize, and energy prices to even crash after a period of very high prices. This is because by 2027-2030:

Russian energy will have come back in full swing.

Shale oil, including non-US shale (Poland, UK, Argentina, China) will add supply.

Additional offshore production worldwide will come online, especially from the “frontier” O&G like Brazil, Guyana, Africa, and Indonesia.

The nuclear renaissance will start to bite at fossil fuel consumption permanently, especially gas.

Macro perspective

Because Russian energy production did not collapse instantly, this risk is now mostly ignored by markets.

The conjunction of some sanctions finally having an effect and logistical chokepoints will be very impactful in the next 6-18 months.

The key macro takeaways are

LNG and oil tanker rates are going to explode.

Energy shock continuing until 2026-2028, in both oil and gas.

The shock will be followed by a crash in fossil fuel prices and profits.

Higher, durable inflation globally.

Electric grid and economic collapse for more fragile countries dependent on oil, gas, and food imports (Pakistan, Bangladesh, Sri Lanka, and most of Africa).

Effect on China’s strategy

One last discussion to have is the consequence for the leader of the Eurasian Tripod, China. The country is going to suffer like everybody else from the massive, global energy shock.

But this should be manageable, short of an uncontrolled financial crash. Something that can be said of the US as well, and even more true for Europe or Japan.

Because land pipelines are insufficient, China's current energy and food supply are simply too easy to shut down by the US navy.

So it is also very unlikely for China to launch soon a serious war (Taiwan?) if it can avoid it.

This also means that once Russia has redirected its energy flows eastward, war is much MORE likely, in the 2028-2030 horizon.

Regarding this topic, I will as soon as possible discuss it in the next (premium) report titled “The Coming Blockade of China”, a tandem with the next free article “The Eternal War between Land and Sea“.