The Next 10 Years In Oil

Why I Am Staying In Energy Markets, And When I Will Leave

Turning Black Tides

A sure sign that energy is slowly getting out of the absolutely awful sentiment with investors, I have been recently asked several times about my perspective on the future prospects of shale oil.

As a massive part of my portfolio is in oil producers (Petrobras/PBR , soon Ecopetrol/EC and Guyana stocks) and oil drilling (RIG), this is something I have a solid interest in getting right. Not just shale, but the direction of oil markets in general.

So let’s dive in.

The Immediate Picture

Stagnating Shale

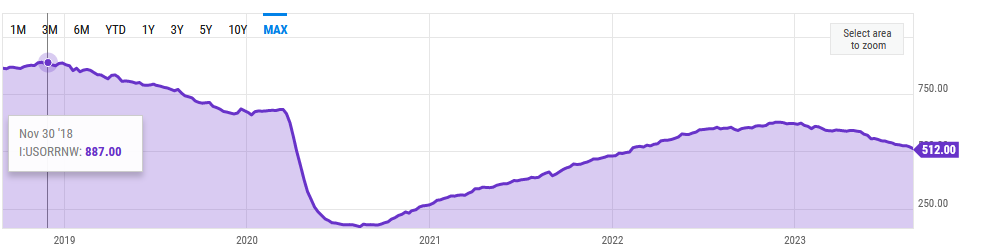

The very first part of the equation that MUST be right is shale oil. This was US shale (over)production and growth, in the so-called “shale revolution”, that durably flooded the market in the 2010s and caused oil to crash, with the pandemic being the coup de grace, pushing oil into negative price territory.

The first thing to consider is that a wave of bankruptcies has changed shale companies’ management. Either new people or new strategy or both. Now the focus is not on production growth while producing at a loss, but actually making money.

This means that shale oil is not really interested in much growth, as illustrated by a constantly declining rig count. No rig, no drilling.

The other problem is that all of the best US shale assets have already been drilled. In conventional oil, this would not be a problem, and it would keep gushing the black gold for many years. But with shale wells declining quickly after 12-24 months, these prime quality assets are essentially gone.

So this leaves the Tiers 2 & 3 quality. Short of high oil prices, good luck making money with those, when depleted Tier 1 led to bankruptcy. This disincentivizes growth even more.

Overall, shale will not disappear, but the world cannot expect growth from it.

Demand

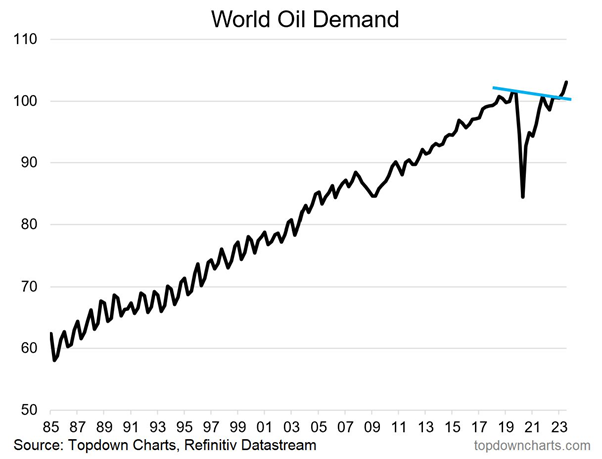

Another thing to figure out is demand. It is a little less important, as long as the guess is in the right range or direction.

Many expect China to reduce demand dramatically due to its real estate crisis. I am rather unconvinced. The economy is transitioning to other sectors, as the freed-up consumption potential by youngsters finally able to buy properties should compensate somewhat.

And this ignores the rest of the world building infrastructures like crazy, in part thanks to the Chinese Belt & Road projects. Almost every day I see in passing new plans for railroads, hydropower dams, highways, etc… in Southeast Asia, Central Asia, the Middle East, Africa, and South America.

Numbers seem to placate this view, with the world’s oil consumption at a record high of 103 million barrels per day.

For a while, the pandemic broke a multi-decade trend of rising demand, but we seem back on track, not surprising with rising global population and the industrialization of vast areas of Africa, Asia and Latin America.

OPEC & Others

Meanwhile, OPEC and Russia seem determined to create a deficit in the oil markets, with “voluntary” production cuts.

I already said before how the real Saudi production is lower than official, leading them to pass Iraqi or even Iranian oil for Saudi oil.

For the same reason, they have to regularly “voluntarily cut production”, to replenish stockpiles depleted by selling more than they produce.

Russia is in the same situation, with some sanctions starting to bite, and forced production decline being declared “voluntary” because this sounds better than “Oops, it takes quite a while to replace the parts we used to import and to retrain technicians we used to hire from the West”.

The next 5 years

The next 5 years will be marked by the conjunction of multiple dynamics, all leading to a tight oil supply.

Stagnation of US shale, with little to no production growth.

The chronic underinvestment in exploration will start to hurt mature fields like the North Sea and even the Gulf of Mexico.

The decline in Saudi production will become more and more apparent.

This will also lead to increasingly desperate tentatives to IPO more of Aramaco and other Arab national oil companies before it becomes clear their fields are in terminal decline. Right on cue, “Saudi Arabia studying another Aramco stock offering -Bloomberg News“

Climate hysteria and the Green Leap Backward will go in overdrive, leading to countless pipelines and exploration permits canceled by judges/activists/politicians.

Some positive growth will be seen in a few spots, like Guyana and China, but overall this will not be enough to compensate for all the rest of the decline.

To crown it all, restoring and an explosion in military spending for energy-intensive projects like ammo depots, more tanks, and more ships, all very energy-intensive endeavors, will also contribute.

Only a Great Depression in Europe and/or China could derail this prediction, as it would obviously collapse demand.

But if this is the case, I am not sure cheap energy producers like Petrobras is the worst place to be…

After 2028

The short version is that I expect to exit 100% of energy markets by 2028.

Yes, I am an oil bull. For now. But when the cycle is done rising, I am out!

By 2028, a lot will likely have happened or happen soon.

Guyana offshore will now be in full swing, with Suriname, Namibia, and a few others becoming big names in energy production as well, or anytime soon.

The rebound in exploration and offshore drilling will bear fruit, with a new life given to many areas, from offshore Persian Gulf, Mexico Gulf, and North Sea, as well as India, Indonesia, Malaysia, China, etc…

Offshore will probably be the factor that calms down energy markets after a few high-price years. But it is shale that will break them.

Except I am not talking of US shale, which will likely be less and less relevant.

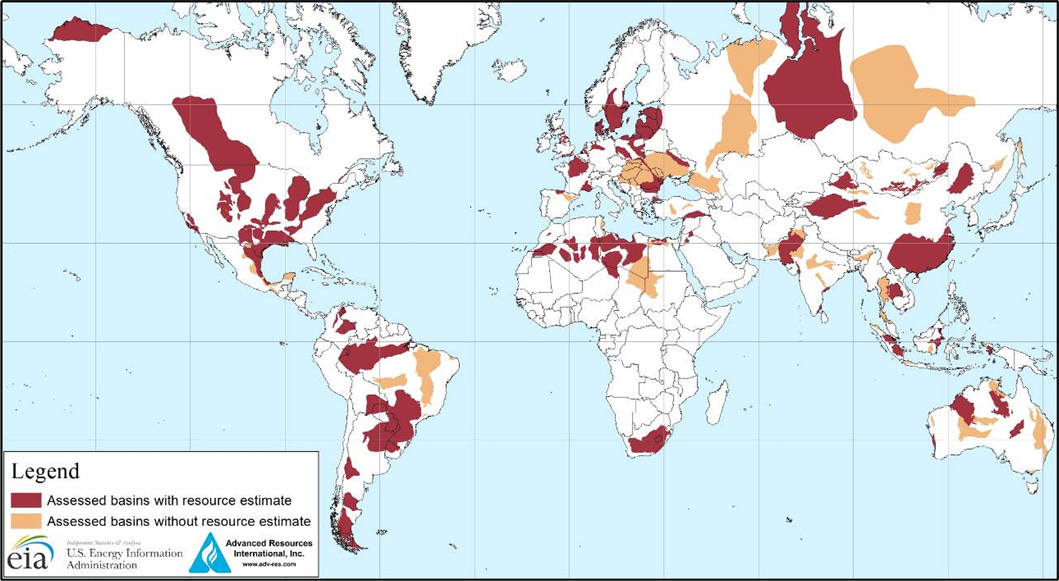

But Vaca Muerta in Argentina, Chinese ultra-deep shale, but also for now virgin territories like, Brazil, Russia, Australia, Canada, South Africa, Ukraine, the Balkans, etc…

Maybe even France, Poland, the Baltics, Scandinavia, if they give up on carbon targets following a defeat in Ukraine and a full interruption of Russian supplies.

Shale oil and gas resources according to the EIA It is also likely that Iran production will have risen, following its recent entries in the SCO and BRICS+ and the de facto end of embargo and isolation.

A return of Venezuela and improving of Iraq production is equally likely.

Together, these countries have massive reserves, and are really underproducing today. Venezuela has the world’s largest reserves, and Iran and Iraq are 4th and 5th.

For that matter, Russia is likely to have solved its production problem by then, and is also likely to have finished pipelines required for exports through Iran or Central Asia & Mongolia.

High enough oil price will make Canadian sands attrative again, and by then maybe Alaska will be less stopped by politicking.

But this is not all. The first batch of SMR nuclear reactors will start to pop up everywhere by 2028-2029. A lot of newly built “classical” nuclear power plants will also already be online or getting there soon.

Solid-state batteries are also scheduled for the same 2026-2028 timeframe, which could actually trigger a mass adoption of EVs for not only cars but also trucking.

And for better or worse, a lot of renewables will have been built, likely weakening electric grids but still removing some demand for gas and oil (and coal).

So overall from that point onward, most trends turn negative for energy companies.

Production risks turning into overproduction at any time.

Demand might be on a terminal decline or at the very least stagnate and decorelate from economic growth for a while.

Nothing Surprising

This to be expected, for an industry very well known for its cyclicality.

2020-2021 was the low point of the cycle, with negative oil prices followed by a string of bankruptcies, including ALL but one offshore driller (Transocean), a big part of the shale industry and energy falling to the lowest percentage of the S&P 500 in decades.

2023 is the beginning of the recovery, where the inflexion curve goes upward and the market starts to pay notice, with “oil ignoring weak economic data”.

2025-2026 is probably when talk of energy scarcity and disillusion about renewables’ ability to support the grid will get much more public and loud, and retail investors start paying attention. Slower than hoped for adoption of EVs will also have an impact.

2027-2028 is probably a repeat of 2008-2009, when peak prices are seen, and the last train leaves the station before the crash.

Known Unknowns

A few things could derail this prediction. Obviously a Great Depression or a world war would put a lot of investing strategy in a pickle. Sadly, both are have a non-zero probability at the moment.

But those are more of unknown unknowns, unpredictable wild cards that at best we might see coming a few weeks of months before it really detonates in our face.

Another factor is how hard the Green Leap Backward goes. I expect it to hit first the production of Western oil companies.

But IF the focus is on 15-minutes cities, carbon ration cards and overall killing the demand for transportation of the Western public, this could have multiple negative effects on demand, from directly reducing consumption to further crashing the Western industrial output, especially Germany’s, which highly reliant on automating and chemical industries.

On the plus side, production disruption is always a possibility. From a resurgence of ISIS in Iraq, Iran-US tensions in the Strait of Hormuz, interruption of Central Asian oil transit through Russia, destruction of pipelines crossing Ukraine, there are a few possibilities. But overall, none should be really important, so this is likely to stay irrelevant.

Parting Thoughts

The last thing on my mind about oil is a massive black swan. A giant, dragon-size, black swan I suspect is appearing on the horizon.

This is however a little long to explain and to make the case for this risk being very real.

I also feel that this is the sort of third-level thinking my subscribers actually pay for, so it will be behind a paywall.

In any case, I think energy equities are a good place to be at the moment, with a lot of factors pushing for stability if everything goes as expected, as a VERY high price in oil is what I suspect to happen, and I give a 20-30% chance for it to materialize in the next 12 months at the moment.

Great analysis. Which Oil companys do you like besides Petrobras?

What do you think about increasing youth unemployment in China?