The World's Future Energy Mix

Getting it right is the trillion dollar question

As a lot of my portfolio is in fossil fuels, and I am looking at miners, understanding the future of energy consumption is rather important.

This is a funny topic as people feel the need to adhere religiously to one camp or another:

The green team, where renewables and fairy dust will power the energy grid tomorrow.

The grey team, where oil and gas will forever stay important.

A key driver is that there is plenty of money and careers to be made in either of the teams. It also overlaps nicely with the left/right divide.

When you look at real statistics, both teams feel a little retarded.

It makes for poor analysis, understanding, and investing.

This will likely be a somewhat controversial post, as it will necessarily challenge almost everyone's assumptions.

What The Green Get Right

Let’s start with a few facts the green team got right:

Electric motors are radically more efficient than combustion engines, which convert only 20% of the energy in fuel into movement, the rest being heat.

Renewable energy is getting cheaper every day, especially solar.

Battery density of the newest chemistry is becoming remarkably good.

EVs are cheaper to maintain and more long-lasting overall.

What The Green Get Wrong

Green energy so far has only been an addition to the energy mix.

EVs only last as long as their battery.

Most people want the reliability of liquid fuels, and it is vital to have them in times of crisis (hurricanes for example).

Renewables are not so cheap when taking into account intermittency, hence the need for energy storage.

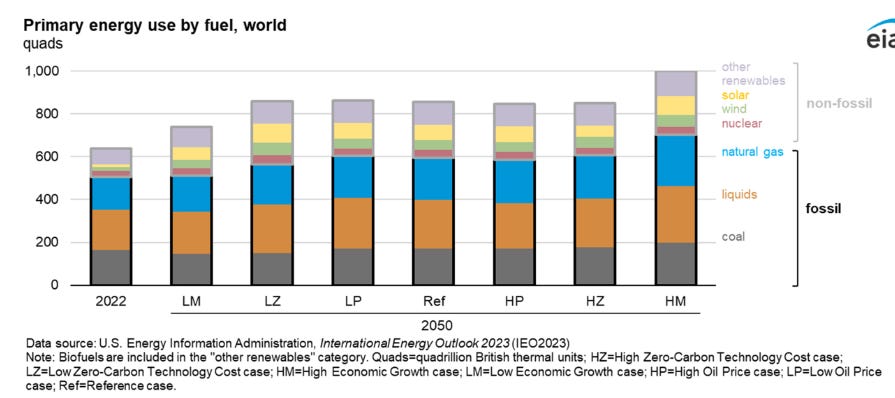

Even the most politicized projections like from the EIA still show fossil a major energy source in 2050 in ALL scenarios.

Currently, most renewable energy is still from hydro.

What the Grey Get Right

Fossil fuels will be needed for the decades to come.

Stable electricity production is a must, batteries will likely never be enough.

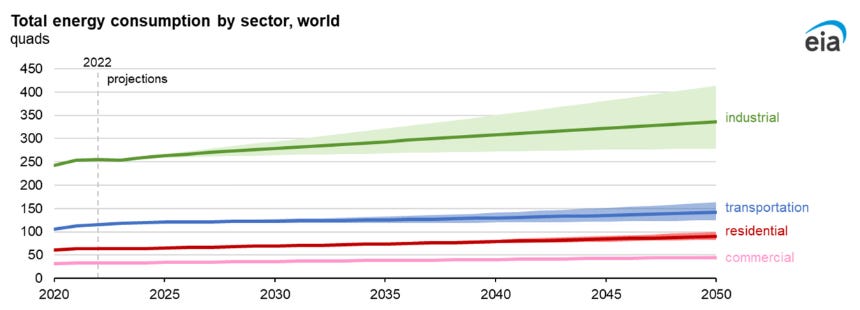

Most of the energy demand is from goods and industry, not transportation: fertilizer, steel, chemicals, shipping, mining, etc.

another big segment is residential (cooling, heating), and it’s getting bigger as the Global South is getting richer.

Some sectors might forever need liquid fuel, e.g. aviation.

What the Grey Get Wrong

Much more can be electrified than initially thought: Tesla Semi can drive 700km in tests ran by DHL, green steel is a possibility, etc.

Most people like EVs if they are reliable, cheap, and long-range.

We are running out of easy fossil fuel, which is why we need to dig thousands of meters deep to find more. Or in unstable countries (Namibia, really?) or hostile environments (the Arctic).

Fossil fuels are not really cheap in the long term, as easy deposits are all depleting, including US shale oil.

Green Reality Check

Renewables are getting cheaper, but not cheap enough due to intermittency.

EVs are getting better, but only the latest battery chemistries make sense for mass adoption.

Focusing on EVs hides the forest of total energy demand.

Grey Reality Check

Fossil fuels are cheap only because of capital misallocation of US shale.

They are going to be less important as EVs take over transportation, including logistics on land.

As easy supply dries out, alternatives become more interesting and speed up the replacement of fossil fuel.

Synthesis

Because of the joint failures of green energy to be actually cheap (when taking into account storage) and the growing rarity of fossil fuel, we are heading for an energy crisis.

The obvious solution is to own stocks of energy producers. But only those with resources that are not depleted.

Frontier markets like South American oil is still one of my favourite picks.

Reliable, fuel-less renewable energy, hydropower, is the other one.

Nuclear

Another option SHOULD be nuclear energy.

The problem is that it is very hard to play.

Building more nuclear power plants requires we get our regulatory procedure under control. Good luck in a late stage of decline for the Western/American empire.

In theory, the sudden push for more nuclear by Big Tech should help. But never underestimate the ability of petty leftist bureaucrats to screw things up.

Uranium is also in theory a way to play it. But a stockpile of uranium in a fund is not very attractive to me (no cash flow, holding costs).

And uranium miners are either horribly overvalued or in terrible jurisdiction at the crossfire of Eurasian tensions AND strategic assets (Kazakhstan).

And anyway, if no new nuclear power out of China/Russia, not so big a demand for uranium.

Hybrid Vehicles

Now, there is a way to have vehicles that have today’s high range, but also the efficiency of EVs on most of the travel done by someone in his daily commute of going to work, kids to school, etc.

These are hybrid vehicles, especially plug-in hybrids, which are essentially a normal car + an EV with a very small battery all-in-one.

The small battery means it does not bump up the car price much. But it is enough to cover 50-90% of total mileage on electricity, depending on the user.

A leader of the segment is Toyota, which is also getting ready to finally enter the fray with EVs, but taking its time, having correctly identified that the near future is dominated by hybrids, not EVs, not fossil fuels, to the displeasure of both the green and grey teams.

However, there is another way to play this upcoming energy crisis that is mostly focused on the EVs vs hydrids story, and even has a little bit of a uranium story on the side.

And that will be the topic of the November report.