Trump 2.0

Trade Wars It Is

As markets were rocked by Trump's assault on the entire world with tariffs, I wondered how to discuss it. This was following a hiatus due to sickness and a general doubt about where to take this publication.

Moving forward, while there will still be stock reports, a focus on accurate macro prediction will take over, as this will be the determining factor in any profit in markets, or even mere survival.

Instead of discussing the petty details of the tariffs, I wanted to try to take the long view and do a few things:

Understand the underlying logic of the tariffs to correctly predict their future direction.

To assess the shape international trade is taking.

To judge if this is an ominous sign of more breakdown of the international order.

Why Tariffing Everyone?

After April 2025, it will appear that the US international trade strategy can be resumed in a simple meme:

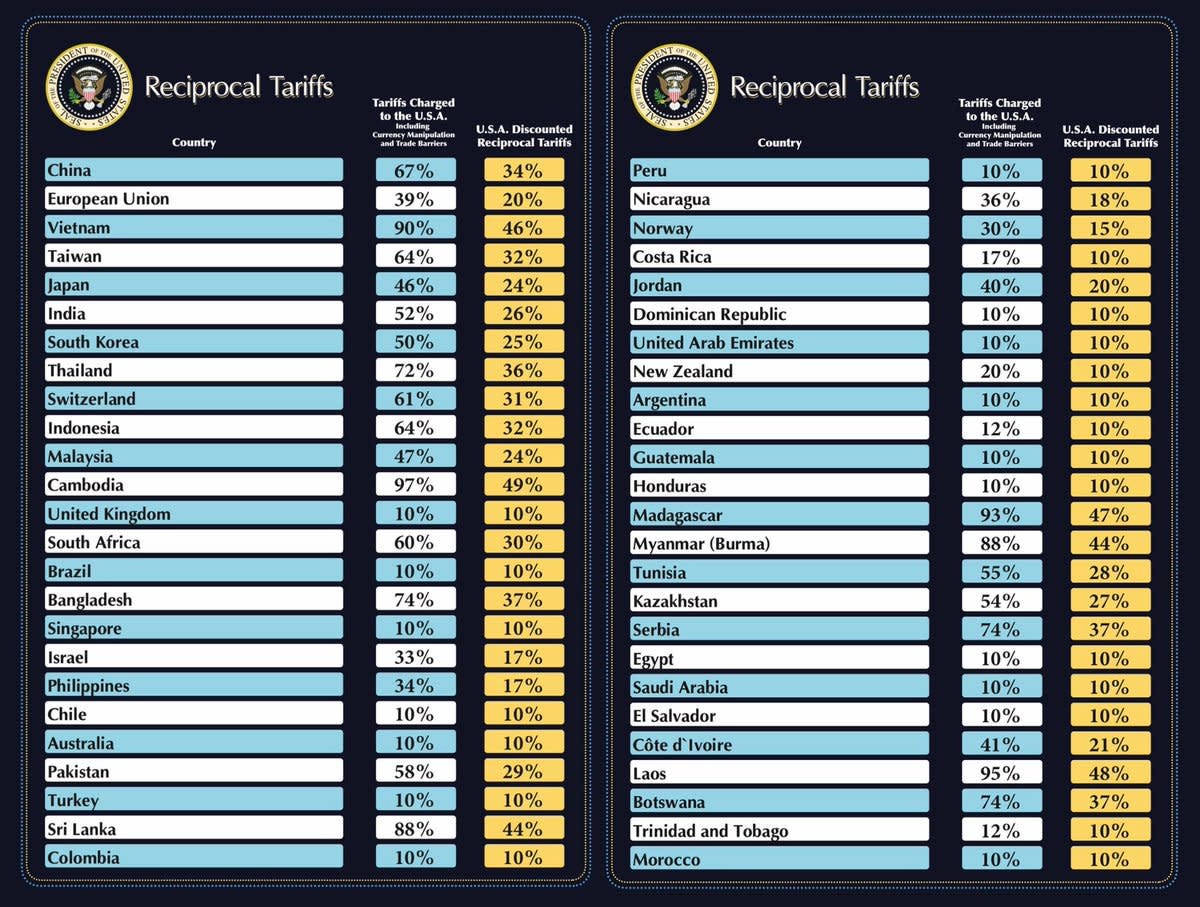

The longer answer is that every country got hit by a minimum 10% tariff, and others with varying tariff burdens, which were claimed by the US administration to be in response to unfair tariffs and trade imposed on US goods.

In practice, it became clear very quickly that local tariffs had little to do with it, and that a very simplistic mathematical formula was applied not to reciprocal tariffs, but to trade balance as a whole.

This is why close and obedient allies like Japan and Taiwan got hit with tariffs in the 30% range, and why Vietnam, a country that has actively courted the US and rejected China was hit by almost 50% tariffs.

Behind this logic is the often-repeated motto that “other countries have taken advantage of the US, and it is stopping now”.

The (own?) Goal?

The first thing is to understand what the goal is here.

If the goal is to get a perfect trade balance or trade surplus with every individual country on Earth, this is going to be quite difficult or even impossible.

In addition, punishing fiercely close allies like Taiwan, Vietnam, and Japan might be antithetical to other more important US goals than trade balance, like containing China, keeping control over the global semiconductor industry, managing to rebuild the US Navy (virtually every ship on Earth is built in China, Korea and Japan), not lagging in drone tech and automation, etc.

The end result would more likely be a USSR-style autarchic economy, as potential partners run away and escalatory tariffs break down the US empire at full speed.

A second possibility is that, in true Trump fashion, the goal is to strong-arm other countries into coming to beg for relief. This seems to be the more likely goal, with more factories relocated to the US, IP transfer, purchase of US weapons, etc. the likely goal.

This interpretation seems to be corroborated by rumors of what the US is asking for lifting the tariffs, essentially “buy our stuff or else”.

For countries like Vietnam, deeply integrated with Chinese supply chain, this might however not be enough. They tried to give complete surrender, eliminate ALL tariffs to the US, and got rebuffed.

If that is the case, they will have no choice but to turn to China for help. Doubtful this is a good strategy for any long-term goal to push all SE-Asia into China’s arms.

The EU too seems to be dealing with more and more demands, even if they initially were ready to cave in. What's the point in negotiating then?

Fighting Back?

Another problem is that some countries are just not going to submit so easily.

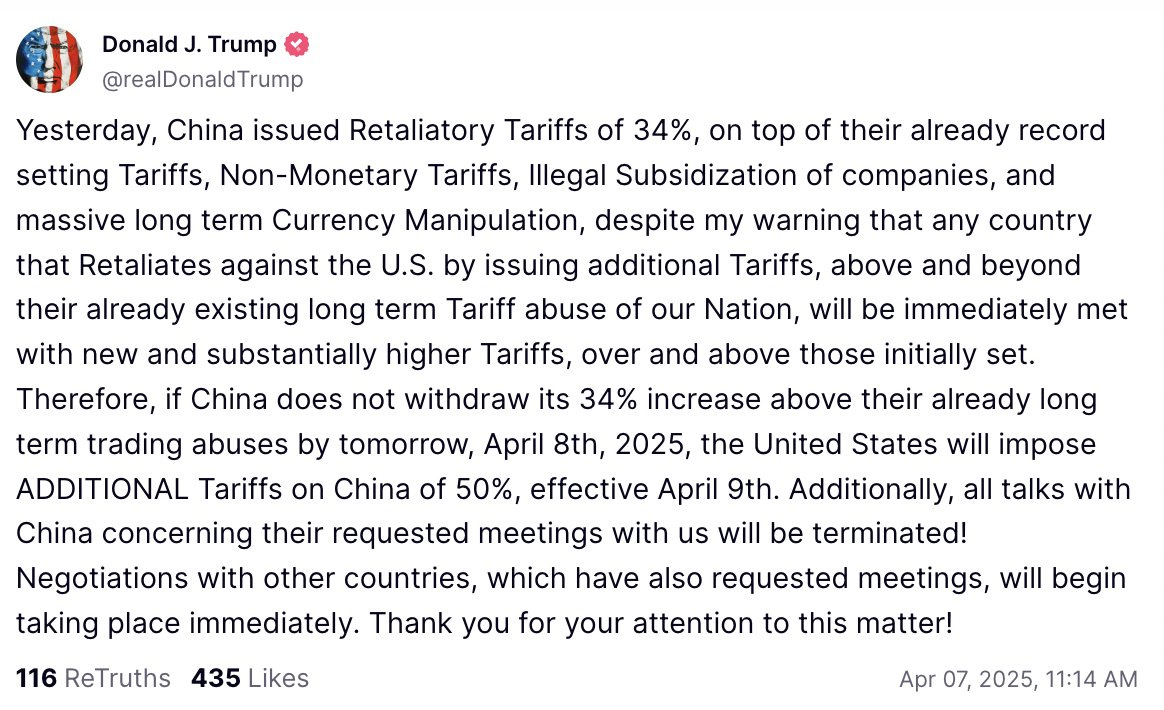

China here is the leader in pushing back against a unilateral push by the US against all. It immediately replied with its own set of retaliatory tariffs at 34%.

China also sold another $50 billion in Treasuries, potentially the reason why even in a market crash, treasury yield (and therefore US debt costs) went UP, although other institutions’ de-risking was likely also to blame.

It also added a few companies and individuals to a sanction list, and put a limit on the export of all the last non-restricted rare earths.

Predictably, Trump is going nuclear in response, pushing the tariffs on China above 100%!

As I am sure all my readers are aware, financial markets did not really enjoy watching the 2 largest countries in the world completely breaking down the international supply chain…

Predicting Trump

I am rather surprised not by the tariffs, but by the way they were announced and handled.

First, it was simply amateurish and not really well put to just crudely apply a mathematical formula instead of a more case-by-case approach. Reforming the international trade system would require a bit more subtlety than the “break things first” approach of DOGE.

It is clear that the method chosen is basically a global shock therapy applied to any trade with the USA. Basically, going so quickly, so hard, that the “patient” has no time to adapt and must radically change direction.

This might work for politically controlled vassals, but most likely the larger or less US-dependent countries will just prefer to walk away from trade with the USA entirely.

Contrary to such a situation, if it had occurred in the 1970-2000s, there are credible alternatives like China for goods and technologies, even cars and chips, and Russia for food, energy, weapons, and materials.

Still, the US establishment in general and Trump in particular, seems to be religiously bound to American exceptionalism. So they will take any defiance as a quasi-war declaration.

So I expect Trump to just double down, and triple down, all the way to going to the deep end of this policy. Also, the more it will be dug in, the less he will be able to change course without “having been defeated”, an unacceptable proposition for domestic political reasons.

So for my free subscribers, you can have at least this prediction. This is not a drill, not a temporary aberration, and this will likely be the determining decision shaping the next 4 years. At least if a war with Iran and the subsequent WW3 is avoided, which is another topic…

Others see it this way too:

Predicting Economic Impacts

If I have so far been critical of the tariffs, it is not to say that they are necessarily a bad policy. Some tariffs can help reindustrialize the USA, and are likely to be necessary. The baseline 10% on all imports is likely even a good idea in my opinion.

The 25% targeted tariffs on steel, aluminum, and automotive are likely also not too bad, even if a progressive rise of the tariffs from a lower level would have been better.

But the serious issues are the intensity of the tariffs, the total absence of consideration for damage they cause to important diplomatic relations, and the lack of coordination or even warning to the very same industries that are supposed to be helped by this policy.

Because there is going to be a lot of damage, both short-term and long-term, something that the MAGA supporters seem to be oblivious to.

Effects on Manufacturing

Killing The Factories To Save Them?

The very first issue is the disruption of the existing supply chain. Let’s say you are a producer of cars, jet engines, or toasters. You likely have to compete locally with other producers, and globally with imports.

If you managed to survive the past 4 decades, you have somehow handled the Japanese industry and the cheap goods from China. But you likely import machines, raw materials or parts from some of the tariffed countries.

If you are unlucky enough, it is not from the 20% EU or 25% Mexico/Canada, but from 50% Vietnam or 100% China (I am rounding the numbers).

The immediate consequence is that you are likely now bound to many contracts requiring you to sell below your production cost. Selling dollars for 90c is not a good business. Good luck renegociating with Boeing or Walmart…

The second-order effect is that because your input costs have risen, you are likely even less competitive in export markets. So you stop all exports, maybe fire a few thousand workers, close a factory, and lose economies of scale.

A third order effect is that at the end of the year, when writing your business plan, you cancel all expansion plans. Calculating the future profitability of long-term investment is nearly impossible if you cannot know if you will even have inputs in the first place, and at what price you find them.

Overall, this will ONLY benefit completely vertically integrated producers, and even then, only the ones with no now risky exposure to export markets.

For example, an LNG exporter that sold previously to the EU or China might in May face business-killing tariffs. Or maybe not. Who knows? Certainly not the White House.

Meanwhile, most MAGA public figures and supporters are ready to call any company doing any imports a traitor. Which virtually means EVERY manufacturer still left in the country.

Overall, yes, tariffs would help companies produce more locally.

But a sudden supply shock will close factories instead. More warning, and progressively rising tariffs would instead be a viable solution.

Directly Killing Small Businesses