Turning To Macro

In my previous article, I explained in September how I am convinced that we are heading for a WW3-type of conflict engulfing all of Eastern Europe and the Middle East, in what is apparently 2 separate conflicts: Europe vs Russia & Israel/USA vs Iran, but run as a joint effort to asphyxiate supplies to China ahead of a confrontation between the West vs China.

I can say that the first two weeks of 2026 certainly vindicated this view.

You can add Venezuela to the list of those “not authorized to sell oil to China”. Whether the US manages to produce anything more, or Venezuela turns into another Libya is an open question for now.

Then there is the Greenland plotline, which is a total deception. Truth is, the USA can already keep all Russian or Chinese influence out of Greenland at will, as well as build all the military equipment it needs.

But what this does is that either Greenland ends up American or not, it gives a good excuse for the breakup of NATO, or the US withdrawing from it.

Once this is done, an active war between Russia and Europe does not directly involve the USA, limiting the risk of nuclear escalation. This matches what I predicted in September.

Now that the stage is set for Europeans and Ukraine to be “unreasonable” and “secretly plot against the marvelous peace plans from Trump”, the USA can disengage while pretending to have done all it could, and focus on the Middle East.

And military spending is exploding ahead of the real fireworks.

But this article will not further elaborate on this topic, because the die is already cast on this subject as far as I am concerned.

It also means that I have been a little paralyzed in terms of decision-making and how to iterate from here.

I finally decided to reorient a course of action and this publication toward a more macro focus, as this will likely be a decade of macro-driven events, together with some ery narrow stock picking.

I have also suspended all my subscriptions and will switch to a fully free model, hopefully helping increase reach.

This will also assume that my readers are somewhat locked in the West, personally and financially, and will sooner or later lose access to some or most international markets.

If not, I would recommend putting some of your money in overseas accounts in places like Singapore or Hong Kong, or even Panaman or Dubai.

But if you are stuck with me in the West (for personal or professional reasons), let’s work through it.

The Big Picture

So the fact is that we are heading for a big industrial military conflict, one that we will likely lose. This simple fact orients a lot of investment decisions.

The first one is a list of what CANNOT be invested in, which unfortunately covers a lot of what would otherwise make sense for a defensive investment portfolio.

In addition to this list is driven by two phenomena: either these companies’ assets will be a prime military target, or they will be strategically important enough to warrant state control, price control, suspended dividend nationalization, etc.

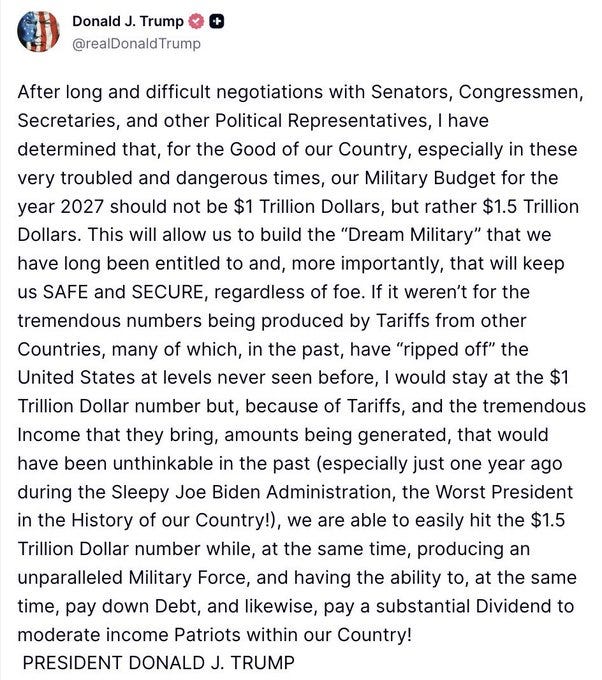

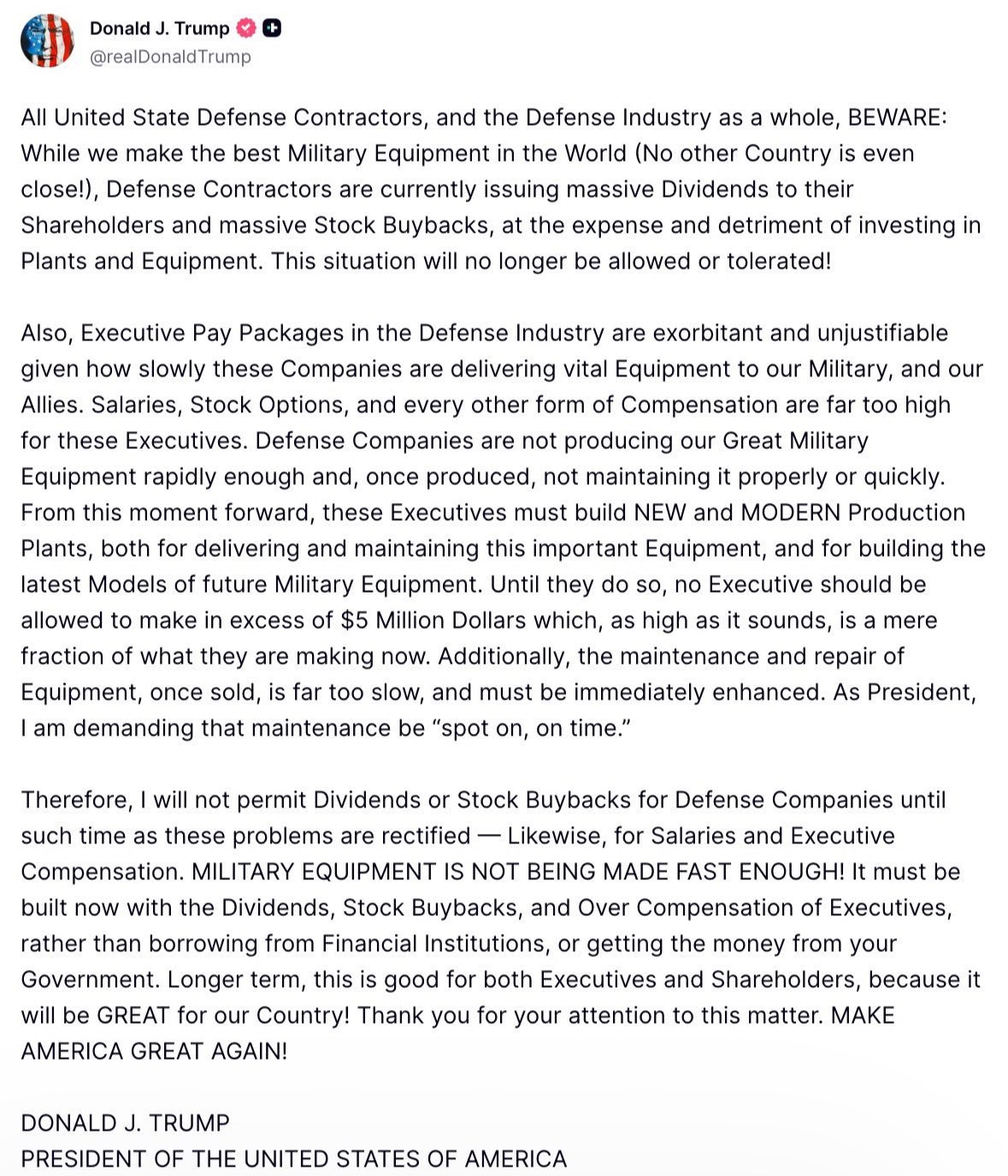

This is already happening to the US defense industry, more sectors to come: “MILITARY EQUIPMENT IS NOT BEING MADE FAST ENOUGH!”

It should also be noted that the current political trends make nationalization and Mussolini-style policies a lot more likely than Roosvelt-type military industrial policies.

Even if you keep the ownership of these assets, good luck keeping any of the profit if you are not VERY politically connected, see Trump’s post above for confirmation of this trend.

The provisional list, certainly to be extended over time, includes:

European Infrastructures / Utilities: just look at the Ukrainian power grid.

US and Western chemical companies, whose products are just too critical to military production to not be either nationalized, bombed, or sabotaged.

Miners of strategic and precious metals and other resources.

Weapons manufacturers (that was the play 3 years ago, only adjacents to the topic can benefit, see below).

Key strategic supply chain: semiconductors, aerospace parts, drone manufacturers, explosive production, etc.

This leaves a select few options, which correlate highly with who made bank during WW2. It will be a mix of niche sectors, surprising winners, and overseas neutral parties happy to sell to the belligerents at a hefty profit.

For this article, I will give an overview and name-drop what seem superficially potential good picks. In the upcoming months, I will go through individual companies and elaborate further.

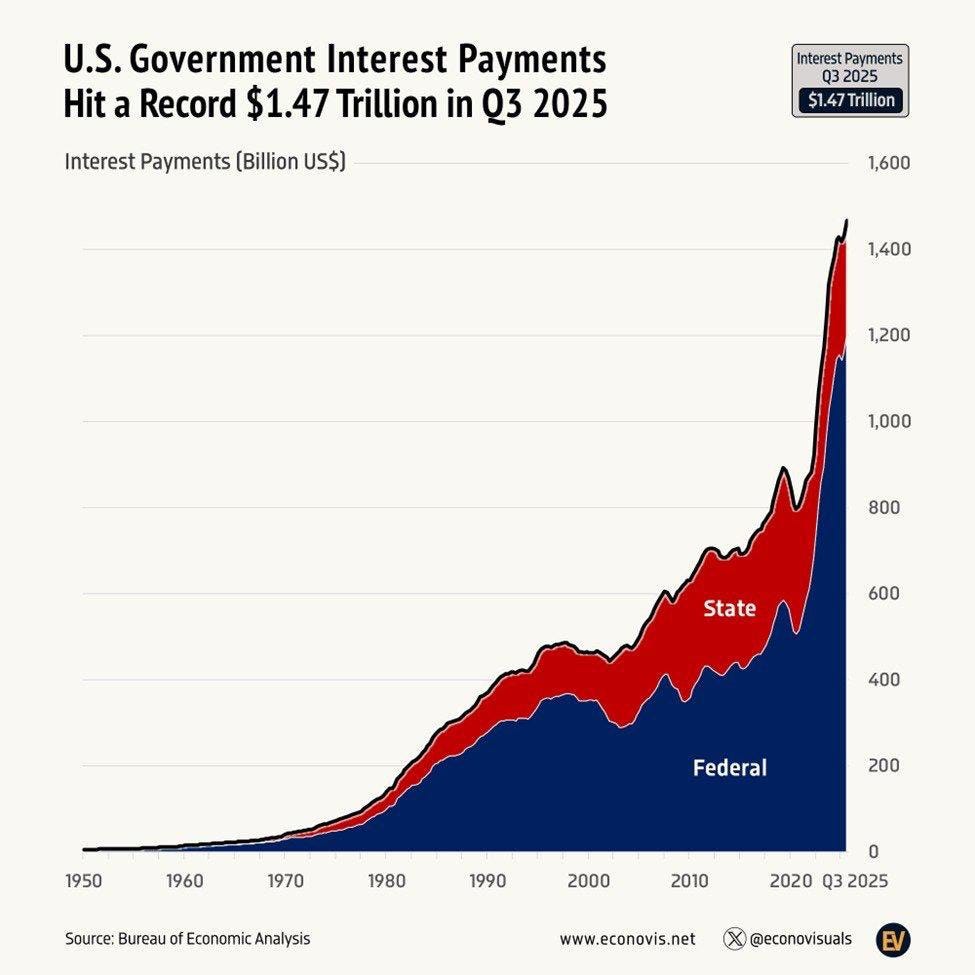

Another structural trend will be currency debasement. When a country goes to war, fiscal responsibility, independence of the central bank, and other such luxuries go out of the window.

And there might be signs, like trying to indict the Federal Reserve leader for rising rates, which is likely the first time in a decade the Fed did the right move…

Lost wars break currencies of the losing countries and sometimes even the winning one as well, as it happened to the Deutschmark , Franc, and Pound in WW1, to the Deutschmark again in WW2, and it will do it to the Euro, Yen, and USD in WW3.

So hard assets and no leverage are to be preferred: commodities, real estate, land, forest, metal, productive machines with low operating costs / low fixed costs.

Another structural trend is that the best protection and investment will grow progressively more illiquid.

If you were an investor in Imperial Japan or 1944 Germany, your priority as the conflict progress is not immediate cash return or liquidity, but capital preservation while everyone else around you lost their shirt.

THEN, you can buy discounted assets on the penny the moment gunfire stops.

Beneficial Sectors

Food & Farming

The first group that benefited, which I know from the direct testimony of my grandparents in France during 1939-1945, was farmers.

When price controls and black markets thrive, while currency devalues, the urban population gets broke buying potatoes t o add to their rationing.

However, this is not a solid option as a direct investment, as any such profit could never be legally recognized in a balance sheet and reach shareholders of agri companies.

Still, farmland, whose leasing price to farmers will be boosted by the black market profits, might directly benefit.

Farmland REITs are an easy way to get in, but I suspect anyone with institutional money would be better off looking at private investment in a land trust, directly buying large lots, etc.

Expect extreme illiquidity of the asset, but strong cashflows.

Overseas farming corporations, like CRESUD (ADR ticker is CRESY), or BrasilAgro (AGRO3.SA) could also benefit (the stocks yield a >5% and 3.7% f dividend yield respectively, for that matter).

This is because we can expect massive stockpiling ahead of time from countries like China and India, but also because if Ukraine and Russian grain & oil harvests or exports are disrupted (de facto cutting production), places like Egypt and Jordan will be desperate for alternative supply.

Large farming oversea corporation will likely also be a key supplier to soldiers themselves.

Oil

Since WW1, wars run on energy, be it coal or oil. One day, it might be lithium and hydrogen, but electrification has yet to seriously hit military equipment.

So stable, safe, not-exploding-in-a-conflict-zone source of oils will be extra valuable.

This might however be the swan song of the oil sector, as serious dent in demand will come from electrification, as solid-state batteries and sodium are now clearly a mature enough technology to several impact demand from transportation, not just from cars, but trucks as well.

So this is a trade, but not a sector to stay for the long run. Weak prices in the run up to the conflict and low economic activity in the real good sector also make it something to time precisely.

For several years, I advocated for South American oil for this very reason. However, the erratic last few days in Venezuela can make for some adjustments. How destabilizing or gushing oil the country will be could determine a lot of the future of the oil market and the attractiveness of the neighboring producers.

Here too, a detailed analysis of individual companies will be needed to correctly assess the situation.

Temporarily, I would focus on Petrobras, as Brazil is a country largely stable, further from Venezuela than Colombia, but less of a basket case than Argentina. However, I think there might be better plays on the continent as well … to be investigated.

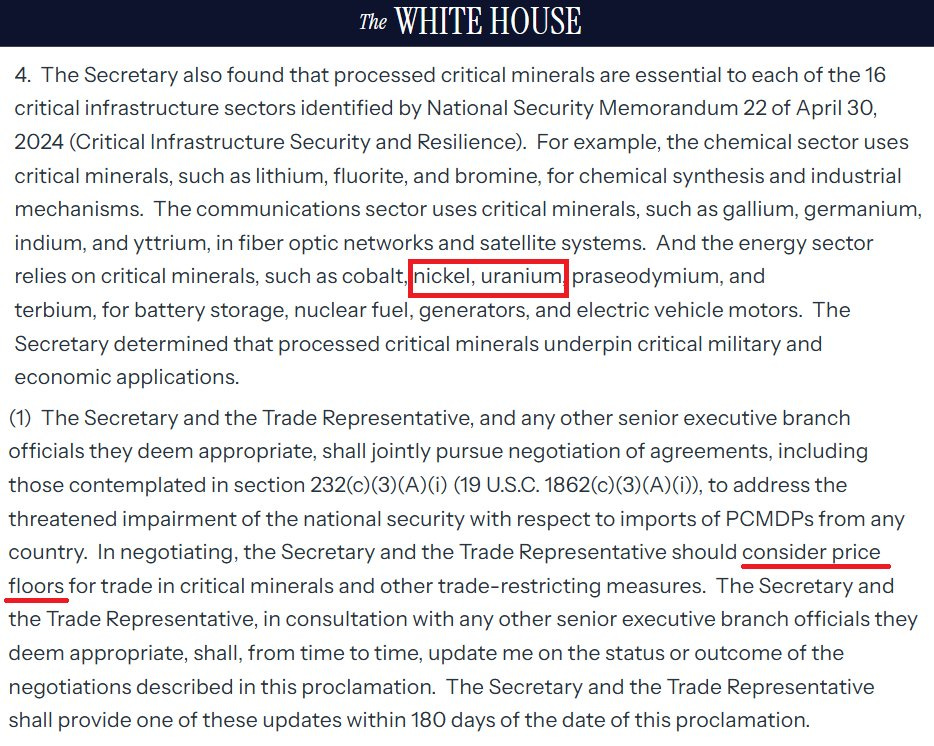

Uranium

Uranium is the commodity that boomed and that I completely missed out on (seemingly) misplaced skepticism. Of course, as ALL commodities are booming, and I did well on others, I can hardly feel sorry about it.

Still, as a disclaimer, keep in mind that this is maybe not the sector where my track record is something I can brag about.

I always felt that the narrative of an uranium shortage, thanks to build up of new power plants and SMRs, was overblown, as they will take another 5-10 years before even starting to consume uranium.

However, if Russian supply, together with Kazakh supply, disappear overnight, markets are undersupplied to feed the CURRENT fleet of nuclear reactors. Combined with the desperate need for more power for data centers and restarted heavy industry, and you get a bid for yellow cake at almost any price from nuclear utilities as long as they keep the lights on.

The obvious company here is Cameco, not any junior, as the uranium need is NOW, not in 5 years when maybe a mine opens. However, a stock chart that looks like that and a P/E of 127 makes me think this has already mostly run its course.

Trading it is maybe possible, as a start of the war with Russia and interruption of supply could send it further in the stratosphere, out of pure reflectivity.

But it is likely to fall quickly after, as “buy the rumor, sell the news” might apply here, with news of an uranium embargo being the crash and not the last boost to the stock.

But of course, if the US start to guarantee a minimum price…

US Utilities & Chemicals

As I said, European chemical and utilities companies are off limits, with maybe some exceptions to be discussed another time (e.g., nuclear utilities in central & West Europe).

US utilities might be in a different position, as it would be extraordinarily difficult for Russia or China to inflict significant damage to the US power grid or water stations, while flying a few thousand Geran drones per month in Europe will be trivial.

As the USA will mostly be officially fighting only Iran, this will also be less likely to happen.

However, some level of sabotage & such shenanigans are to be expected. So overall, I would focus on the companies with the larger asset bases, and the less likely to go boom.

Less dependence on natural gas as a cheap feedstock, which will be required by other industries to forge steel and produce explosives, will be best.

If the power price goes up a lot, a bunch of dams and solar farms will do fine. But if sabotage becomes a thing, a company producing ammonia or TNT may not be so safe.

So the best would be utilities with a strong presence in nuclear, hydro, and solar, and chemical companies with low dependency on natural gas.

(Monitoring the risks of incoming price control will the highest priority for that investment idea)

Military Services Providers

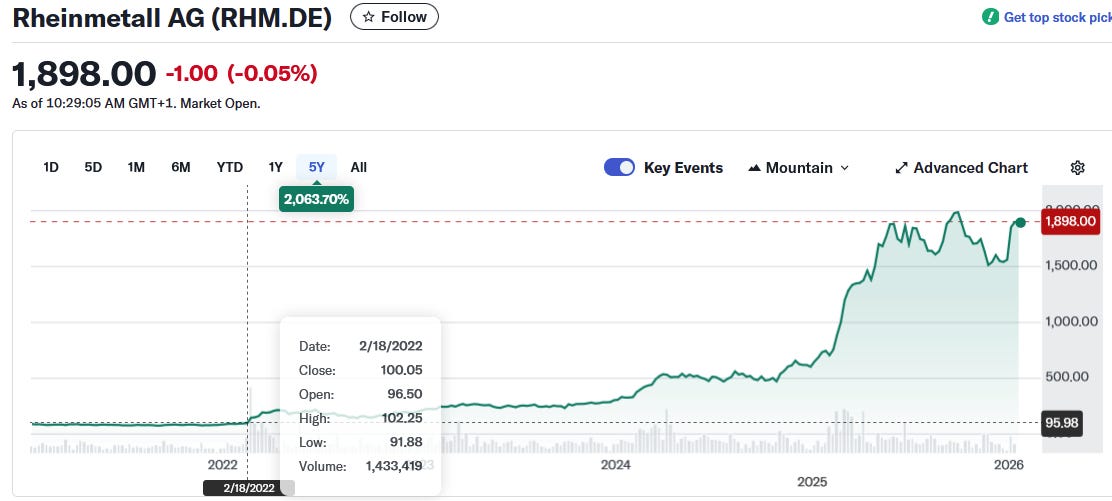

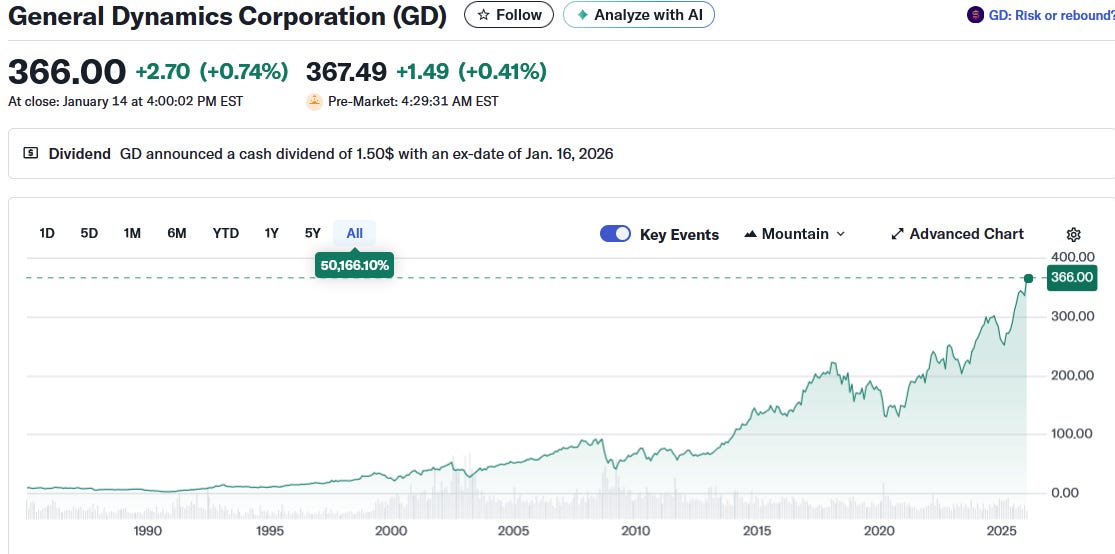

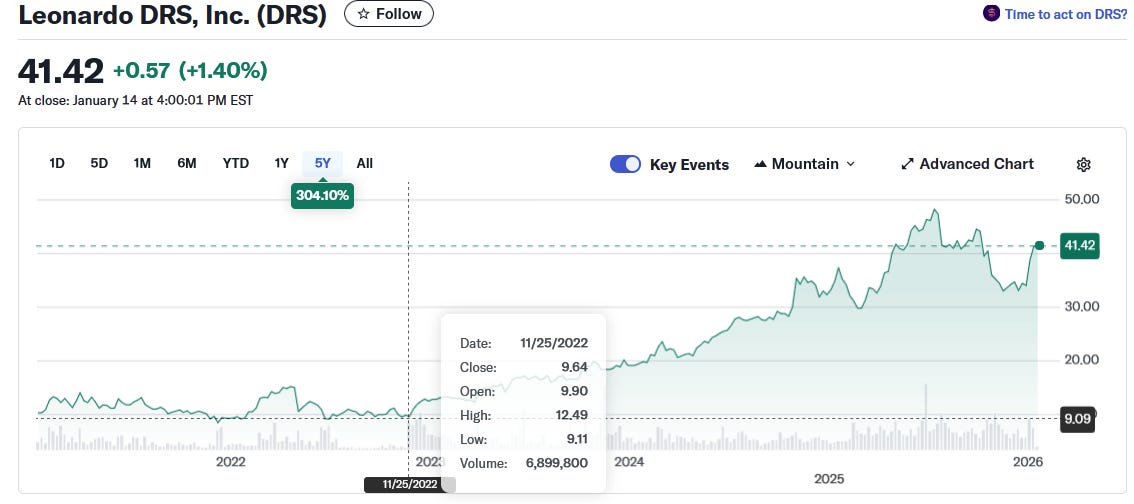

As I said, directly investing in weapons manufacturers is a trade that is 4-years too late, just a glance at some chart is a good indication, together with Trump's ban on dividends and share repurchases.

Anybody who has followed my recommendation in buying Leonardo, GD, and HII the past 1-2 years in that field must have done well (although I missed Rheinmetall), but it is time to not overstay our welcome.

However, another category could be the military service providers. I am not talking of the provider of parts and directly linked to the supply chain of the main defense contractors, as these will be squeezed out of profit as well.

But companies that can provide satellite telecommunications, cyberdefense, transport, logistics, etc, WHILE not being defense-centric, therefore not worth coercing in giving up on profit, could be a major beneficiary.

Think of it as in WW2, avoiding military shipyards, but profiting from juicy military contracts to sell canned soup for the troops, fabric & ropes for parachutes, or building radio transistors.

Potentially, this sector is the deepest, most diverse pool of war-proof investments.

Precious Metals

Lastly, especially with the craziness regarding silver price the past few weeks, I could hardly not mention the timeless protection against manmade chaos: gold & silver.

In a time of weaponization of the USD, unlimited military budget, and resource shortage, going out of fiat makes a lot of sense.

Silver

Regarding silver, it is a speculative but potentially highly lucrative trade to be done here.

The key is that silver is structurally in shortage, and being consumed by industries like electronics and solar panels, leading to much less silver to go around than gold.

This is a commodity that has a recorded tendency for speculative moves and vertical rise and fall.

It should also be noted that only physical silver should be considered, as the whole point is the potential explosion of the paper silver market, now that China is actively repricing the physical silver according to PHYSICAL supply, and not financial speculation.

Same physical that the US Mint repriced over the weekend from <$100 to $169.

The key ratios to follow for me, and deciding when to sell your silver, are:

The silver-to-gold ratio, which will signal it is time to move from silver to gold

Anything below 25 is a warning sign, and 1:15 is likely when you should sell urgently. The ratio could briefly brush the 1:5 or even 1:3 (it happened briefly historically), but we would be in extremely overpriced territory then.

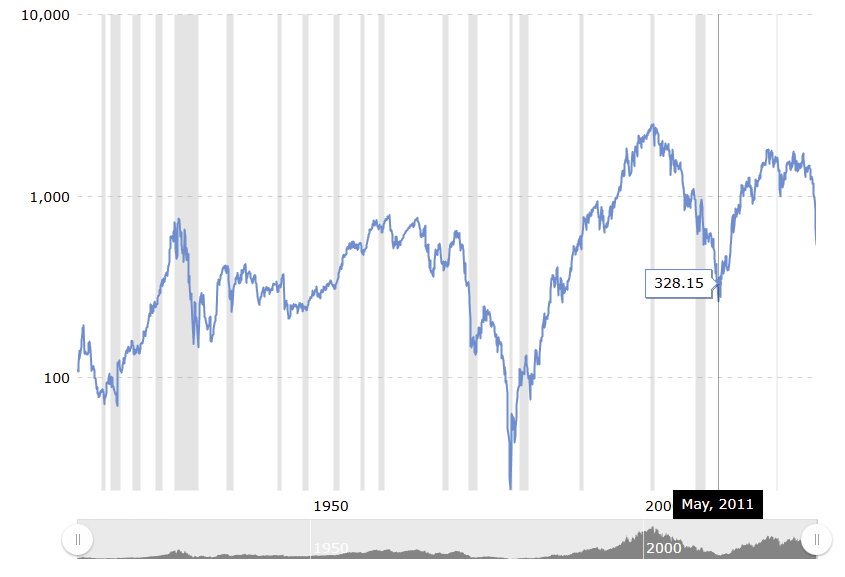

The Silver to Dow ratio, which always craters in periods of silver overvaluation or crashes when stocks are reaching a bottom: 1929 Great Depression onset, 1980 Hunt Brothers price manipulation, or 2011-end of commodity boom.

It has certainly started to fall, but we are far from 2011 levels, despite much more dramatic silver shortages. I think going from the current 670 to 200-150 levels would make sense if the current speculative pattern holds.

Falling to the 50-25 level of the Hunt Brothers era is possible, but it will require serious commitment from Chinese buyers.

(On a side note, did you know that the final blow to China’s economy in the 1930s was delivered by the US Silver Purchase Act of 1934, throwing China into the Great Depression.

I will elaborate later, but it would be very much in the CCP style to pick silver for this exact reason in order to wreck US financial institutions and the USD a century later.

Gold

Gold in your hands is basically cash out of reach of central banks.

In this sense, it is not so much an investment as it is “dry powder” waiting for a better opportunity.

After a period of analysis paralysis, I am starting to see patterns emerge that make some sectors still investable.

However, it is entirely possible that gold, anyway, ends up performing as well or better, without the headache. There have been entire decades where this was true, like the 1970s, or for localized regions, the losing countries in WW2.

The key will be to convert gold into productive assets in due time, probably right after guns stop shooting, or even a year or two after, with the subsequent crash in economic activity when the war economy stops and a recession ensues, crashing profits and valuation multiples further.

Conclusion

We are going to face a very narrow and progressively shrinking investment landscape in the next few years, as we are sliding at an accelerating pace into a global war, and lileky not winning it.

This is not to say that NOTHING is investible, just that an extreme level of caution is required, as well as a clear head.

Flexibility and the ability to navigate the changing circumstances and change our minds or admit mistakes will be required.

Lastly, a hold onto our own greed is also required. This is the type of era where some fortunes are made, but many more are lost.

A Great Reset of sorts, if you wish.

In that game, staying head above water is winning, as most will be drowning…