Disclaimer: I own, through a company I control, 10000 shares of MML and intend to likely increase this position in the future. This article is for educational purposes only, please do your own diligence, as this does not constitute investment advice. Full disclaimer can be found HERE.

This article is part 3/3. Here are the links to Part 1 and Part 2.

If you are reading this, this likely means you have read about MML's situation and still consider it a quality investment idea. Jurisdiction is really the weak point of the company, but the rest are either quite good or at least okay.

But what really caught my attention about MML is its financials. I have been teasing and talking about it long enough, now let's dive into it.

The latest news

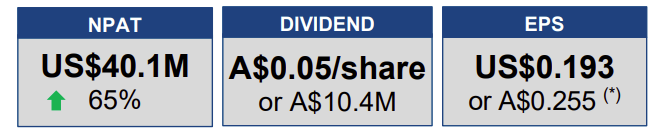

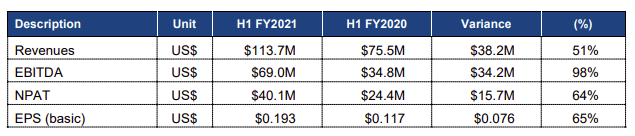

I will start simply with the H1 Y2021 highlight

On April 4th 2021, the share was trading at 0.84 $AUD for a market capitalization of 174 million Australian dollars. This means that in the first half of the fiscal year, only 6 months, the company has generated a net profit after tax (NPAT) of 40 million $AUD. Or no less than 22% of the whole market cap.

The company also finally started in this spring of 2021 to distribute a dividend of 0.05 AUD, giving a yield of 6.29%, which in itself makes it a lot more attractive. Previously it was just sitting on its cash and I was starting to wonder if they ever intended to do anything with it. Despite the high yield, such dividends represent only a quarter of the earnings, leaving plenty for further increase in dividends or acquisition and development of new mines as well.

MML has been consistently doing that for a while now. For some reason, this has not yet transferred into the share price, which is going sideways (flat) for the last 2 years. And in that can be the opportunity for an investor ready to take the risk, as the company is very cheap regarding its earnings. I will discuss later the possible reasons for the stock to have been ignored by markets so far.

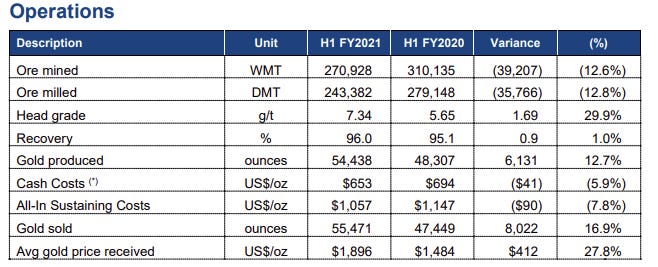

But despite a good profit, does the operation have any issues or looming problems? Not at all. Less ore got mined, but the grade was much higher, allowing for 13%, or 6,000 ounces more of gold to be produced compared to the same period last year.

The AISC has also decreased by almost 10% and should for sure stay in the US$1200 range by the end of 2021.

And of course, the average price of gold sold was better due to the much higher price of gold lately, as it was "only" US$1484 in H1 FY2020.

A skeleton in the closet?

Another way the company could have engineered good earnings was by reducing too much capex. Did they do that? Not at all, they spent US$4.4 million in H1 2021 compared to US$3.2 million in H1 2020. Or did they give up on exploration to generate more cash? Neither, with US$5.6 million spent on it in 2020.

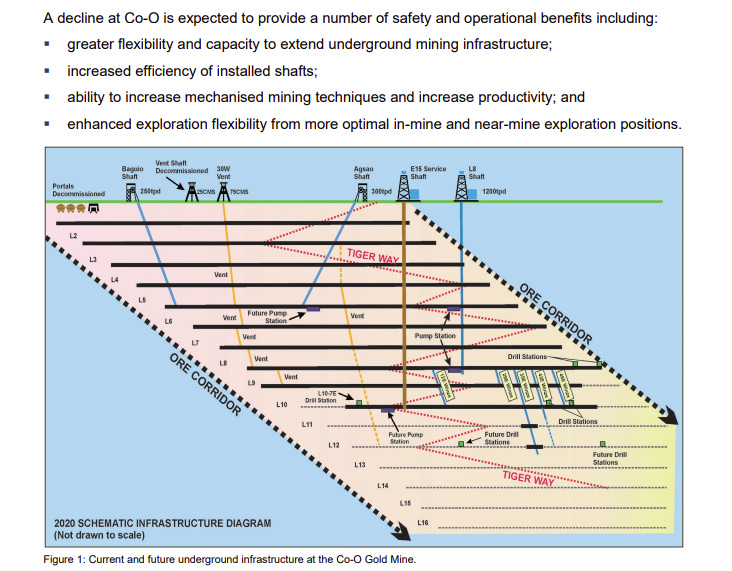

In fact, they are planning to spread over the next 3 years US$54 million to build a decline access to further reduce operating costs and extend the mine's lifespan. The plan just got approved on 16th of April, you can see the full data HERE. The decline is basically a long underground slope to better access the deeper level of the mine. It will expand the mine, from its existing 10 levels, with an extra 4 levels.

So this profit is "real", and not coming from cutting corners and risking the future operations of the company. With the company earning now 22% of its market cap in 6 months, it just needs to stay on course for another 27 months to earn its entire market cap. Let's be conservative. Even with earnings divided by 2 tomorrow and not recovering ever, it would need only 54 months, or 4.5 years to cover its entire market cap.

But remember the previous part about reserves, the mine is now expected to operate at the current rhythm for the next 16 years. So you basically would get, in a pessimistic scenario, 2/3 of the mine life for free. And maybe more if any of the inferred reserves prove true.

Naturally, when discovering such astounding metrics, I got more skeptical. That is when I took a dive into the balance sheet and the annual report. I was mostly looking for crushing debts or large liabilities like for example ongoing litigation.

What I found was instead almost no debt and tons of cash growing quickly.

The (really clean) balance sheet

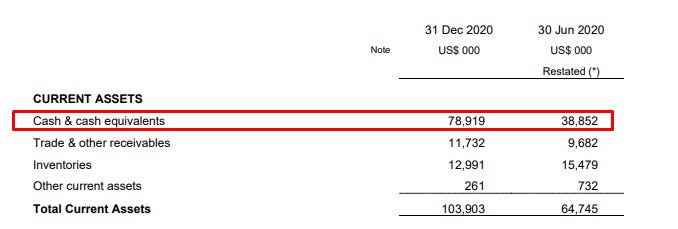

Let's start with that famous cash. The company was actually sitting on US$78 million of cash at the end of 2020. With earnings still strong and gold prices in the $1700 range, this is only getting better by the day.

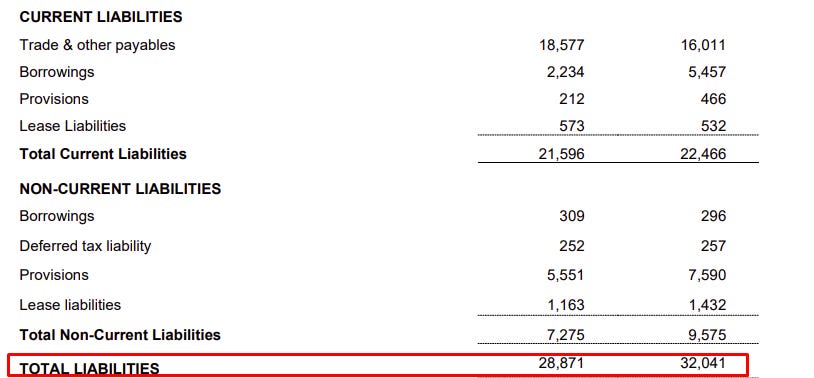

In comparison, the entirety of liabilities is only US$28 million.

In practice, the amounts in current liabilities, US$21 million, are compensated by the amounts in the non-cash current assets of US%25 million, representing the normal operation of the company. Basically, gold not melted or sold yet, spare parts for machinery etc... versus bills due soon, salaries to pay soon, etc...

So the cash should only be compared to the non-current liabilities, which stand at the ridiculously low level of US$7.2 million.

So the real net cash position of the company is US$70 million. At the risk of being obnoxious, I must remind you the market cap is only US$120 millions. This means that once the cash balance is taken into account, the entire company is priced at only 126-70=US$56 million.

That US$56 million "real" valuation is for a company that made US$40 million in earnings just in H1 2021. If you ever needed a demonstration of the falsehood of the efficient market theory, here it is. If MML manages to simply repeat in the second semester H2 what it did in the first half of the year, its entire cash balance might get close to its whole market cap. But somehow, the "efficient" market is completely missing it.

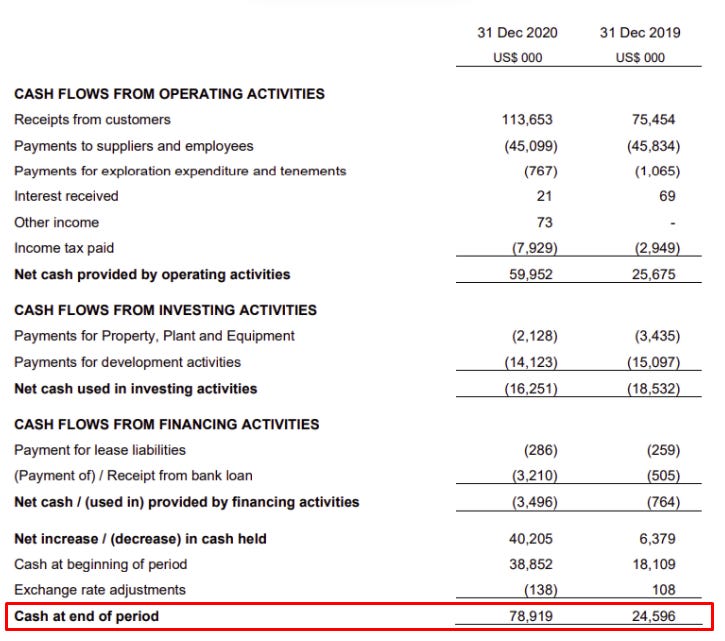

At this point in its life, MML has become a cash machine (US$40 million per year), being finally rid of all its long debts and having only moderate capex ahead.

Its only large project ahead for the next few years, the building of decline for the deepest level of the mine, will only cost US$18 million per year. So it should leave the company with a comfortable 40-18= US$22 million of extra cash every year for the years ahead if only the gold price stays stable. So even with those large investments taken into account, the whole company will have more cash than its current market cap in 1-3 years (as long as gold prices stay stable).

Personal conclusion

I could go into deeper details about all the financials of MML, but the rest is pretty straightforward. No royalty agreements, no other liabilities, no large investments needed. Of course, I invite you to give it a check yourself before you take any decision regarding MML.

Frankly, the combination of these qualities was enough to convince me:

very low market cap

high earning

high cash flow

large enough ore reserves

longenough mine lifespan

very high quality balance sheet rich in cash

I am personally bullish on gold prices for the long term. I think that now that governments have discovered they can print unlimited amounts with no consequences, they will never stop. For that matter, people will most likely vote (or riot) out of office any politicians that will consider closing the money tap and stop sending stimulus checks. All of this is a reason in itself to have a position on gold.

But with MML, none of this needs to happen. We just need a small portion of investors and central banks to worry about it for gold prices to stay in the $1500-$1700 range. If gold prices does shoot up, MML will be even better.

But the company is now so cheap, that I just need gold prices to not completely collapse for the company to have more cash than its market cap in 18-24 months (or maybe more considering the cost of the Tiger way and dividends distribution). And in the meanwhile, I will just collect a nice 6% dividend.

I personally intend to keep buying MML occasionally whenever the stock is a little bit down from the 0.8-0.9 AUD range. The company is small, and not fit for large investors needing high enough liquidity to enter and exit their position. But for an individual investor like me, willing to sit on the shares and watch the company for the next 10-20 years, simply collecting dividends and enjoying share repurchase or expansion, this is fine.

The possible scenarii of the company

The way I see it, MML is likely to be a nice cash cow or a growth stock for the decade to come.

One possibility is that the management fails to find new deposits and projects overseas and just develops the Bananghilig mine, adding another 4-5 years of operation to the company. This would mean MML is likely to keep giving a dividend yield of 6-10% for the next 20 years, and I would be fine with that. If this is the case, I expect the valuation to stay somewhat subdued, and multiple to grow from a 3.5P/E to a maybe 7. So the stock could double over some undetermined period and I can collect the dividends in the meanwhile.

The other possibility is that MML manages to find new projects in which to expand and turns itself from a minor and visibly ignored gold miner to a larger company attracting more attention.

The second option would be my favorite outcome, even if it carries the risk that the new project is not as good as the Co-O mine. On one side, this gives the management a project on which to apply their expertise and keep producing a return on capital on behalf of the shareholders.

On top of that, a larger, expanding company is more likely to catch the attention of more analysts. And a larger company would have a more liquid stock and larger capitalization, making it "investable" by larger funds and family offices. I do not think it will ever command the multiple of the gold miner giants like Newmont (at an almost 18 P/E at the moment, down from 25-30 not long ago), but it might get more in line with a 7-11 P/E ratio, giving a very nice return on the stock, not even counting on the redistribution to shareholders.

A third possibility would be the acquisition by one of the larger miners. I really hope this does not happen, as at the moment the best potential of MML is to grow into a larger player in south-east Asia. I think being acquired would waste a lot of the long-term potential of MML and dilute its assets into a too large corporation. Management seems mostly looking to grow the company and never mentioned looking for a buyer, and I hope it stays this way.

One last possibility for return is share re-purchases. If the stock price continues to stay this low, the best use of capital for the management would be to start doing share repurchases strategically, whenever the stock stays below the real value. For now, I think looking for cheap projects to expand into is fine, as such opportunities will disappear semi-permanently in case gold prices goes up. But if gold price stays low-ish and MML stays so undervalued, I would like to see a change of strategy.

One last word

As a final note, of course, the future of a gold miner is deeply tied to the future of its product. If gold rises strongly due to currency depreciation and/or inflation, we might see the entire sector getting popular or exuberant. This would be my best case for when to sell my MML stock.

At the moment, no one is greedy about commodities, preferring tech stock, short squeeze on Reddit and what not else. When this changes, I will look at our position in the cycle, and decide if it's time to exit the sector. I hope I will be able to be cautious when everyone is greedy the way I am greedy when everyone is fearful of miners at the moment.

I hope you enjoyed this series of articles about MML. Tell me if you would like me to cover more similar companies or if you want even more details about MML. And of course, tell me if you think I am missing something that would explain the relative cheapness of MML at the moment.

Remember that none of this analysis constitutes investment advice, please do your own research and look for licensed advisors before taking any action. Please find a full disclaimer HERE.

Until next time.

Jonathan Schramm