Investing In South America - Colombian Stock (Part 6)

Betting On Max Pessimism

In previous parts 1-5, we looked at how to manage South American political risk and discussed practical applications with Brazil and Argentina.

In this one, we will look at Colombia, a country that seems at the right timing when it comes to minimal political risk, with an Uber-leftist president hell-bent on ruining his country’s economy.

A country with a terrible reputation with investors, and where 14%+ dividend yields are not uncommon.

Colombia Primer

History & Geography

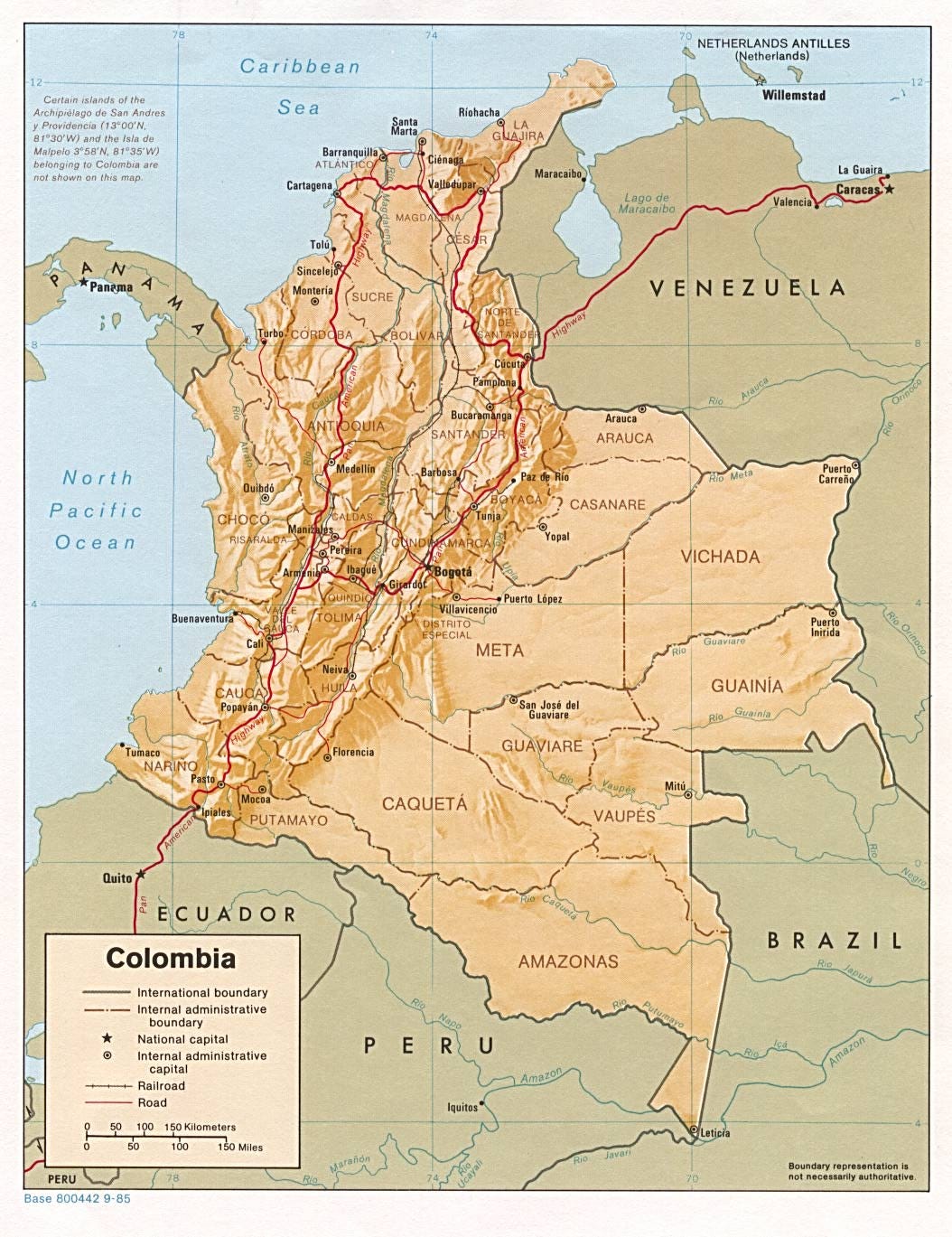

Colombia is the 2nd largest South American country by population, with 52 million people, and the 4th largest by surface.

It is essentially cut into 3 regions by the Andes, a coastal area with most of the population, a mountain region, and the Amazon Basin.

It is neighboring Panama, Venezuela, Ecuador, Peru, and Brazil.

Historically, a lot of the neighboring regions used to be part of the Viceroyalty of New Granada which included modern Panama, Ecuador, and most of Venezuela. From the Viceroyalty emerged Gran Colombia, which would dissolve roughly into the modern setup in the early 19th century.

In modern times, Colombia has struggled with persistent insurrection in its rural region, fueled by a mix of inequality, corruption, marxism, and narcotrafficking. To this day, this is still an issue (although much less than in previous decades) and has durably damaged the image of the country.

Economy By Sector

Colombia's economy is highly dependent on commodities, with oil making up 45% of the exports. The country also has the largest coal reserves in Latin America (the world’s 12th largest producer), is the largest producer of emeralds, has significant resources of gold, silver, nickel, and platinum, and is second only to Brazil in hydroelectric potential.

Thanks to its mountain ranges, the country has a surprisingly wide range of climates, from tropical to temperate. Agricultural commodities are also important exports, with the highest added value from coffee in the world, and in the top 10 ranking for the production of sugarcane, palm oil, and banana, and large production of rice, potato, cacao, cassava, maize, pineapple, etc.

Manufacturing makes up only 12% of the exports but is growing quickly at 10% per year. Electronics is a key target for the government, as well as appliances and automotive. Some textile and manufacturing activity moving out of China could also benefit Colombia (see “How Columbia Sportswear Is Loosening Its Ties to Asia“).

The service industry is large, 58% of the economy, but relatively low in productivity. Tourism is growing in importance and has massive potential, but always at the mercy of political instability or a flaring of insurrection movements or mass protests.

Overall Economics

Except for 2020-2021 (pandemic), growth in the last 10 years has been consistently positive, in the 4.5%-1.4%, at 3.3% in 2023.

The country has invested reasonably well in infrastructure, notably with the longest fiber optic network in Latin America.

Road and rail networks still need serious improvement thoough, especially in mountainous and Amazonian regions.

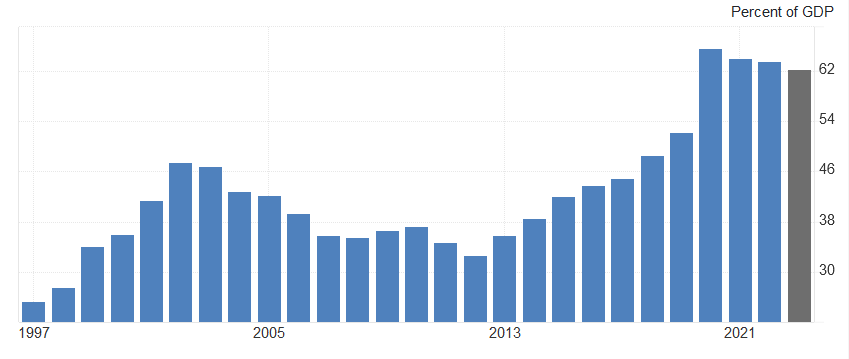

Debt to GDP has increased a lot since 2012, partially driven by a slump in commodity prices.

While Colombia has a significant middle class (25% of the population), it also has a large part of the people living under the poverty line (a staggering 42%). In 2021, 54% of Colombian families were food insecure and more than 560,000 children under the age of five were chronically undernourished.

This is typical of the region, and drives the political instability, with a vast left-oriented underclass at war with a right-oriented middle and upper class.

Thanks to Colombia's ownership of a few islands off Central America’s coast, it has a rather extensive EEZ (Exclusive Economic Zone).

Investing In Colombia

Petro The Petrol Companies’ Bane

It is worth remembering the framework for investing in South America, a high-political risk region. The best moment to invest is at peak leftism when valuations are trashed, the economy is tanking, and no one wants to touch the country’s stocks with a 10-foot pole.

I previously stated how oil is 45% of Colombia’s exports. So it is a bit of a dark humor twist that a man named Petro was elected president and working hard to ban PETRO-l production in the country.

To some extent, Petro is the Colombian equivalent of Brazil’s Lula: President since 2022, he was previously a guerrilla leader, later turning politician. Saying that he is to the left of the political spectrum is an understatement.

Most notably for foreign investors, he has promised to attack head on fossil fuel and make Colombia, a state highly dependent on oil exports to stay afloat, a model of climate activism.

"What is more poisonous for humanity, cocaine, coal, or oil?

Gustavo Petro

Internationally, he is somewhat close to Venezuela but has seemed careful to not outright support the neighboring dictatorship. He has also advocated for land reform, LGBT rights, and overall welfare spending.

So it is no surprise that Gustavo Petro's election to the presidency had been … poorly received by international investors. Mind you, not an outright crash in the general stock market (see below the COLCAP Index).

But for some stocks considered to be in danger from Petro’s rule, like the national oil company Ecopetrol, definitely jumped off the cliff from his election, after a pretty abysmal decade:

The Colombian Peso did not fare much better, taking a dive immediately after the election to later recover, but far from its long-term decline initiated by low oil & commodities prices in 2014.

How Did It Turn Out?

Now 2 years in, it is clear that Petro is not going to make Colombia into a new Venezuela. For starters, he is far from having enough support from the army and police forces to easily do a coup.

A second factor that has limited the impact of his presidency has been the poor management of his cabinet. He also does not fully control the parliament, limiting his ability to pass new laws.

While obviously not to be considered objective, the recent onslaught of international press titles explains it well:

Recordings shake confidence in Colombia’s leftist government, jeopardize reforms

Colombia government labor bill shelved after legislators fail to reach quorum

This failure to do much did not change the narrative around Colombia. Yet. But I think we are getting closer to it.

Starting with a collapse of his cabinet: a good sign. Collapsing approval reinforces the pattern.

Colombian Stocks

In the following parts, I will focus on 3 Colombian oil companies, because they match my favorite stock-picking method: the intersection of hated segments.

Colombia is “un-investable”

+ oil & gas are still ignored in favor of more trendy AI and US mega tech - the Magnificient 7 or Mag7). Nevermind that these AI data centers are hungry for electric power to the extreme

This does not mean that there are no other potentially interesting stocks. Overall, I can see quite a few that could be worth investigating as well, but I do not plan to turn this publication into a Colombia-only newsletter.

Overall, I would look at cheap valuation (being paid for the political risks) and dividend yield, for being able to not get the money permanently locked in the country.

I will share the name of the companies for my free subscribers, and give a quick overview of each to premium subscribers before going into deeper analysis of the selected 3 Colombian oil and gas stocks.

The free access list of stock is:

Cementos Argos

Interconnection Electric

Bancolombia

Enka de Colombia

Grupo Energía Bogotá

Ecopetrol

Geopark

Canacol Energy