The Plaza Accords

Now that we have set the facts straight, let's look at what is happening to Japan and why it is not applicable to China.

The Plaza Accord of 1985 was an “agreement” where the USA strong-armed Japan (and Germany) to essentially sabotage their industry through currency manipulation.

Per Investopedia:

The goal of the Plaza Accord was to weaken the U.S. dollar in order to reduce the mounting U.S. trade deficit.

The Plaza Accord led to the yen and Deutsch mark dramatically increasing in value relative to the dollar.

An unintended consequence of the Plaza Accord was that it paved the way for Japan's "Lost Decade" of sluggish growth and deflation.

Obviously, these countries would have had no interest in doing so.

Equally obviously, when the USA was unable to compete fairly with Japan’s industries, it was far from “unintended” that it was a major cause of Japan's stagnation forever after.

Another factor in Japan's economic disaster was that the US went ahead and simultaneously placed 100% tariffs on Japanese electronics in 1987. Tariffs Japan wasn't even allowed to match or even retaliate to in any way.

If you outmatch the US corporations, you will be punished.

Almost like when China is “overproducing” … Ring a bell?

Of course, not all of this was purely due to international trade. Japan's central bank also boosted the domestic bubble at the worst moment to compensate for the lost exports.

Although considering how every West-centric central banker seems to take his orders from DC, you can wonder how much that was self-inflicted…

It’s as if infestation by Keynesian economists is not a disease spreading from the UK and USA…

Trying for Plaza 2.0

It worked so magnificently to destroy the rising Japanese economy, that it is not a surprise that the same crowd, still alive and in power (most of US decision-makers are 80+ years old) wants to do the same to China today.

The problem is of course that Japan was a demilitarized, occupied country with 1/3rd of the US population.

By contrast, China has a much LARGER industrial capacity and 4x the US population.

The issue for the US leadership is that in the past decades, the alternative to direct control eg. (Japan) has been military destruction (eg Serbia, Lybia, Iraq).

It is very unlikely to work this time.

China’s Strategy

I have recently explained that China is emerging as a new unprecedented model.

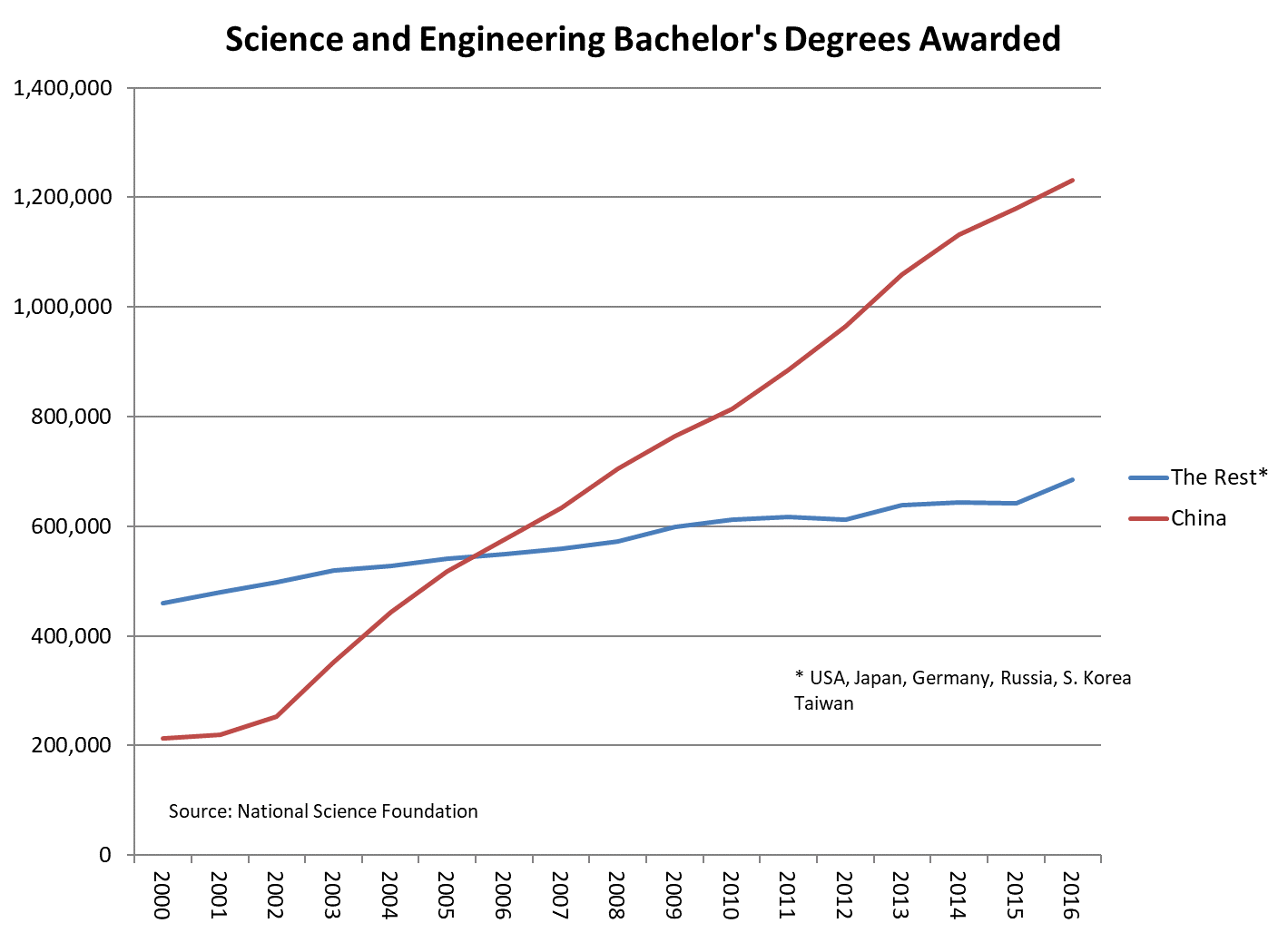

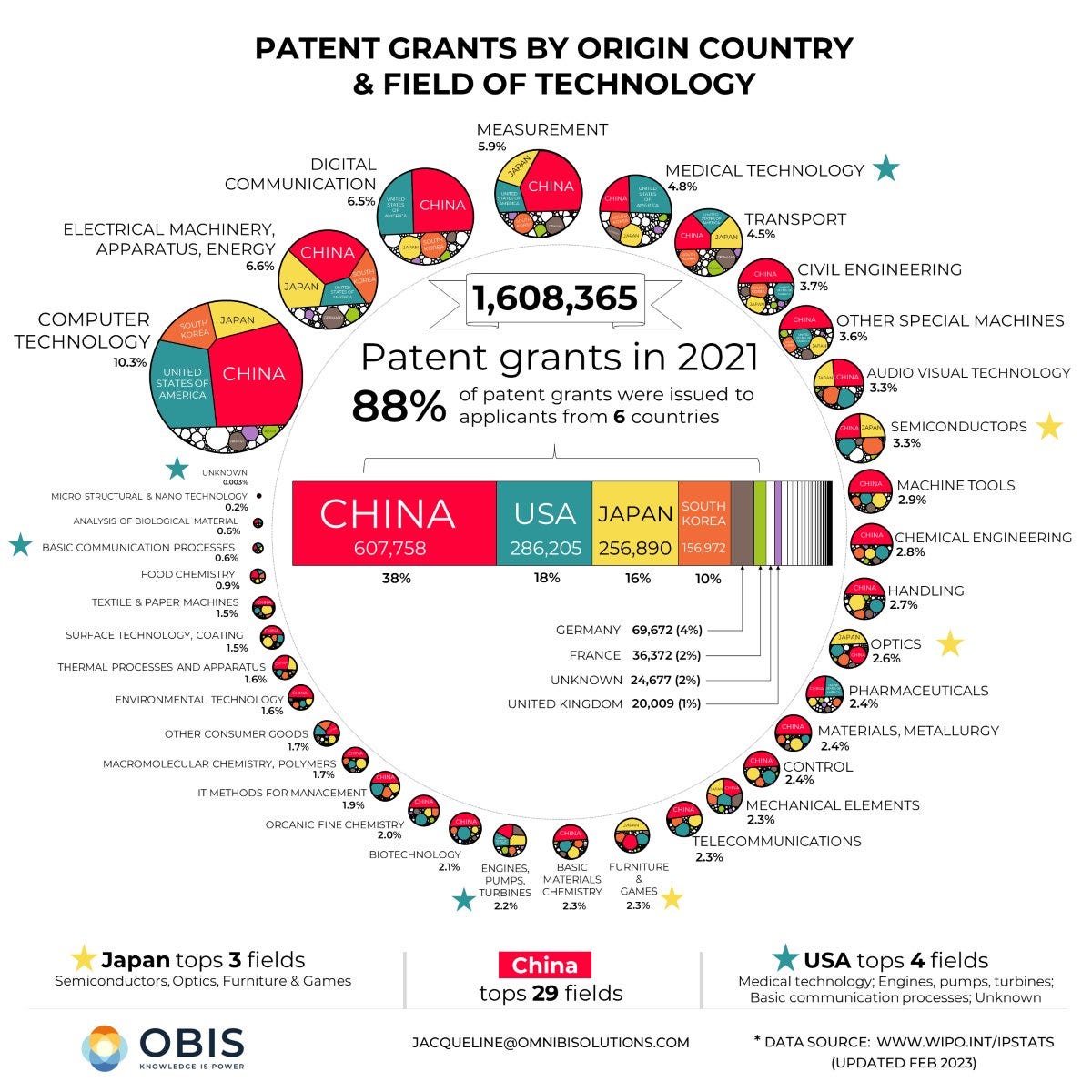

Not only a new economic model but also civilizational, breaking the mold of sea vs land power to create a new type of industrial/production-focused civilization lead engineers.

The other part of the story is that the Chinese leadership is acutely aware of Japan’s fate.

What killed Japan's ascension was a combination of:

Losing access to the US market, without a credible replacement.

Lack of independent policy and strategic autonomy, with major decisions teleguided from DC.

A situation especially empowered by Japan's lack of military might AND its extreme dependence on overseas energy inputs.

Inept monetary policy that led to flooding the real estate market with cash, causing an insane bubble (50-year or 80-year mortgages were a thing in late-1980s Japan).

Failure to keep innovating due to ossification of the corporate (and social) structure.

So it is really not a surprise that Xi is essentially tackling each of these threats separately.

Replacing The West

Sooner or later, a new panic mimicking the reaction to 1980 Japan was going to target China.

See below the forgotten similar hysteria: “A Group of Congressmen Smashing a Toshiba Radio, 1987“.

This is one of the purposes of the Belt and Road Initiative, as well as other things like the BRICS (payment system via the New Development Bank and multilateral coordination), and the SCO (to keep Asia at peace and provide financing via the AIIB - Asian Infrastructure Investment Bank).

The Global South is where China plans to sell semiconductors, cars, airliners, bridges, nuclear power plants, solar panels, and so on.

And China will even provide loans to afford it, not dissimilar to the US Marshall Plan in post-war Europe.

Independence

Of course, none of these grand plans can work if China cannot defend itself and be bullied into self-destroying as Japan did.

As I discussed in a previous article, when it comes to actual real-world power, industrial capacity is a lot more important than GDP. We see it currently, with Russia’s industrial capacity and large access to resources allowing it to outproduce the entirety of NATO in terms of missiles, artillery shells, etc.

In the report “The Future of Russian Oil” I took notice of this:

When it comes to war and “hard” power, the main factor is industrial capacity. You might have fewer deli shops and fewer concerts, but this matters little on a battlefield. Russia has a similar industrial percentage to Germany (26%), and MUCH higher than Italy (19%) or France (14%), or the USA (15%).

For reference, China is an astonishing (considering its size) 36%.

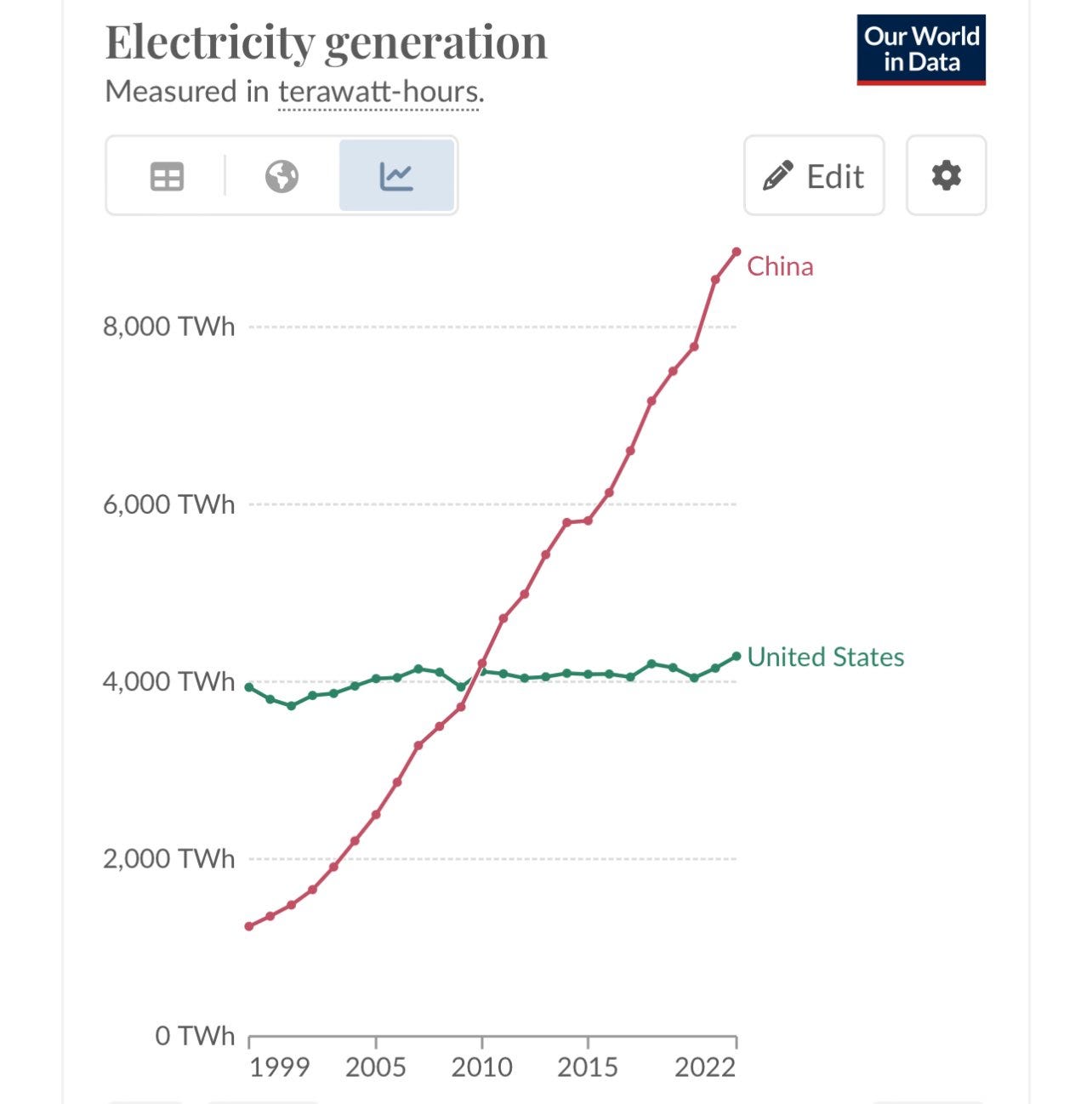

If you take both PPP and industrial capacity into account, it is likely China has 2-3x more capacity for great power rivalry than the US.

An image is worth a thousand words here:

So movements like having a factory able to churn out 1,000 cruise missiles PER DAY is not necessarily to start a war, but to be sure to win if it comes to that, and to avoid it in the first place if possible.

For reference

Per DAY what the US Navy buy in 10 years? It may be an exaggeration, but the ratio is likely in that direction. Even a reality as low as 1/1000th of China's claim would still leave it 3x more equipped.

And actually, it kind of matches the recent realization that China’s ship-building capacity is more than 200x larger than the US’.

Getting overland supplies of crucial gas, coking coal, oil, minerals, and calories (grains) from Russia and Iran is also a vital part of the plan to deter American aggression, a card 1980s Japan could never play.

I would also point out that struggling through the Great Depression did not stop the USA from winning the “arsenal of democracy” in WW2.

So even in the case of a Chinese crash and “economic collapse”, it would be far from clear that it could allow the US to dictate anything on China’s policies.

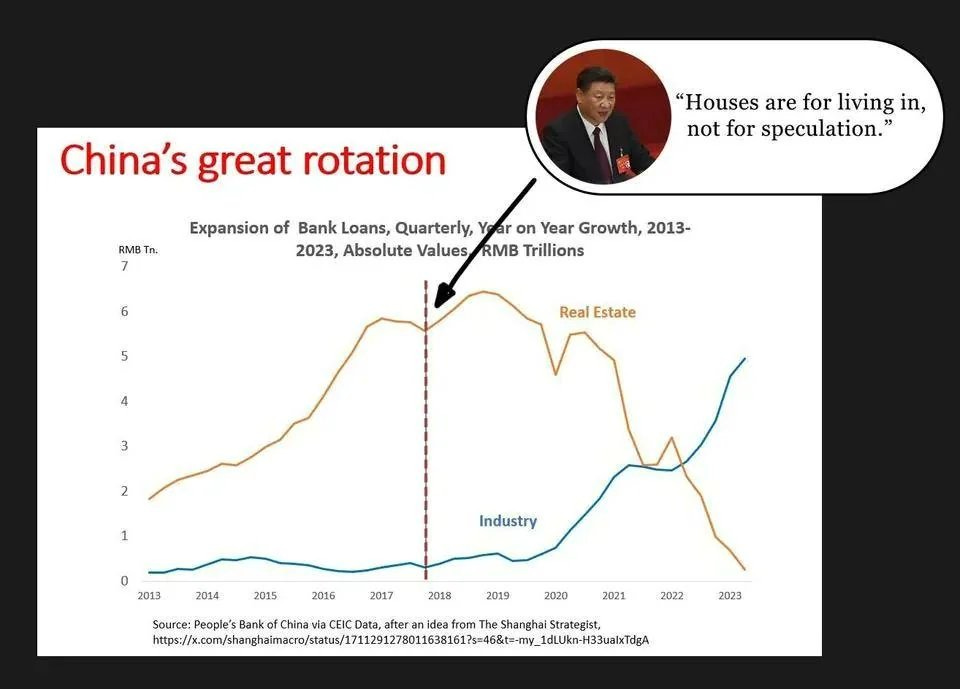

Stimulus and Real Estate

The other danger is all the capital flocks to useless sectors. Real estate speculation is a good candidate, and so is software that brings more problems than solutions (*cough cough: social media).

Which is why it was imperative to start deflating the real estate bubble.

I actually think this was rather late and almost too late.

Probably the only thing that buffered the blow was letting some of the losses be swallowed by foreign investors.

This brings us back to the discussion of the uselessness of GDP.

GDP from landscaping, manicure salons, casinos, and hedge funds is not as useful in the long run as steel mills, semiconductor foundries, and car factories.

A chemical engineer is not the same as a Youtuber (or a newsletter writer, I am aware of the irony).

Innovation

And lastly, the key part is to not sleep on your laurels.

It is clear that China is not at the part of its civilizational cycle where it gets fat and complacent.

It certainly was there when the West conquered the world and invented the modern world.

And it hasn’t yet forgotten the lessons of the Century of Humiliation -Chinese: 百年国耻, lit. "hundred years of national disgrace").

From the horse’s mouth (to be precise, the “State Council Information Office“ of the PRC):

Another key part of the strategy is doing that innovation by opening to those who want to join.

Once again, it is the behavior of a young/rejuvenated nation so sure of itself that it does not fear competition but embraces it.

Think of the XIXth century to 1920s America, invented or quickly adopting (aka “stealing technology”) the steam engine, railroads, oil industry, telegram, radio, electricity, etc.

Our era will see the same Chinese-driven impulse around energy (green and nuclear), space tech (not only rockets and Moon bases but also mass drivers, essentially a maglev to the orbit), biotech and gene medicine, AI, computing (photonics, quantum), superconductors, etc.

Conclusion

I think it is clear to anyone who wants to look at it honestly that China is not going anywhere.

It is not collapsing, not isolated, and not at risk of military defeat.

This brings the question of investing in China, especially with many of its stock prices severely depressed.

Considering the new focus on technology and industry, let’s see what we can buy at a discount.

And how to own these shares while staying as safe as possible from US sanctions.

Extra reading

China’s economy is not in a Great Decline but a Great Transition (by ING)

I have almost 50% of my portfolio in Chinese companies. Several things incredible cheap:

- LU.NYSE - 0.10x p/b after dividends

- YRD.NYSE - 1.3x P/E, 25% ROE

- 6968.HK - RE Company, 0.05x P/B, 0.3x Net Debt/Equity, 1.7x Current Ratio, Still profitable

- 2198.HK - Chemical company at 1.5x normalized p/e

- JKS. NYSE - Biggest solar panel producer, 2x p/e at normalized margins, growing fast

- 1051.HK - Net Cash 6x bigger than marketcap

- 0489.HK - Big car manufactores, 0.14x P/B, net cash > mktcap

And much more others things like this.